MUSCAT, OCT 4

US-based Electric Hydrogen (EH2), a leading manufacturer of electrolyser systems — a critical component in green hydrogen production — has announced that it has secured funding from an array of leading international investors, including the Oman Investment Authority (OIA), the integrated sovereign wealth fund of the Sultanate of Oman.

Massachusetts-based EH2 said its $380 million Series C financing round was successfully oversubscribed, generating new capital that would accelerate the manufacture and deployments of what is billed as the world’s most powerful green hydrogen systems.

For Oman Investment Authority (OIA), the latest financing adds to a series of climate-tech investments made by the wealth fund that align with, on the one hand, the Omani government’s support for global decarbonisation efforts, and on the other, the wealth fund’s keenness to partner with start-ups on the cutting-edge of sustainable energy and climate mitigation technologies.

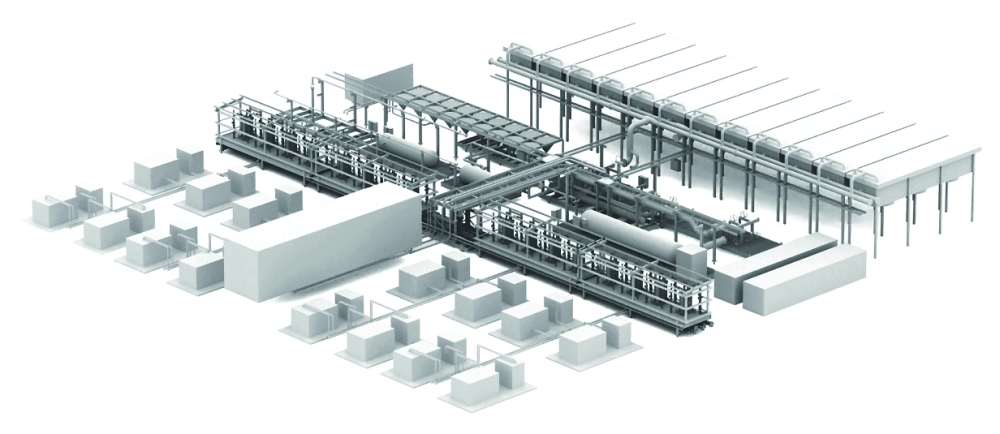

Electric Hydrogen plans to deliver and commission industrial-scale electrolysers — systems that produce green hydrogen from renewable electricity and water. With a capacity of 100 megawatts (MW), each unit will be capable of producing around 50 tonnes of cost-competitive green hydrogen per day.

Oman is anticipated to require potentially thousands of these mega-scale electrolyser systems to meet its target of producing 7 – 8 million tonnes per annum of green hydrogen by 2050. Partnerships with leading-edge manufacturers, such as Electric Hydrogen (EH2), will give Oman a foothold in this critical sector.

Underscoring the robust investment appeal of Electric Hydrogen, a large number of leading global investors participated in the funding round. It was led by Fortescue, Fifth Wall and Energy Impact Partners and included new investors Oman Investment Authority, bp Ventures, Temasek, Microsoft’s Climate Innovation Fund, the United Airlines Sustainable Flight Fund, New Legacy, Kajima Ventures and Fatima Holdings USA.

Existing strategic investors Amazon’s Climate Pledge Fund, Equinor Ventures, Mitsubishi Heavy Industries, and Rio Tinto continued their participation, as did previous financial investors Breakthrough Energy Ventures, Capricorn Partners, Prelude Ventures, and S2G Ventures.

Electric Hydrogen, which is building a 1.2 gigawatt (GW) factory in Massachusetts, has more than 5 GW of its electrolyser systems on order. Deliveries are expected to begin later in 2024. Capital raised by Electric Hydrogen since its founding in 2020 totals over $600 million.

Raffi Garabedian, CEO and Co-founder of EH2, commented: “We’re here to replace natural gas and coal with renewable green hydrogen. To address the global climate challenge, we need new technologies that help critical industries reduce their emissions. Electric Hydrogen’s 100MW electrolyser systems do that. Today’s hydrogen comes from natural gas and coal and accounts for around 2.5% of global carbon emissions.1 There has not been a viable solution to this problem because renewable green hydrogen has been too expensive to produce at scale. The Electric Hydrogen team is changing that and the opportunities for decarbonisation go far beyond today's applications.”

Oman Observer is now on the WhatsApp channel. Click here