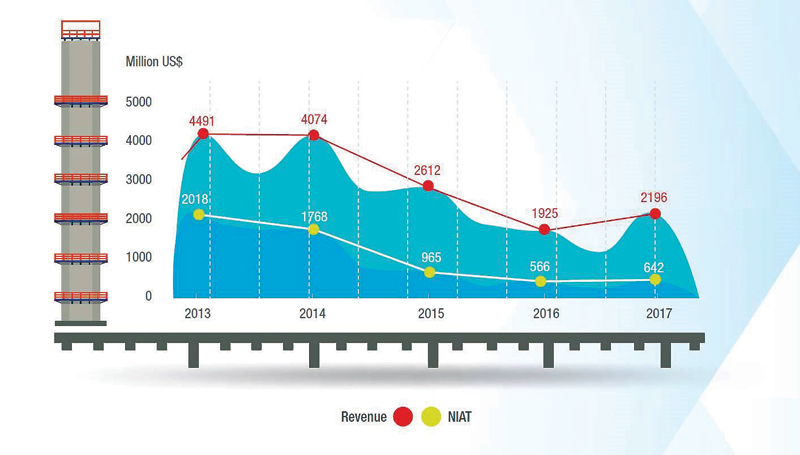

Oman LNG has reported revenues totalling $2.196 billion in 2017, up from the previous year’s tally of $1.925 billion — an increase attributed in part to additional feed gas arriving from BP Oman’s recently launched Khazzan development in central Oman.

Net Income After Tax (NIAT) amounted to $642 million for the year, versus $566 million in 2016. The uptick was reflective of the modest increase in oil prices last year compared to 2016, the company said in its 2017 Annual Report issued here yesterday.

LNG export revenues have halved in trend with the collapse in oil prices beginning in mid-2014. From a record high of $4.491 billion reported by the company in 2013, earnings slumped to their lowest at $1.925 billion in 2016, recovering somewhat last year to $2.196 billion.

Summing up Oman LNG’s performance in 2017 amid ongoing challenges for the global LNG industry, Dr Mohammed bin Hamad al Rumhy, Minister of Oil & Gas and Chairman of Oman LNG, commented: “After three years of contraction across the industry, it is an agreeable task to be able to report 2017 as something of a turnaround year, a welcome herald of expansion returning to Oman LNG. The global gas price trend does appear to have bottomed out for the near term at least and, despite some recent retracements, to have entered a modest uptrend.”

“We have earned some relief in 2017 ending the year in a moderately healthy financial state. With the efficiencies sustained during the lean years, we enter 2018 in a spirit of well-founded optimism and expanding revenue,” he further noted.

Harib al Kitani, Chief Executive Officer, added: “We have had to manoeuvre our way around challenges without abandoning our core objectives as a company with important national responsibilities. Financially, 2017 was an improvement on 2016, positioning Oman LNG well for the future.”

Qalhat LNG, which owns the third of the three trains that together constitute the LNG liquefaction plant in Sur, garnered revenues of $1.003 billion in 2017. Oman LNG operates and maintains the 3.3 million tonnes per annum (mtpa) capacity train on behalf of Qalhat LNG.

In all, a total of 134 LNG cargoes were loaded from Oman LNG’s plant in Sur during 2017. While Oman LNG’s two-trains contributed 88 cargoes, 46 other cargoes were generated by Qalhat LNG. In addition, there were four spot cargoes that were shipped to India, UAE and Japan in deliveries that generated added value to Oman LNG. Besides, 29 cargoes were successfully diverted from the 2017 Annual Delivery Plan. Additionally, 38 cargoes of natural gas liquids (NGL) — a valuable byproduct of the gas liquefaction process — were also generated last year. A key highlight of 2017 was the landmark Sales and Purchase Agreement (SPA) signed by Oman LNG for the supply of 1.1 mtpa of LNG to BP Singapore for seven years starting from 2018. The pact not only helped cement collaboration between Oman LNG and BP, but also boosted the global LNG market, according to the company.

“With the new stream feeding straight into the overhang of spare capacity at our plant, we are happy to report that all three liquefaction trains are now operating at almost full capacity,” said Dr Al Rumhy in the Chairman’s Message. “Even more satisfying is the fact that our partnership with BP has come not only in upstream operations, but more importantly venturing a new long term SPA with BP Singapore.”

The Qalhat complex, the Chairman said, has been suitably prepped to handle the additional volumes from Khazzan, while further work is planned.

“With rising domestic demand squeezing export revenue in recent years, we are now well on our way to recovering a healthier export-domestic allocation balance. If and when the market strengthens, we will be well placed to extract more revenue from exports without slowing growth at home,” he stated.

According to Al Kitani, the company has already adopted the Readiness Plan for 2018, which prepares the production facility for maximum possible availability and utilisation from 2018, while enhancing asset reliability and shareholder value.

Oman Observer is now on the WhatsApp channel. Click here