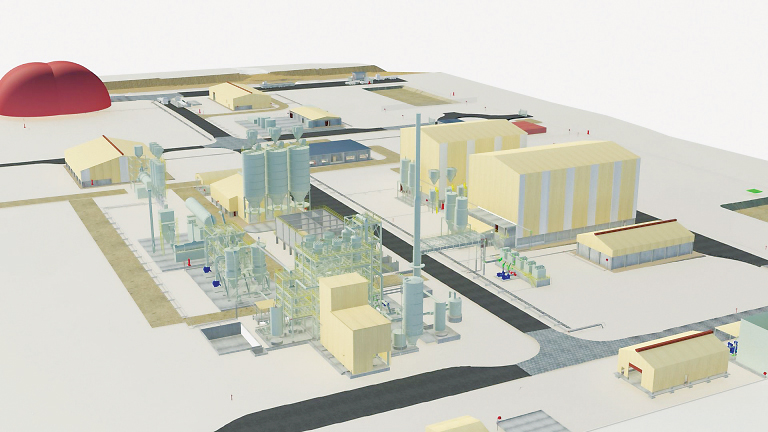

First metal from the Oman Antimony Roaster (OAR), a $100 million project nearing completion in Sohar Freezone, is expected this June, marking the culmination of a four-year-long effort by its promoters to bring this strategically vital venture to fruition.

The Oman-based Strategic & Precious Metals Processing LLC (SPMP) is developing the first-of-its-kind project, which is essentially an antimony and gold production facility with capacity of up to 50,000 dry tonnes per annum of antimony and gold concentrate. Output is anticipated at 20,000 tonnes of antimony and 50,000 ounces of gold per annum.

“Construction of the plant is ongoing with over 600 people now working on site and overall completion is at 86 per cent. The front end of the plant, comprising of the concentrate handling shed and concentrate dryer, is complete and ready for cold commissioning,” said Tri-Star Resources, a 40 per cent shareholder, in a statement.

“The plant is due to produce its first antimony metal in June 2018. SPMP expects the plant to then ramp up to a production rate of between 2,000-3,000 tonnes/month by the end of the year (around 50 per cent of design capacity),” it added.

The announcement follows the signing of a new banking agreement by SCMP with Alizz Islamic Bank covering the provision of $30 million to be used for a combination of project and trade finance for SPMP. The facility will rank alongside the company’s existing debt provided by Bank Nizwa and brings SPMP’s total debt facility to $70 million.

Oman-based SPMP is a partnership of Oman Investment Fund (OIF), a sovereign wealth fund of the Sultanate, with a 40 per cent equity interest in the company; Tri-Star Resources, a London-based mining development firm, also with a 40 per cent stake; and DNR Industrials Ltd, part of Dubai-based investment and project development corporation Dutco Group of Companies (Dutco), with the balance 20 per cent.

With the project’s imminent launch, the Sultanate is set to join a select handful of countries that produce antimony – a strategically important metal widely used in the industrial, electronics and plastics sectors.

“Negotiations are also underway to sell the antimony metal to key customers and the gold doré to a gold refinery,” Tri-Star Resources added. A doré bar is typically a semi-pure alloy of gold and silver, which would need to be further refined in a gold refinery.

Oman Observer is now on the WhatsApp channel. Click here