MSM30 ended the week down by 1.05 per cent, led by Financial Index which was down by 1.29 per cent. Other sub-indices were higher w-o-w. The Industrial index and Services Index were higher by 0.08 per cent and 0.10 per cent, respectively. Traded value during the week was higher on w-o-w basis by 2.2 per cent.

Last week MSM announced the revised list of Shariah Compliant Companies. Twenty companies are Shariah compliant and the changes were: Included — Oman Education & Training, Oman Packaging, and Gulf Mushroom; Excluded — Oman Cables, Shell Oman and Salalah Port Services.

Oman’s Ministry of Finance announced at the weekend its intention to launch the third issuance of a sovereign Sukuk denominated in Omani riyals within the framework of its sovereign Sukuk programme unveiled in 2019. The bond will be issued via a book-building subscription process and will include a segment for small investors. The Ministry indicated that to meet financing requirements of the year, development bonds amounting to RO 550m in value have been issued so far this year, while the government recently obtained a bridge loan of RO 770m. This is in addition to withdrawals from state reserves, among other funding methods. Work is also underway to issue an integrated package of measures, it added.

As per CBO’s latest statistics, Oman banking sector’s total credit stood at RO 26.18bn (-0.6 per cent MoM and +1.7 per cent YoY) as at the end of Jul’20. Total deposits stood at RO 23.82bn (-0.6 per cent MoM and +3.5 per cent YoY). Total private sector credit stood at RO 22.83bn, (-0.9 per cent MoM and 1.1 per cent YoY). Loan-to-deposit Ratio stood at 109.91 per cent in Jul’20 (stable from Jun’20) and down from 110.2 per cent in May’20, as monthly credit and deposit declines were the same.

Conventional credit growth has slowed to 0.7 per cent YoY in Jul’20 as compared to 1.5 per cent YoY in Jun’20. Total conventional credit reached RO 22.05bn (-RO 171m on MoM basis or -0.8 per cent MoM). Conventional credit slowed largely on account of a 1.3 per cent MoM contraction in private sector credit (contracted by RO 245.1m), which forms about 86 per cent of the total. Credit to non-residents also declined by about 47 per cent (down RO 136.1m). This is in spite of a rise in credit to the Government and Public Enterprises (+RO 210m). Conventional deposits growth also slowed to 3.3 per cent in Jul’20 vs. 3.4 per cent in June’20 and 5.7 per cent YoY in May’20. Total conventional deposits stood at RO 20.24bn (-RO 164.2m on MoM basis or -0.8 per cent MoM). Sector Loan-to-deposit (LTD) ratio decreased to 108.9 per cent (flat from Jul’20) and down from 109.5 per cent in May’20. Conventional deposits declined on MoM basis largely on account of a 7.6 per cent MoM (RO 371.2m) decline in Government deposits (total at RO 4.52bn or 22.3 per cent of total conventional deposits). Public enterprises’ deposits expanded by 1.1 per cent or RO 30m. The share of Government & Public Enterprises deposits has dropped to 27.7 per cent Jul’20 from a simple average of 32.0 per cent over the trailing 12 months. Private sector deposits, which account for about 70 per cent of total conventional deposits, rose by 1.3 per cent MoM and 10.9 per cent YoY.

Islamic Banking financing (Banks & Islamic Windows) reached RO 4.13bn (+0.6 per cent MoM and +10.1 per cent YoY). Islamic deposits reached RO 3.57bn (+0.9 per cent MoM and +4.8 per cent YoY). Islamic financing stands at 15.8 per cent of total Oman banking credit, and Islamic deposits form 15.0 per cent of total bank deposits. Islamic Financing-to-Deposit Ratio stood at 115.5 per cent vs. 115.8 per cent in Jun’20 and 114.3 per cent in May’20, on MoM deposit expansion outpacing credit growth.

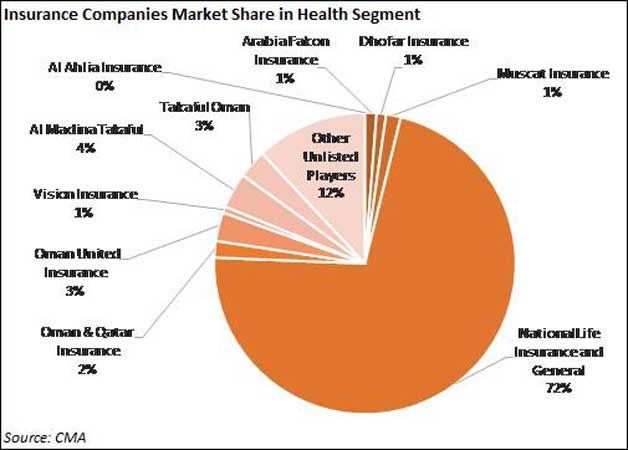

Oman Chamber of Commerce and Industry (OCCI) has joined hands with health insurance companies to support the introduction of a standard unified health insurance policy to cover COVID-19 testing and treatment in the Sultanate. The product, which is currently the subject of deliberations among insurance companies, will be rolled out once it is reviewed and approved by the Capital Market Authority (CMA), according to a key official associated with the initiative. Chairman of OCCI’s Finance & Insurance Committee, said: “They are currently exploring the initiative to launch a special product for COVID-19 insurance coverage in the Sultanate. Discussions have already commenced with insurance companies on the scope and features of the policy. It will be offered to the market once it is certified and approved by the CMA, which is the regulator of the insurance sector in Oman.”

[Courtesy: U Capital]

Oman Observer is now on the WhatsApp channel. Click here