Investment activities continued to increase in the last week on better investment sentiment, positive news at macro level and nearing of announcement related to 2Q 2018 results. The MSM30 closed the week down by 0.83 per cent at 4,571.75. The Services sub index was the only gainer as it closed up by 0.59 per cent. Both the Financial and Industrial indices went down by 2.05 per cent and 0.28 per cent respectively. The MSM Shariah Index closed up by 0.12 per cent.

The extraordinary general meeting of Ahli Bank has approved the issuance of additional Tier I Capital Instruments in the form of perpetual bonds up to RO 75m. The nominal value is RO 1.000 per bond plus issue expenses, in single or multiple tranches and either by Public or Private Placement.

Bank Dhofar Board of Directors has approved an issue price of 152 baisas per share (consisting of a nominal value of 100 baisas, a premium of 50 baisas, plus issue expenses of 2 baisas) for the rights shares of ordinary shares. On April 26 this year, the Board of Directors of the bank approved raising of Core Equity Tier 1 (CET-1) Capital of an amount up to RO 55m by the way of rights issue of ordinary shares, subject to necessary regulatory approvals.

In the weekly technical analysis, approaching our previous recommendation for the first support level that MSM index still fluctuate between the first support level at 4,560 points (broken this level will allow the index to reach 4,520 points) and the first resistance level at 4,600 points (cross this level will enable the index to reach 4,640 points. In the technical analysis, the market is still moving between these two levels.

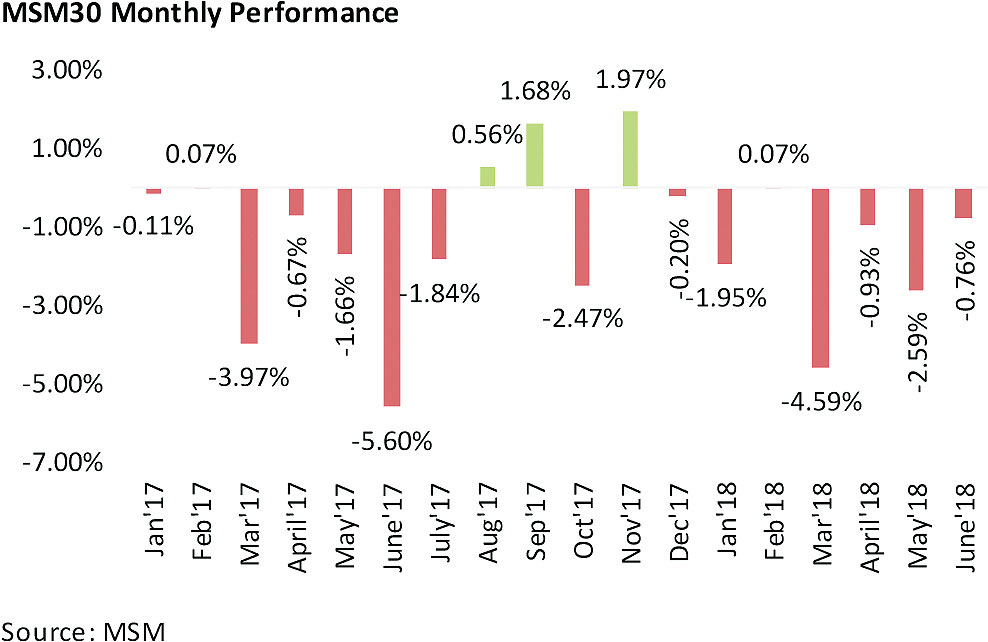

The MSM30 ended on June 2018 down by 0.76 per cent at 4,571.75 on foreign and GCC institution selling pressures, cautious sentiment and continuing geo political pressures.

Locally, Oman’s Public Finance continued posting better a performance. 4M 2018 data showed a decline of 53.4 per cent in the deficit on yearly basis at RO 808m. This was mainly due to better revenue and lower expenditure. According to the CBO latest monthly bulletin, total revenues went up by 24.3 per cent to RO 3.17bn supported by higher earnings from all segments especially net oil revenue which went up by 31.8 per cent on better oil price as average price ($/bbl) went up by 22 per cent during the period. Further, gas revenue went up by 17.3 per cent and other revenue by 13.8 per cent. Net oil revenues to total revenue stood at 58.2 per cent in 4M 2018 versus 54.9 per cent in 4M 2017. On the other hand, total expenditures dropped by 7.1 per cent on yearly basis to RO 3.98bn largely due to lower actual expenses under settlement (60.5 per cent) and lower investment expenditure (-5.5 per cent). Current expenditures formed 69.1 per cent of the total expenditures up from 58.8 per cent in 4M 2017 and interest on loans went up by 126.7 per cent. Total oil and gas production expenditures (current and investment) saw a rise of 9.2 per cent on yearly basis at RO 583m for 4M 2018.

We continue to see a good response to the government issuance of development bonds as the recent issue 57 ( 5-year bond) auction results showed that the total subscription amount stood at RO 137.4m (1.37x) versus the allotted amount of RO 100m, thus showing continued trust in the government. The accepted average yield is 4.85 per cent at a price of RO 99.56. It would be worth mentioning that the last 5 year development bond (issue 48) issued in February 2016, offered an average yield of 4.32 per cent at a price of RO 96.345.

Fitch Ratings has affirmed Oman’s Long-Term Foreign-Currency Issuer Default Rating (IDR) at ‘BBB-’ with a Negative Outlook. The agency forecasts Oman’s budget deficit at 6.3 per cent of GDP in 2018, representing a notable drop compared with 13.5 per cent of GDP in 2017. The agency expects the budget deficit to widen again in 2019 under the baseline assumption that oil prices will moderate to an average of $65/bbl from $70/bbl in 2018. Further, it expects real GDP growth at 3.6 per cent in 2018 (led by an expansion of LNG output related to gas production at the Khazzan field) and 2.5 per cent in 2019, from 0.2 per cent in 2017. It worth stating that Fitch has neither changed the rating nor the outlook.

Kuwait Stock Exchange topped the gainers up by 1.4 per cent within the GCC region while Dubai Financial Market was the worst as it went down by 3.66 per cent.

Dubai market is down 16.29 per cent YTD, making it the worst performing market within the GCC this year. The market has hit its two year low and if it falls few more percentages down it will reach the level which was last seen in September of 2013. Apart from geopolitical tensions in the region, Dubai is marred by some private and public companies facing litigation issues, while we have also witnessed capital flight whereby investor preferred Saudi Stocks over Dubai. Lately, companies with exposure to Abraaj Funds has been the main reason for the tumult. Dana Gas and Air Arabia lead so far, whereas other companies will be announcing its exposure to Abraaj soon as directed by Securities and Commodities Authority UAE. While at the public level one of the heavy weight contracting company Drake and Scull (DSI) is currently investigating the mal practices adopted by the previous management. Overall, DFM is currently trading at P/E and P/Bv multiple of 9.08x and 1.07x, respectively.

Globally, Opec met a week before where they decided to modestly increase the oil production after the previous agreement of oil production cut reached compliance of over 150 per cent. Compliance hit 150 percent after production outages in Venezuela, Libya and Angola. Opec and its allies have since last year been participating in a pact to cut output by 1.8 million bpd.

The measure helped rebalance the market in the past 18 months and lifted oil to around $75 per barrel from as low as $27 per barrel in 2016. The group last week agreed that Opec and its allies led by Russia should increase production by about 1 million barrels per day (bpd), or 1 percent of global supply after United States, China and India urged Opec to release more supply to prevent an oil deficit that would hurt the global economy. Decision to increase oil production also came in the wake of recent imposition of sanction on Iran and Venezuela, which will reduces their oil exports and overall volumes in market. Post the meeting, Saudi Energy Minister also said that Russia is considering joining the Organization of Petroleum Exporting Countries (Opec) as an “associate member.”

[Courtesy: U Capital]

Oman Observer is now on the WhatsApp channel. Click here