MUSCAT, JAN 5

Oman’s 2026 State General Budget may be judged less by its headline deficit and more by whether it can convert improving investor confidence into steady non-oil growth, as indicators tracked by leading brokerage firm United Securities show stronger banking activity, a sharp recovery in the Muscat Stock Exchange and rising foreign direct investment.

United Securities Research said the MSX gained 28.2% in 2025, with the MSX30 touching 5,985 in December and ending the year near its peak, as sentiment improved alongside domestic developments and regulatory support.

The same note reported broad-based strength in the banking system, with sector assets up 6.6% year-on-year in the first nine months of 2025. Credit expanded 8.0%, while bank investments rose 19.1%. Asset quality remained stable, it said, with non-performing loans at 4.5% and a capital adequacy ratio of 18%.

Foreign direct investment inflows increased 12.8% year-on-year in the first half of 2025, driven by higher investment in oil and gas exploration, manufacturing and construction, while the UK, the United States and Kuwait remained the top three source countries, according to the note.

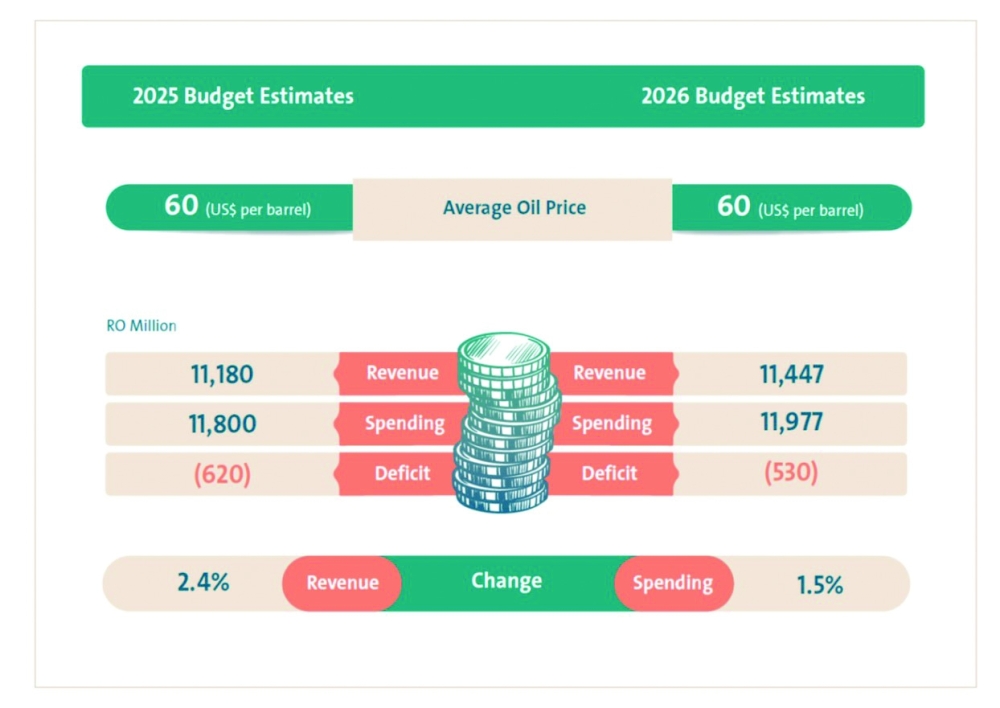

These signals come as the 2026 budget projects a deficit of RO 530 million, following an estimated RO 480 million deficit in 2025 that the report said came in below the original budget target.

The research note said the 2026 deficit is expected to be funded through RO 130 million of borrowing, with the remaining RO 400 million covered by reserve withdrawals. Despite the planned borrowing, it expects the debt-to-GDP ratio to remain within a 30–35% range in 2026.

A fiscal table included in the report places total debt at RO 13.827 billion in 2026, equivalent to 33.0% of GDP, alongside projected total revenues of RO 11.447 billion and expenditures of RO 11.977 billion.

On ratings, the note summarised improvements in 2025 from Moody’s and Fitch, while S&P reaffirmed its rating with a stable outlook, developments that typically help lower sovereign borrowing costs over time.

Population dynamics add another layer to the 2026 “confidence test”. Oman’s population reached 5.3 million as of September 2025, with Omanis accounting for 56.6%, the note said — a reminder that investment and credit momentum must translate into jobs, services and productive private-sector growth.

Oman Observer is now on the WhatsApp channel. Click here