Business Reporter -

Muscat, MAY 1 -

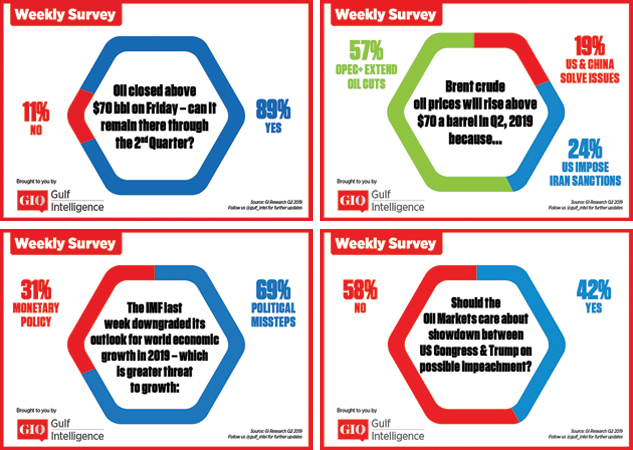

Brent crude prices will hold above $70 a barrel during the second quarter, according to 89 per cent of those polled in GIQ’s monthly Energy Market Survey in April.

On the factors which would provide the strongest support for this, 57 per cent of the survey audience said it would be indications from the Opec+ group of producers that they would likely continue with output cuts beyond June, while 24 per cent felt that the re-imposition of US sanctions on Iran would be the main impetus.

Brent prices averaged in the $60s/bbl during the first quarter. In April, they broke through the $70/bbl mark on the back of continued strong compliance by the Opec+ group and on the US saying it would end the temporary waiver on Iran sanctions. Continued disruption to oil production in Venezuela and Libya has also provided a boost to prices.

According to a poll of 10 investment banks by the Wall Street Journal, Brent crude is now expected to average $70/bbl for the whole year whereas as recently as March, the same group had said it would be $68/bbl.

On the macroeconomic front, the IMF in April downgraded its outlook for global growth in 2019 for the third time in six months, to the lowest rate since the 2009 financial crisis, citing a bleaker outlook for most major advanced economies and signs that higher tariffs are weighing on trade. It said the world economy would grow 3.3 per cent this year, down from the 3.5 per cent forecast for 2019 in January. 69 per cent of the GIQ polled audience felt that political missteps were providing fuel to this negative economic sentiment while 31 per cent attributed it to monetary policy.

The US Federal Reserve, which has been incrementally increasing interest rates for the past two years, said at the end of March that it did not plan to hike rates any further this year (contrary to previous plans for two more increases) due to a slowdown in the US economy. The Fed benchmark rate currently stands at 2.4 per cent.

Oman Observer is now on the WhatsApp channel. Click here