Don Lee -

The United States and China are in the final stretch of talks to resolve a conflict over American complaints about China’s unfair trading and economic practices.

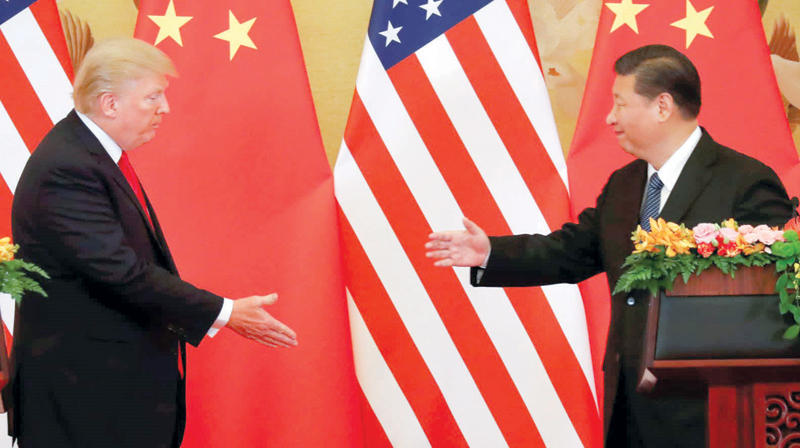

Senior US officials say they have reached agreement on enforcement and other key elements of the dispute, raising the possibility that President Trump and Chinese President Xi Jinping could sign a deal in late May.

But at least one big sticking point remains: what to do with all the tariffs that the two sides slapped on each other in the last year. China wants the duties to be lifted. The United States wants to leave at least some of these taxes on Chinese goods in place.

Failure to come to terms on this issue could doom the deal. One thing is certain: It’s in Trump’s hands. And as he has throughout the negotiations, the self-described “Tariff Man” is keeping the world guessing.

Why does Trump love tariffs so much?

Past American presidents typically embraced tariffs for one of three reasons: to raise government revenues; to protect a domestic industry; or to press for reciprocity from a trading partner.

For Trump, it’s all three — and more. He sees the imposition of tariffs, or the threat of them, as leverage to force countries to the table and to make concessions.

In Trump’s world of deal-making,tariffs are the weapon of choice, and unlike any US leader in modern times, he has employed them against adversaries and allies alike.

For Trump, tariffs are a win-win because the US government either gets a better deal or collects the revenue, says Douglas Irwin, an economic historian at Dartmouth College. “It’s all good” to him, Irwin said.

What tariffs have the US and China placed against each other?

After his administration concluded that China’s behaviour on technology transfer and intellectual property had been harmful to the United States, Trump fired the first big salvo in mid-June 2018. He imposed 25 per cent tariffs on $34 billion in Chinese industrial machinery, electronic equipment and other goods. Beijing immediately retaliated, dollar for dollar, slapping 25 per cent duties on US soybeans, seafood and electric vehicles, among other products.

Since then, there have been two more rounds of tit-for-tat tariffs on thousands of goods exchanged between the two countries.

All told, over the last year the United States has placed additional duties of 10 per cent to 25 per cent on about $250 billion of Chinese products, or almost half of all US imports from China. China has applied tariffs of 5 per cent to 25 per cent on about $110 billion of American goods, which represent the vast majority of US shipments to China.

These figures don’t include tariffs on Chinese solar panels, steel and wooden cabinets and other merchandise that have been assessed duties by the Trump administration because of dumping, unfair subsidies and concerns about national security. Trump has threatened to ratchet up the tariff amount and hit all Chinese imports, but he and Xi agreed to a ceasefire on December 1, pending the outcome of the talks.

How much revenue have tariffs raised, and who’s footing the bill?

The US Treasury collected $34.7 billion in tariffs from October to March, up from $18.4 billion in the prior six-month period. That’s an additional $16.3 billion. But as federal budget watchers are quick to point out, the amount is a drop in the ocean. By the Treasury Department’s estimates, Uncle Sam is expected to end this fiscal year with a budget deficit of around $1.1 trillion .

What’s more, the recent gain in tariff receipts looks a lot less impressive when we consider who’s paying the bill. Despite Trump’s claims to the contrary, it’s not China. It’s the American importer and US consumer.

Based on a detailed analysis of import data, economists at the New York Fed and Princeton and Columbia universities estimate that Trump’s trade war has had the effect of reducing US real income by $1.4 billion a month.

There are hidden costs as well. One of them is higher premiums for bonds that importers are paying to secure the extra tariff obligations to US Customs, says Ted Murphy, a trade expert a the law firm Baker McKenzie in Washington. “The duties are sort of bad enough,” he says, adding that the bond premiums may not drop even after tariffs are removed. — dpa

Oman Observer is now on the WhatsApp channel. Click here