According to the Central Bank of Oman's annual report, these applications allow users to make payments using smartphones and smart watches, instead of carrying cards.

Samsung Pay was launched at the end of April 2024, while Apple Pay was launched in September 2024.

Apple Pay

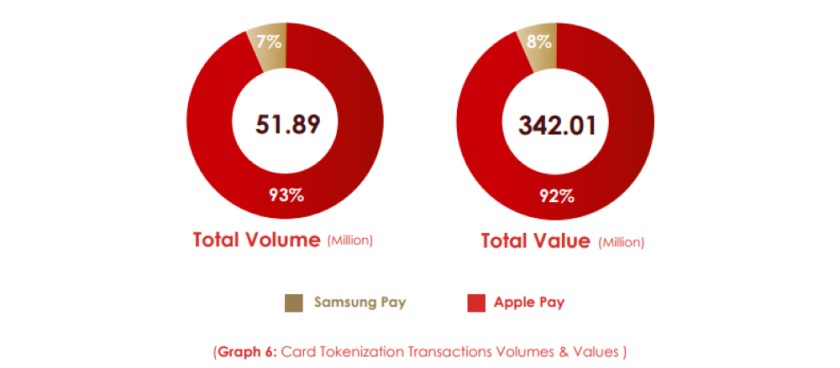

Apple Pay has the highest share due to its popularity among consumers, capturing 93 percent of the number of transactions and 92 percent of their value. On the other hand, Samsung Pay, despite being launched earlier, holds a transaction share of 7 percent and 8 percent in terms of volume and value, respectively.

The report added that card tokenization has encouraged innovative electronic payments, reduced reliance on cash, enhanced security in card payment transactions, and provided a smooth and easy payment experience, in addition to supporting the national program for digital transformation and the e-commerce strategy.

Debit cards

Data reveals that debit cards recorded the highest percentage with 4.6 million active cards observed during 2024, representing 93% of the total active cards, as a result of their convenience and ease of use for daily transactions.

Credit cards

In contrast, the number of active credit cards reached 239.3 thousand cards, which is equivalent to 5% of the total cards, along with the benefits provided by banks, in addition to ongoing promotional offers.

As for prepaid cards, 93 thousand active cards were recorded, which represents 2% of the total cards, and they are primarily used for shopping, fuel payments, and other daily transactions.

Person-to-Person (PPP) transactions

Person-to-Business transactions

On the other hand, Person-to-Business transactions increased from 56,230 in 2023 to 190,900 in 2024, with their value rising from RO0.858 million to RO2.03 million. This accelerated growth indicates a growing reliance on digital payments for commercial transactions, highlighting the increasing acceptance of mobile payments in business dealings.

Oman Observer is now on the WhatsApp channel. Click here