MSM30 ended the week marginally lower by 0.20 per cent. Services Index was down 1.19 per cent while Industrial was down by 0.21 per cent. Financial Index rose marginally by 0.02 per cent. Shariah Index was down 0.64 per cent.

Oman REIT Fund is planning an initial public offering that could raise about $100 million, in what could be the biggest-ever listing of a property trust in the Gulf, according to media reports. The REIT, managed by Shumookh Fund Management LLC, plans to seek a valuation of $170 million or more. It aims to offer an annual dividend yield of about 7 per cent. Shumookh Fund Management confirmed that it has filed a draft prospectus for the IPO with Oman’s market regulator and is awaiting approval.

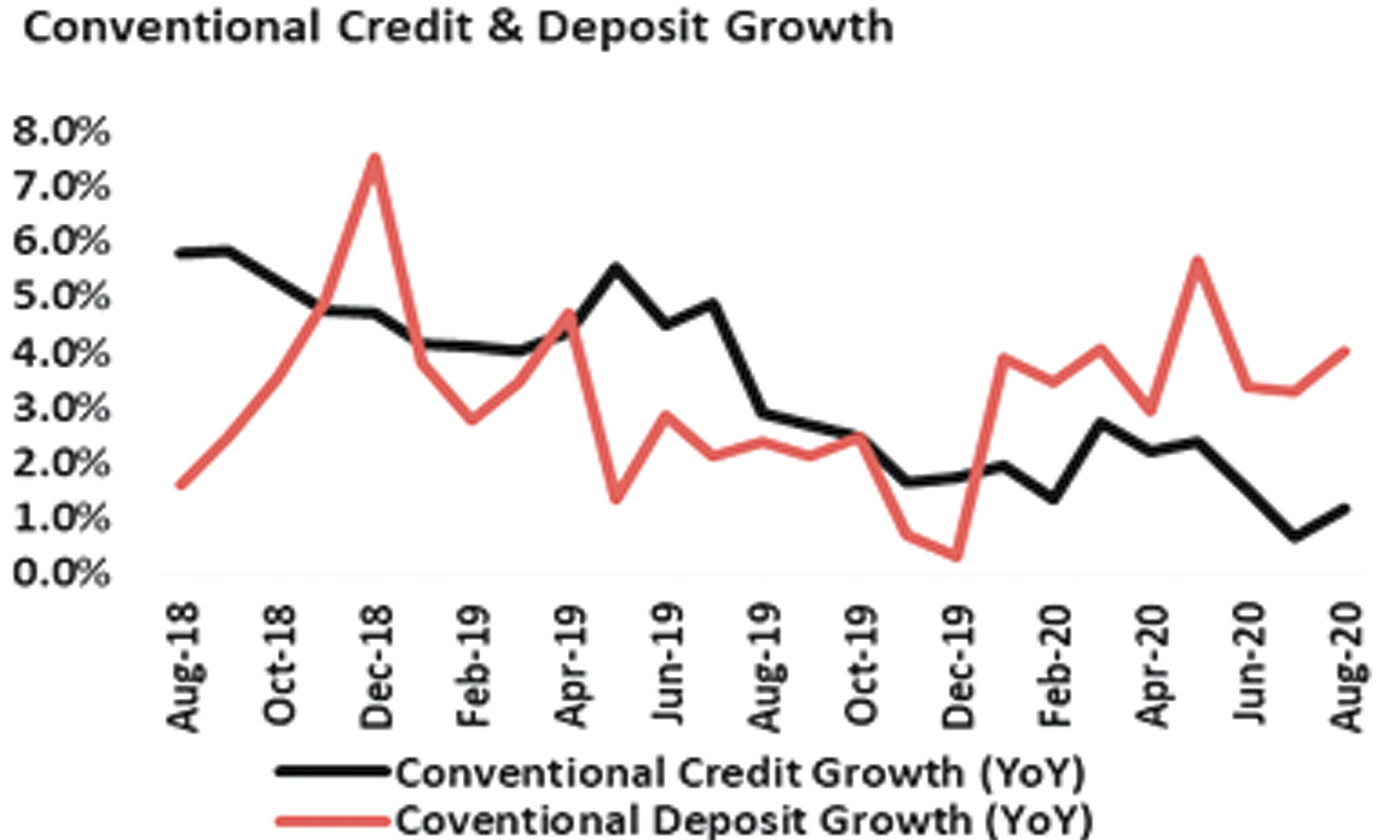

Conventional credit growth picked up to +1.2 per cent YoY in Aug’20 as compared to +0.7 per cent YoY in Jul’20. Total conventional credit reached RO 22.15bn (RO 104.3 million on MoM basis or +0.5 per cent MoM). Conventional credit expanded largely on account of a 6.4 per cent MoM (RO 193 million) increase in credit extended to Government and Public Enterprises, which form 14.5 per cent of total conventional credit. The private sector credit contracted by RO 71.9 million or 0.4 per cent MoM, and it forms about 84.9 per cent of the total. Credit to non-residents also declined by about 11 per cent (down RO 16.5 million). Conventional deposits growth also picked up to 4.0 per cent YoY in Aug’20 vs. 3.3 per cent YoY in Jul’20 and 3.4 per cent YoY in Jun’20. Total conventional deposits stood at RO 20.38bn (+RO 141 million on MoM basis or +0.7 per cent MoM). Sector Loan-to-deposit (LTD) ratio decreased to 108.7 per cent, down from 108.9 per cent in Jul’20. Conventional deposits increased on MoM basis on account of expansion in all categories of deposits: Government deposits rose 0.1 per cent MoM (RO 2.6 million), Public enterprises’ deposits rose 6.2 per cent or RO 67 million, Private sector deposits rose 0.3 per cent or RO 40.6 million, and finally, non-resident deposits rose 7.8 per cent or RO 30.9 million. The share of Government and Public Enterprises deposits, which had dropped to 27.7 per cent in Jul’20 as compared to a simple average of 31.6 per cent over the trailing 12 months, rose slightly to 27.8 per cent in Aug’20.

Islamic Banking financing (Banks and Islamic Windows) reached RO 4.13bn (flat MoM and +8.1 per centYoY). Islamic deposits reached RO 3.65bn (+2.2 per cent MoM and +6.8 per cent YoY). Islamic financing stands at 15.7 per cent of total Oman banking credit, and Islamic deposits form 15.3 per cent of total bank deposits. Islamic Financing-to-Deposit Ratio contracted to 113.0 per cent vs. 115.5 per cent in Jul’20, on MoM deposit expansion outpacing credit growth.

Oman Government has announced its Medium-Term Fiscal Plan (2020-24). Medium-Term Fiscal Plan (MTFP) 2020-2024 has been developed to reduce the primary and overall fiscal deficits to sustainable levels in the medium-term. The MTFP will be implemented over the 2020 to 2024 period and projects the budget deficit gradually narrowing to 1.7 per cent of GDP in 2024 which is considered a sustainable level. Government recognises the need to strengthen the Sultanate’s revenue raising framework by decreasing its reliance on hydrocarbon revenue. Initiatives related to increasing non-oil revenues will have an impact of almost RO 1.4bn by the end of MTFP. Debt-to-GDP ratio remains at level of 80 per cent by the end of the MTFP. Under the MTFP, debt-to-GDP will plateau and start to decline after 2022. During 2020, the government adopted a policy position to reduce the operational and development expenditures of government agencies by 10 per cent from the 2020 State General Budget. The government is committed to further recognising efficiencies in 2021 by reducing recurring spending compared to the levels achieved in 2020.

[Courtesy: U-Capital]

Oman Observer is now on the WhatsApp channel. Click here