The MSM30 Index closed the week up by 1.53 per cent. Sector wise, the Financial Index closed up by 1.43 per cent w-o-w, followed by the Services Index up by 0.54 per cent w-o-w. The Industrial Index was higher by 0.47 per cent w-o-w. The MSM Shariah Index however closed down by 0.34 per cent w-o-w. Foreigners continued to remain net sellers in the market with net foreign outflow of RO 1.18m ($3.06m) last week. YTD foreign outflows amount to $25bn.

Port of Salalah said last week that it has reached a settlement with its insurer for a sum of $67.75m as damages arising out the destruction and disruption caused by Cyclone Mekunu when it struck the southern part of the Sultanate during May 2018.

During 2018, on-account payment of RO 14.8m was received towards the Company’s Mekunu insurance claim. No insurance receipts have been received during the year 2019. Settlement has been reached with insurance company at RO 26.06m ($67.75m) out of which RO 14.80m ($38.50m) has been already received and recognised in the income. The balance amount of RO 11.25m ($29.25m) will be received and recognised as income in 2020.

The latest CBO statistics indicate that the total deposits (Islamic + Conventional) of Oman’s banking sector reached RO 23.7 bn (+1.7 per cent YoY and 2.1 per cent MoM) as at the end of Dec 2019, out of which, private sector deposits accounted for about 64 per cent, increasing by 6.2 per cent YoY and 2.4 per cent MoM to RO 15.2 bn.

Total deposit growth on YoY has slowed to the lowest level seen since May 2016 when a deposit growth of 0.4 per cent YoY was recorded. Total credit amounted to RO 25.8 bn, a rise of 3.1 per cent YoY (flat MoM). Private sector accounted for 88 per cent of total credit outstanding, at RO 22.67 bn, +2.8 per cent YoY and -0.4 per cent MoM. Total credit growth on YoY picked up slightly from the lowest level ever recorded at 3.0 per cent YoY in Nov 2019. Loan-to-deposit ratio stood at 109.2 per cent vs 107.8 per cent a year ago.

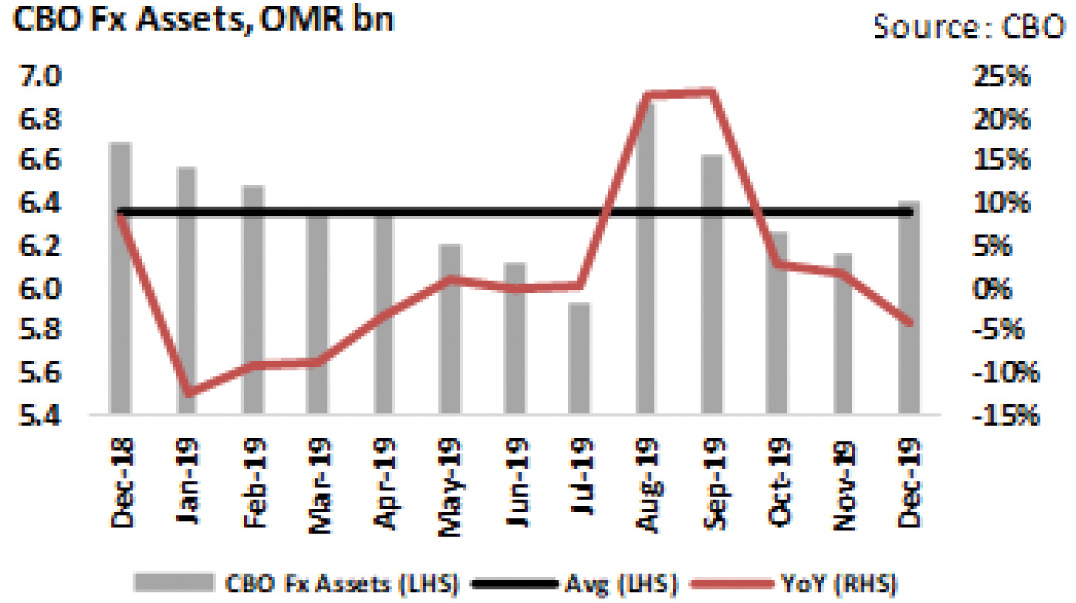

CBO’s foreign assets as at the end of December 2019 stood at RO 6.41 bn, having contracted by 4 per cent YoY. The assets are still 4 per cent up on MoM basis and are above the trailing 12m simple average of RO 6.34 bn. These assets include bullion, IMF reserve assets, placements abroad and foreign securities.

CBO announced the auction results of 63rd GDB Issue. As against the total value of RO 150m, the issue received applications of RO 218.477m. The average yield was 5.10 per cent at an equivalent price of RO 100.875. The 7-year bond issued on February 20, 2020, and will mature on February 20, 2027, carrying a coupon rate of 5.25 per cent p.a. Government was able to reduce its cost as the last 7year bond carried average yield of 5.52 per cent while the current one is at 5.10 per cent.

Regionally, Saudi Stock Exchange topped the gainers while Kuwait Stock Exchange lost the most down by 0.34 per cent. S&P Global Ratings last week said that the recent outbreak of coronavirus in China has increased risks to the economies of the GCC countries. GCC countries send 40-45 per cent of their exported goods to China. Virus-related travel restrictions, if not lifted as S&P expect, could weigh on the GCC’s hospitality industry, but more so in Dubai, which receives almost 1m visitors from China. S&P warned that if the virus continues to spread, there is a risk that the economic impact could increase unpredictably, with credit implications not just for China but elsewhere.

GCC Telecom Sector (14 companies) profitability was up 2.6 per cent to $7.6 bn in 2019 compared to $7.40 bn in 2018. In 4Q19, net income reported by the sector was $1.78 bn, lower on QoQ and YoY basis by 8.3 per cent and 15.6 per cent, respectively. On an annual basis almost, all countries reported growth in income. Qatar led the growth with net income increase of 11 per cent followed by 4.7 per cent and 4.5 per cent in Oman and Kuwait.

Saudi Arabia and Bahrain reported earnings growth of 2.5 per cent and 1.9 per cent in 2019. In terms of composition, Saudi Arabia and UAE comprise 39.3 per cent and 37.3 per cent to the total in 2019, respectively. Followed by 12.6 per cent in Kuwait, 6.7 per cent in Qatar and 3.8 per cent in Oman. [Courtesy: U-Capital]

Oman Observer is now on the WhatsApp channel. Click here