Muscat: The global real estate advisor Savills released its latest research analyzing Oman’s real estate market performance.

The report provides a comprehensive snapshot of the Sultanate’s macroeconomic environment whilst focusing on the residential and commercial real estate sectors.

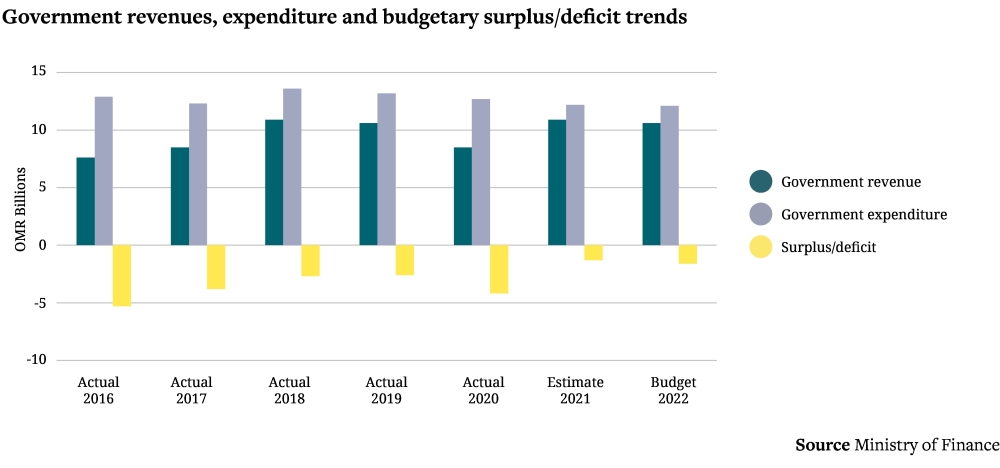

Swapnil Pillai, associate director – of Middle East Research said, “Oman’s economy has recovered well from the effects of the

Covid-19 pandemic and weak oil prices. The government’s financial position is much stronger now than it has been for several years, despite the pandemic, due to a prudent fiscal approach. Recent months have also witnessed an acceleration in government investment projects.”

“Headwinds, however, remain for the real estate sector but there are some emerging signs of market stability.”

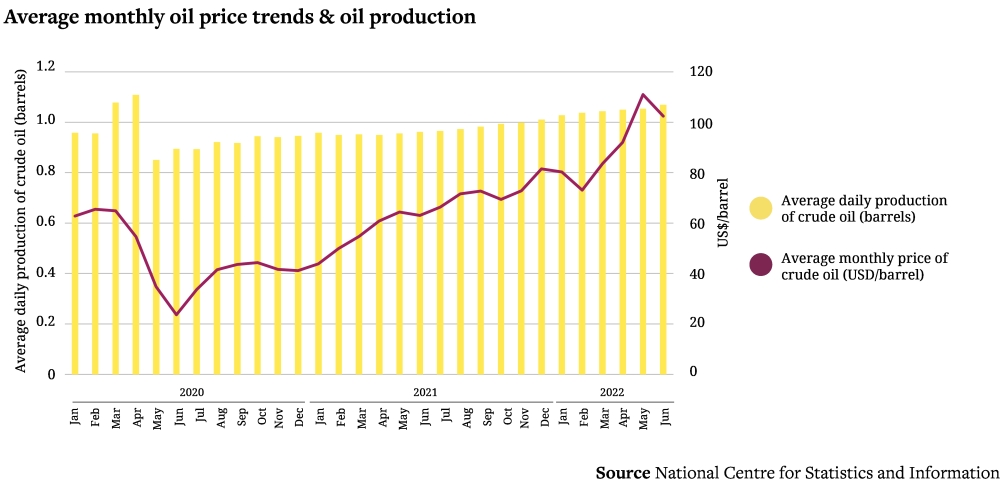

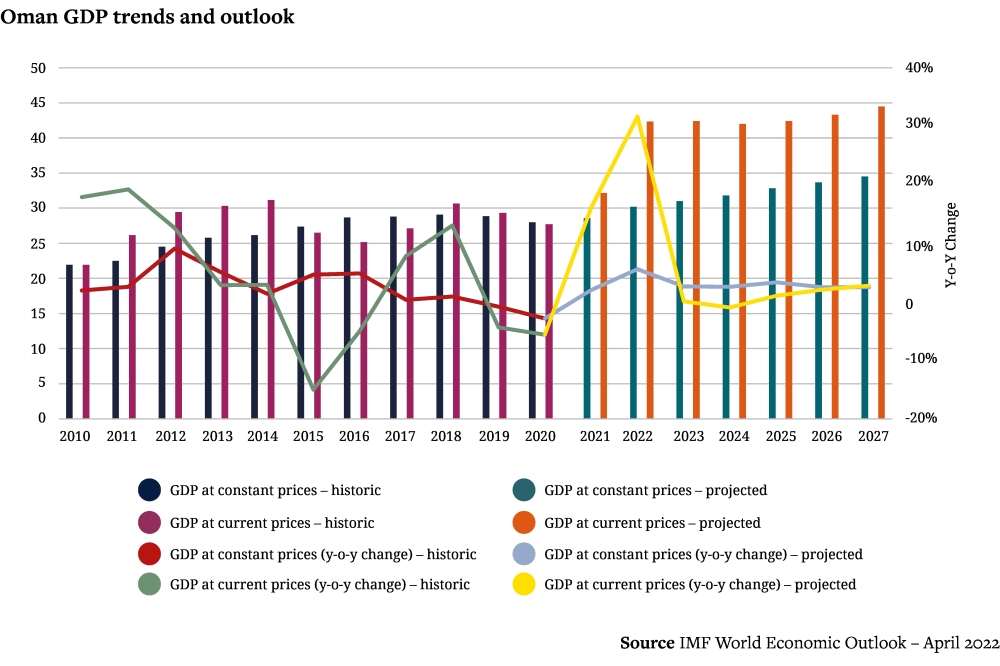

As per the IMF, the Sultanate’s economy (at current prices) contracted by 17 percent in 2020 as a result of the Covid-19 pandemic and lower oil prices but is projected to have grown by over 16 percent over the course of 2021.

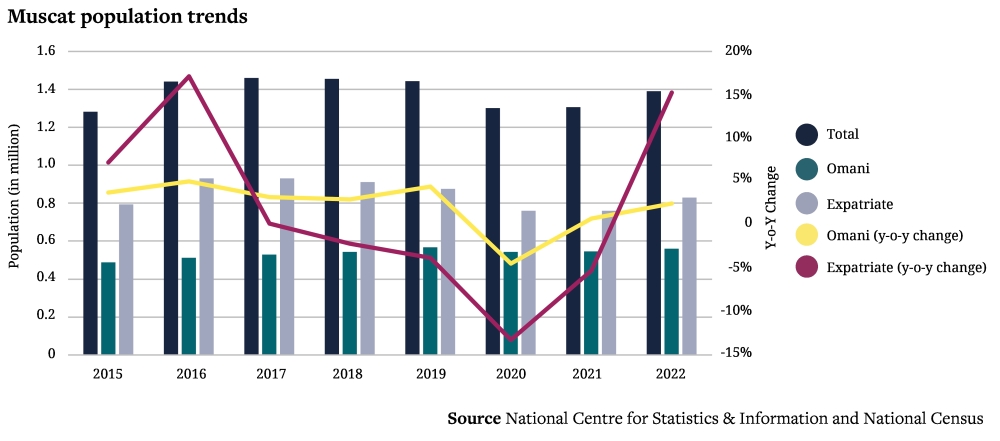

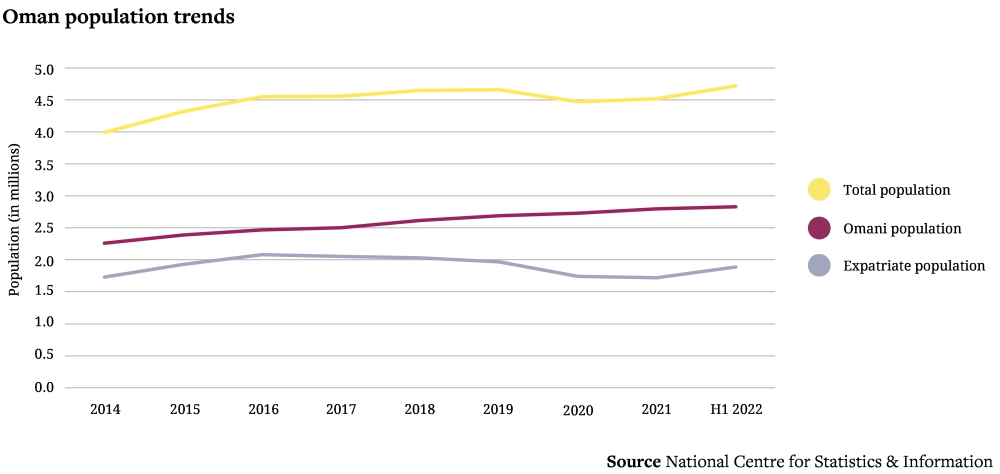

During 2020, the impacts of the Covid-19 pandemic accelerated the decline of the expatriate population that started in 2017 with around 230,000 expatriates leaving Oman over the course of the year. Last year saw expatriate numbers reduce further but in H1 2022, the expatriate population grow by approximately 10%, driven almost exclusively by an influx of expatriate workers rather than professionals.

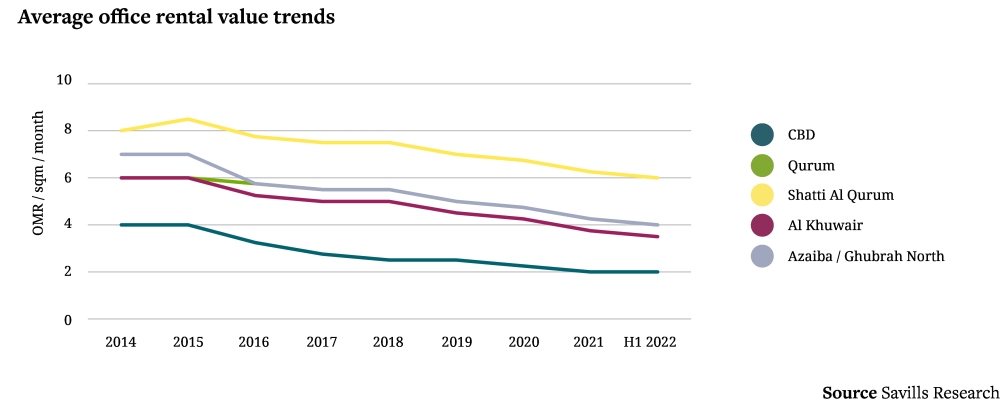

Recent years have seen the introduction of a significant supply of new office space which has exceeded demand. Savills estimates that there is currently around 400,000 sqm of mid to higher-grade office space for the rental market in Muscat with a further roughly 100,000 sqm of office space under construction, although much of this is lower to mid-end.

Due to tepid demand relative to supply, there has been downside pressure on occupancy with only a limited number of buildings currently achieving occupancy levels in excess of 70%.

Realistically, achievable rental values dropped by 5 to 10% over the course of 2021 and are currently 25 to 40% lower than in 2015 with the Shatti Al Qurum submarket showing the greatest resilience.

The notable recent upswing in oil prices, if sustained, is likely to have a positive impact on the commercial sector and could help to drive demand and occupancy.

Matthew Wright, Head of Consultancy at Savills Oman said, “We expect market conditions to remain challenging over the remainder of 2022 in terms of both demand and achievable rental values but high oil prices if sustained, are likely to provide a boost for commercial activity.”

Recent years have seen extensive development of residential units—particularly of low to moderate-grade residential apartments with limited to no facilities—for the rental market across Muscat, which has resulted in a significant oversupply relative to diminished demand.

Many expatriates, who are the primary demand generators of the residential rental market, are limiting their expenditure due to a combination of rising living costs and concerns about job security against the backdrop of Omanisation initiatives.

As a result of the notable drop in the number of expatriates in Muscat over the years, overall demand has seen a marked reduction and competitive pricing is key to attracting and retaining tenants.

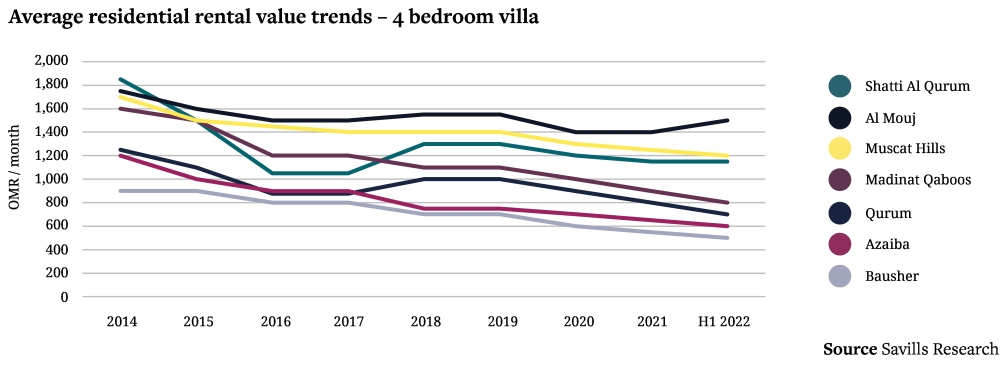

Another key trend experienced over the last two years has been a “flight to quality” as rental values for high-end properties have become more affordable. This has been particularly evident at Al Mouj where villas and townhouses have high occupancy levels whilst apartments have seen higher demand.

Rents across established locations such as Al Mouj have also seen a gradual correction but have been relatively resilient with average rental values for townhouses and villas reducing by 15% to 20% in comparison to 2014, outperforming the wider market. The last six months have, however, seen rental values generally start to stabilize, particularly for better-quality properties.

Ihsan Kharouf, Head of Savills Oman said, “Similar to the commercial property segment, market conditions will generally remain challenging over the remainder of 2022 from a landlord perspective, but current evidence is that we are nearing or are at the bottom of the market with the rental declines likely to slow down. The limited supply relative to the demand for good quality products indicates that villas and townhouses at sought-after locations such as Al Mouj and Muscat Hills are likely to see a moderate strengthening of rental values over the coming year.”

a

Oman Observer is now on the WhatsApp channel. Click here