KEY SURVEY: GIO markets survey delivers optimistic outlook on eve of ADIPEC 2017 -

Business Reporter -

MUSCAT, NOV 13 -

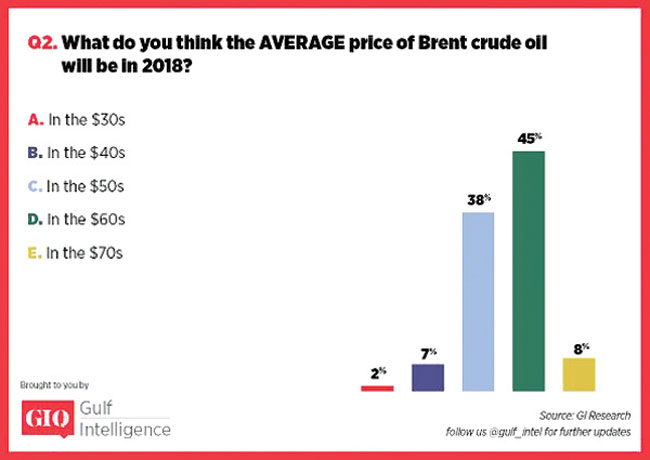

Brent crude oil, the world’s largest oil price benchmark, will average in the $60s a barrel range in 2018, according to 45 per cent of respondents to the Gulf Intelligence GIQ Oil Markets Survey of 100 energy industry professionals conducted on the eve of ADIPEC 2017.

Brent crude oil has averaged at about $52 a barrel thus far this year, so the optimistic outlook reported in the GIQ Oil Markets Survey would see the six Gulf Arab States earning on average about $175 million dollars more each day in 2018.

The relatively bullish sentiment is supported by the International Energy Agency’s (IEA) forecast that global oil demand growth will average 1.4 million barrels a day next year. That said, it is worth noting that 38 per cent of those polled said prices would average in the $50s a barrel range next year.

Brent crude oil broke through $60 a barrel in late October for first time in 2 years on the back of the continued commitment by 24 Opec and non-Opec oil producing countries to curtail supplies by 1.8 million barrels a day through to the end of the first quarter of 2018. Opec, which will next meet in Vienna on November 30, should extend its current output agreement through to the end of next year to maintain oil prices at current levels, 80 per cent of the GIQ survey respondents voted.

“The Oil markets are still feeling uncertain about the price recovery because global crude inventories are still well above the five-year average,” said Sean Evers, Managing Partner, Gulf Intelligence. “Opec won’t be out of the woods until they remove the stocks overhang,” he said.

In its October report, the IEA said the inventory surplus over the five-year average still remained at 170 million barrels a day, however it has been declining due to the estimated demand growth for 2017 of at 1.6 million barrels per day.

Still, the GIQ Oil Markets Survey also indicated that the immediate future oil price could experience some turbulence in the coming weeks with 52 per cent of those polled saying Brent crude oil would close the year at below current levels in the $55-$60 a barrel range.

Oman Observer is now on the WhatsApp channel. Click here