The MSM30 Index rose marginally after last week retreat, albeit with lower turnover and volumes. Selling pressure from Omanis was absorbed by foreigners and GCC investors, who were net buyers of about $1.1 million worth of securities last week. The MSM30 Index rose by 0.26 per cent this week to close at 3,999.8. Within the sub-indices, the Financial & Industrial Index rose by 0.26 per cent and 0.37 per cent w-o-w, while Services Index dropped by 0.71 per cent w-o-w. The MSM Shariah Index, closed down by 0.02 per cent w-o-w.

Phase 1 of the Musandam Power IPO subscription will start this week between November 3-7. Musandam Power caters to the bulk of current and future projected electricity demand of the Musandam region. Company has no cash sweep mechanism and also has no pending litigation issues.

During the week, Galfar announced that it has been awarded a contract for a value of $16.4 million, bringing its total new contract awards to RO 171.7 million. This award for Civil & Concrete works at Ras Markaz Crude Oil Park Project (Phase 1) has a completion period of the work at 12 months.

Oman & Emirates Investment Holding Company and The Financial Corporation (Fincorp) have agreed to start discussions for a potential merger between the two financial institutions. The board of directors of Oman & Emirates Investment Holding sent a potential merger proposition to the board of Fincorp. The company received a response from Fincorp’s Board of Directors expressing their agreement to conduct discussions to assess mutual benefits. The shares of Oman & Emirates Investment Holding jumped nearly 8 per cent on Tuesday last week.

United Finance (UFCI) announced that its Board has approved proposal to enter into discussions to explore a possible strategic collaboration with Taageer Finance (TFCI), subject to approval of shareholders, regulatory authorities and Taageer Finance’s Board. Depending on the outcome of this discussion, we believe that if the companies decide to merge, either through merger by acquisition or merger by combination, the total book value of the combined entity will be RO 85 million, with combined entity surpassing Al Omaniya Financial Services as the second largest non-banking financing company (NBFC) of Oman in terms of total net financing asset. National Finance, with RO 427.5 million worth of net financing asset will maintain its status as the largest NBFC of Oman.

The World Bank issued its Doing Business Report last week. Oman ranked fourth in the GCC and fifth in the MENA region on the Doing Business 2020 rankings. The Sultanate improved its ranking by 10 positions to reach the 68th position globally. Oman also strengthened minority investor protection by increasing shareholder rights.

An analysis of Oman’s listed conventional banks H1’19 financial statements reveals that two banks: BankDhofar and NBO are relatively closer to the retail limit imposed by the Central Bank Oman (CBO) of 50 per cent. The other four banks are well-below the limit on retail lending. The latest CBO bulletin indicates that about 56.3 per cent of total RO deposits lie between 0 per cent-2 per cent interest bracket, whereas only about 3.3 per cent of total RO lending lies within this bracket as at August-end 2019. 53.6 per cent of total RO lending lies within the 5-7 per cent interest bracket.

The total value of property transactions in the Sultanate till the end of September 2019 dropped by 11 per cent to reach RO 1,820.7 million from RO 2,046.1 million for the same period of 2018, as indicated by the preliminary statistics issued by National Centre for Statistics and information. Of the total traded value till the end of September 2019, RO 697.6 million worth transactions were sales contracts, while RO 1,106 million transactions were mortgage deals. The number of properties issued till the end of September 2019 were 159,574 which is a decline of 5.0 per cent from the same period last year.

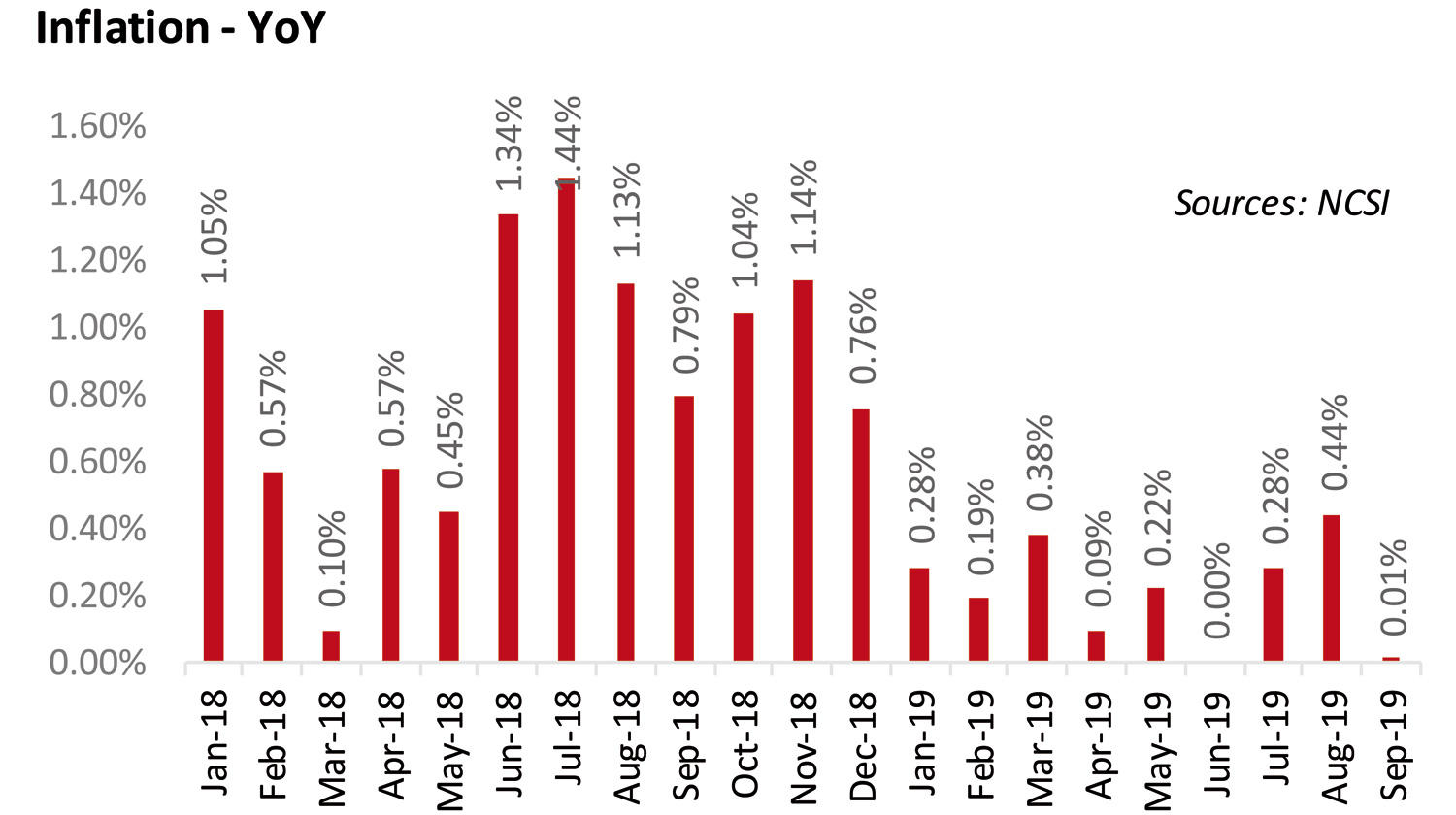

Inflation rate in Oman was recorded at 0.01 per cent in September 2019 compared to September 2018. Inflation rate when compared to August 2019 was however down by 0.56 per cent. The food and non-alcoholic beverages group witnessed a price rise by 1.64 per cent; furnishings, household equipment, and routine household maintenance by 5.16 per cent; health by 0.20; restaurants and hotels by 0.36 per cent; education by 1.99 per cent; and recreation and culture by 0.60 per cent. However, the prices of housing, water, electricity, gas, and other fuels fell by 0.28 per cent; transport by 2.57 per cent; communication by 0.32 per cent; and miscellaneous goods and services by 2.11 per cent in September 2019 compared to the same month of the previous year.

Among the GCC markets, Oman is the only market which was up last week while Saudi Arabia was the worst performer during the week. As per the World Bank’s latest “Ease of Doing Business” report, almost all of the countries in the GCC witnessed improvements in their rankings for ease of doing business. The countries in the GCC adopted 35 reforms over last year to improve the business environment. Saudi Arabia was the most improved economy in the report and saw the biggest gain in its rank in the GCC, improving by 30 positions to rank at the 62nd spot. Bahrain ranked 2nd in the GCC and MENA region with an overall global rank of 43. (Courtesy: U-Capital)

Oman Observer is now on the WhatsApp channel. Click here