MUSCAT, JUNE 9 - The number of insurance policies issued across all classes and types surpassed the two million mark for the first time in 2018 — a figure projected to further rise exponentially once the Unified Health Insurance Programme (Dhamani) is implemented in the Sultanate starting from this year.

According to the Capital Market Authority (CMA), which is also the sector regulator, the number of general and life policies issued by various insurance companies in 2018 jumped 17 per cent to 2.007 million policies. While life insurance accounted for 285,664 policies, the balance 1.722 million comprised all kinds of general insurance policies. In comparison, 1.722 million policies were issued in 2017, comprising 1.614 million general insurance policies and 108,549 life insurance policies.

The insurance sector continues to witness rapid growth, said Abdullah bin Salim al Salmi, Executive President of the CMA. “The sector’s contribution to the (GDP) in 2018 was 1.52 per cent, growth rate of gross insurance premiums was 11.36 per cent, written premiums totalled RO 463.595 million, number of issued insurance policies grew by 17 per cent, retention ratio of insurance companies was 58.7 per cent and Takaful’s share in the total gross direct premiums of insurance companies was 12 per cent, representing a growth of 17 per cent,” he stated in the newly published 2018 Annual Report of the Authority.

Significantly, gross direct premiums written by insurance companies increased in 2018 to reach RO 463.595 million compared to RO 451.571 million in 2017, an uptick of around three per cent, according to the report. Gross direct premiums for general insurance climbed to RO 403.964 million in 2018, up from RO 390.199 million in 2017. Gross direct premiums for life insurance dipped slightly to RO 59.631 million in 2018 versus RO 61.372 million in 2017.

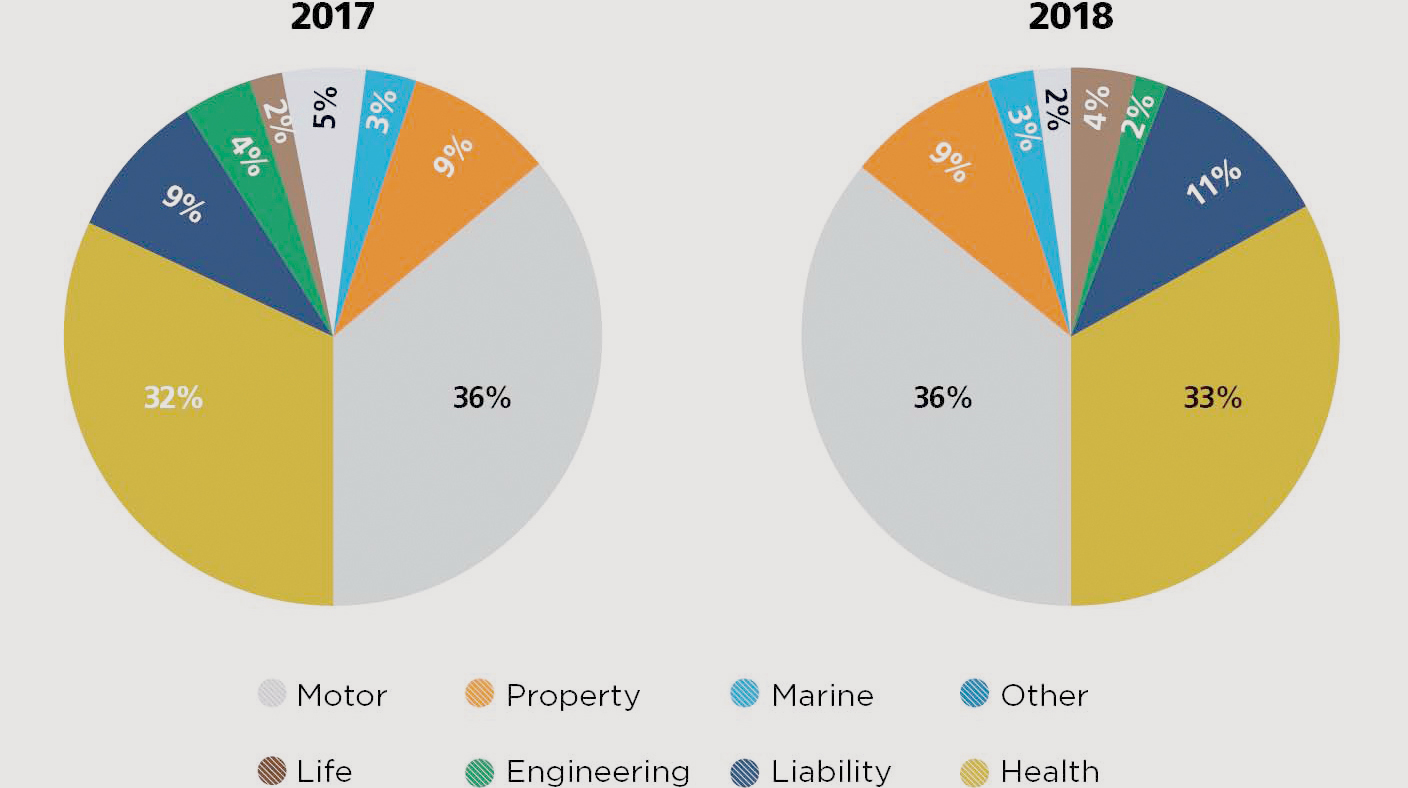

Health insurance accounted for the biggest share (36 per cent) of gross direct premiums in 2018, followed by motor insurance (33 per cent).

Insurance companies reported a retention ration of about 58.72 per cent last year, which was slightly higher than the previous year’s level of 57.46 per cent. Foreign insurance companies fared better with a retention ratio of 75.71 per cent (up from 66.23 per cent in 2017). National insurance companies posted a retention ratio of 54.92 per cent last year, down from 55.05 per cent in 2017.

Takaful companies also reported a 17 per cent increase in gross direct premiums, which climbed to RO 53.584 million last year, from RO 45.762 million in 2017. The Takaful business accounted for around 12 per cent of the gross direct premiums garnered by insurance companies last year. General Takaful represents around 16 per cent of the total general insurance of all companies in the sector, while Family Takaful makes up around 11 per cent of the total life insurance business.

As many as 169 licenses were issued by the CMA to insurance companies and brokers last year.

Oman Observer is now on the WhatsApp channel. Click here