Singapore :Global markets faltered on Thursday, with Asian stocks mixed and U.S. futures turning lower, as investor sentiment was rattled by the Trump administration’s shifting stance on trade tariffs and the Federal Reserve’s leadership.

In recent days, U.S. President Donald Trump launched attacks on Fed Chair Jerome Powell, only to later walk back calls for his resignation. Simultaneously, uncertainty looms over potential changes to tariffs on Chinese imports.

According to a source cited by Reuters, the White House may consider easing tariffs, a report echoed by The Wall Street Journal. However, Treasury Secretary Scott Bessent clarified that any changes would require reciprocal action from Beijing. White House spokesperson Karoline Leavitt supported that view.

“I don’t think you can ever get used to the kind of flip-flopping we’re seeing. It’s extreme,” said Tony Sycamore, market analyst at IG. “But that’s Trump – he tries levers and isn’t afraid to reverse if they don’t work.”

MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.72%, while Japan’s Nikkei edged up 0.4%. In China, the CSI300 rose slightly by 0.06%, but Hong Kong’s Hang Seng dropped over 1%.

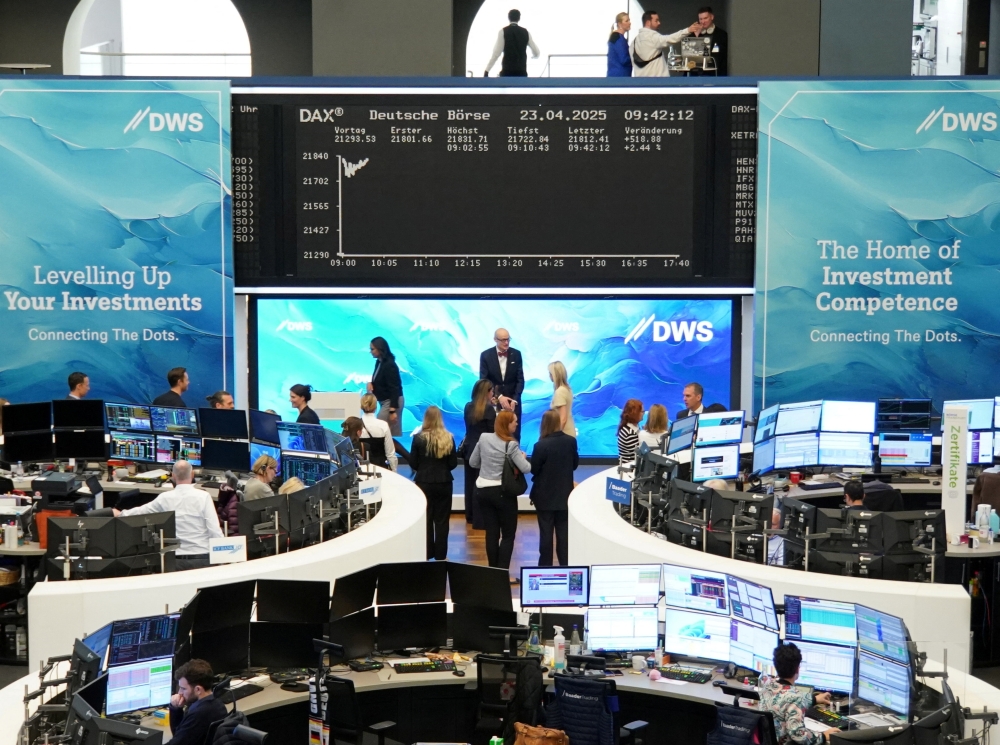

U.S. stock futures retreated, with Nasdaq futures down 0.32% and S&P 500 futures falling 0.23%. EUROSTOXX 50 futures were flat, while FTSE futures dipped 0.04%.

Japan’s chief trade negotiator, Ryosei Akazawa, is expected to visit Washington at the end of April for a second round of tariff talks, according to informed sources.

China, meanwhile, reaffirmed its commitment to free trade and multilateralism, according to state broadcaster CCTV, quoting the central bank governor’s remarks in Washington.

“Short-term volatility is extreme right now,” said Salman Ahmed, Global Head of Macro at Fidelity International. “We’re beyond peak globalization—trade and capital will no longer flow freely in a steady state.”

Japanese Finance Minister Katsunobu Kato also called on G20 partners to stabilize financial markets, warning that U.S. tariffs and retaliation from trading partners are weakening global growth.

The dollar retreated slightly following a rebound earlier in the week. It fell 0.5% against the yen to 142.75, while the euro gained 0.25% to $1.1341. The Swiss franc rose 0.3% to 0.8281 per dollar.

U.S. Treasury yields dipped, with the benchmark 10-year yield falling 3.5 basis points to 4.3578%, and the 30-year yield steady at 4.7960%.

Federal Reserve Bank of Cleveland President Beth Hammack said the Fed remains cautious amid ongoing uncertainty, reinforcing market expectations of over 80 basis points of rate cuts by December.

Oil prices steadied after falling in the previous session, as sources reported OPEC+ is considering accelerating output hikes in June. Brent crude edged up 0.1% to $66.19 per barrel, while U.S. crude rose 0.14% to $62.36.__ Reuters

Oman Observer is now on the WhatsApp channel. Click here