The MSM 30 Index continued its downward trajectory as seen in the last couple of weeks, primarily on selling pressure from foreign investors. Foreigners were net sellers of about $1.1m worth of securities this week. The MSM30 Index declined by 1.28 per cent w-o-w. All sub-indices closed down, led by the Industrial Index which closed down by 2.48 per cent w-o-w, followed by the Financial Index which closed down by 1.53 per cent w-o-w, and the Services Index which closed down by 1.2 per cent w-o-w. The MSM Shariah Index closed also closed down by 1.14 per cent w-o-w.

Oman Oil and Orpic Group, which has been rebranded to OQ last week, will undertake a readiness programme for next 12-18 months before considering the privatisation or stake sale options to raise money for future projects, according to a senior OQ official. The readiness programme will evaluate lots of aspects of the group post integration such as whether the right corporate governance practice is in place or not and also to look at whether right policies are in place or not.

Oman’s Capital Market Authority issued Takaful regulations. The issuance of Decision has specified six months for the companies to adjust their position from the date the regulation comes into force on December 23, 2019. The legislation was in response to the growth of Takaful companies in Oman which started four years ago to meet the needs of individuals and institutions including Islamic banks.

The regulation obligates all the companies to constitute their respective Sharia Supervisory Committees and that the differences between the Sharia Supervisory Committee and the board of directors of the company shall be referred to the Supreme Sharia Committee of CMA, which will have the final say.

The regulation also obliges the company to appoint Sharia external supervisor to perform Sharia supervision for each financial year to ensure all activities are sound and specified the functions of the external Sharia supervisor.

MSM announced the list of Shariah compliant companies. Shariah Index which constituted 31 companies of 2Q19 have been changed and now comprise of 29 companies as of 3Q19, as per the recent announcement. Two companies which have exited from the Index are: Muscat Gases and National Real Estate Development & Investment Company.

Galfar Engineering was awarded contract work for a value of RO 3.95m during the week. Recent awards were related to construction of recharge dams and cliff/access road. This was the fourth announcement of contract awarded to Galfar in the month of December 2019. With this contract, YTD contracts received by Galfar amount to RO 188.7m.

CMA approved the prospectus of Dhofar International Investment & Development Holding Bond at a size of RO 25.018m divided into 250.183m shares at an issue price of RO 0.100 per bond and an interest rate of 9 per cent per annum. The bonds is listed on the in the Bonds and Sukuk market until its maturity i.e. 22/12/2026.

SMN Power announced that the tax committee in its judgement dated December 19 has rejected the Company’s appeal regarding the disallowance from the tax department of the liquidity damages paid to OPWP, although liquidity damages received from Doosan were taxed in the hands of the Company for the tax year 2009. Based on the advice, Company has now decided to appeal to primary court and appoint a legal adviser and file the legal proceedings.

We continue to see a good response to the government issuance of development bonds as the recent issue 62 (10-year bond) auction results showed that the total subscription amount stood at RO 270.98m (1.35x) versus the allotted amount of RO 200m, thus showing continued trust in the government. The accepted average yield was 5.55 per cent. As per our database, the last 10 year development bond (Issue 56) issued in March 2018, offered an average yield of 5.66 per cent.

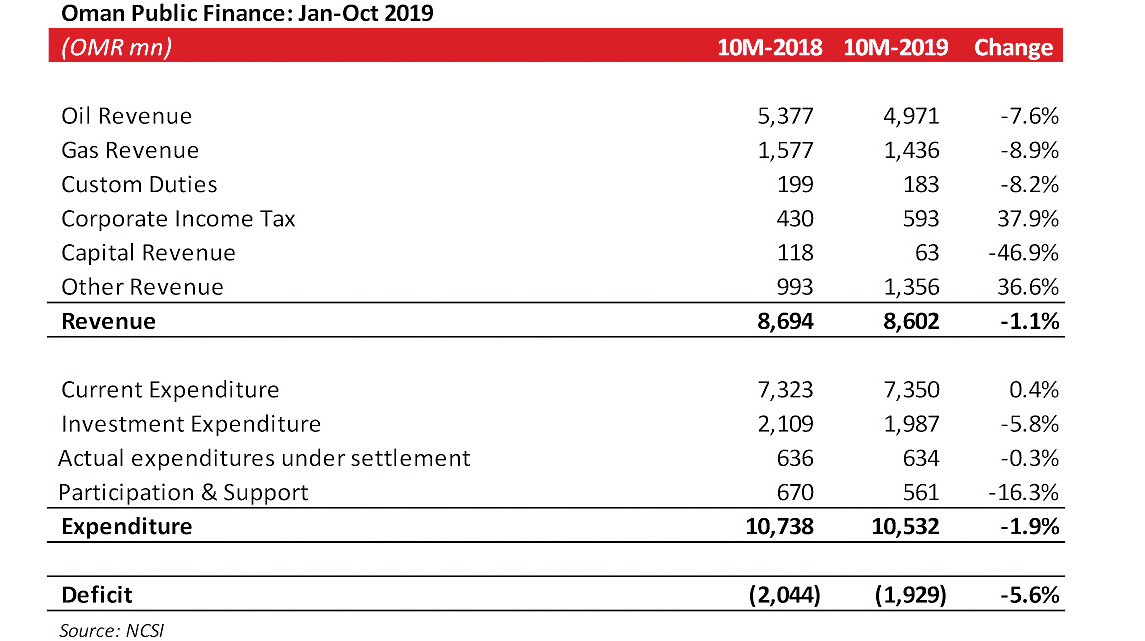

NCSI announced latest data related to the public finance. As per the data, Oman deficit has gone down 5.6 per cent during 10M-2019 to RO 1.92 bn compared to RO 2.04 bn in 10M-2018. Revenue was down 1.1 per cent during the period, major impact coming from fall in oil and gas revenue. Expenditure was down by 1.9 per cent supported by drop in civil ministries expenditure and defence/security expenditure.

As per the latest CBO Quarterly Bulletin, Non-performing assets (NPAs) of the sector have reached RO 175m as of September 2019. NPAs as percentage of gross finance assets have risen to 15.5 per cent as of 3Q19 compared to 13.7 per cent in 2Q19 and 12.0 per cent at the end of 2018. Provision cover has fallen to 0.57x at the end of 3Q19 compared to 0.60x in June 2019 as well as in December 2018. Gross finance asset growth receded by 0.5 per cent on a QoQ basis and 0.7 per cent on a YoY basis. Borrowing from banks and other financial institutions remains the primary source of funding reaching RO 712.7m.

Amongst the GCC markets, the Bahrain bourse was the best performer during the week up by 1.26 per cent while MSM30 was the biggest loser. [Courtesy: U Capital]

Oman Observer is now on the WhatsApp channel. Click here