MUSCAT, JAN 17 -

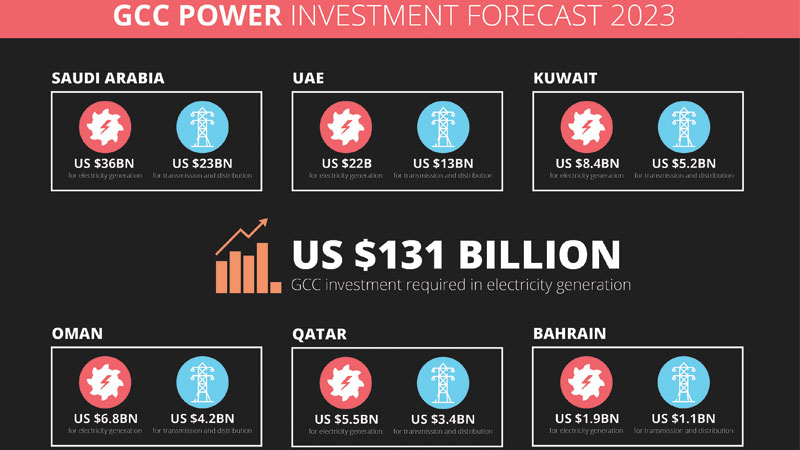

A new report from Middle East Electricity (MEE), the region’s leading annual international trade event for the power industry, states the GCC requires a combined $131 billion worth of investment in electricity generation, transmission and distribution over the next five years to cope with increasing demand from growing populations, expanding economies and climatic changes.

The report, ‘GCC Power Market’, reveals that despite the GCC’s current power-generating capacity of 157 gigawatts (GW) — which equates to 43 per cent of all Middle East and North Africa capacity — its six states will still require $81bn investment for another 62 GW of increased capacity and $50bn for additional transmission and distribution.

Saudi Arabia accounts for the largest spend needs with $36bn required for generation and $23bn for transmission and distribution, followed by the UAE at $22bn investment needed for generation and $13bn for transmission and distribution. Kuwait requires the third largest investment with $8.4bn needed for generation and $5.2bn for transmission and distribution, followed by Oman at $6.8bn and $4.2bn respectively, Qatar requires $5.5bn and $3.4bn respectively, with Bahrain needing the least investment level at $1.9bn and $1.1bn.

The report, produced for the Middle East Electricity exhibition by Ventures Onsite, says much of the investment is likely to come from public-private partnerships (PPP) if a regulatory framework is introduced to incentivise independent power producers (IPP).

Over the last two decades, the PPP model has become the most attractive financing mechanism for the GCC power market with the model helping to ease the strain on government finances in delivering complex engineering solutions and delivering advanced technology solutions. The report outlines reliance on IPPs will grow but warns:

“According to industry experts, there also arises the need for the power sector to establish a regulatory framework to push for the private sector’s participation.”

It adds: “GCC governments need to ensure that IPPs play a larger role in power generation and not be looked upon as a short-term fix to increasing demand.”

Such is the demand for change, that the Global Smart Energy Summit (GSES) — which will debut alongside MEE 2018 — has a track dedicated to reforms, policy and incentives where regional and international industry leaders will look for tomorrow’s financing and partnership solutions.

“There will be keen debate on energy models needed to fuel economic growth, including policy reform needed to accelerate the global transition to smart energy,” explained Ryan O’Donnell, Programme Director for GSES. “This includes a review of successful policy rethinks from around the world. It will be a track that could well set a course for the region’s power industry future.”

BUSINESS REPORTER

Oman Observer is now on the WhatsApp channel. Click here