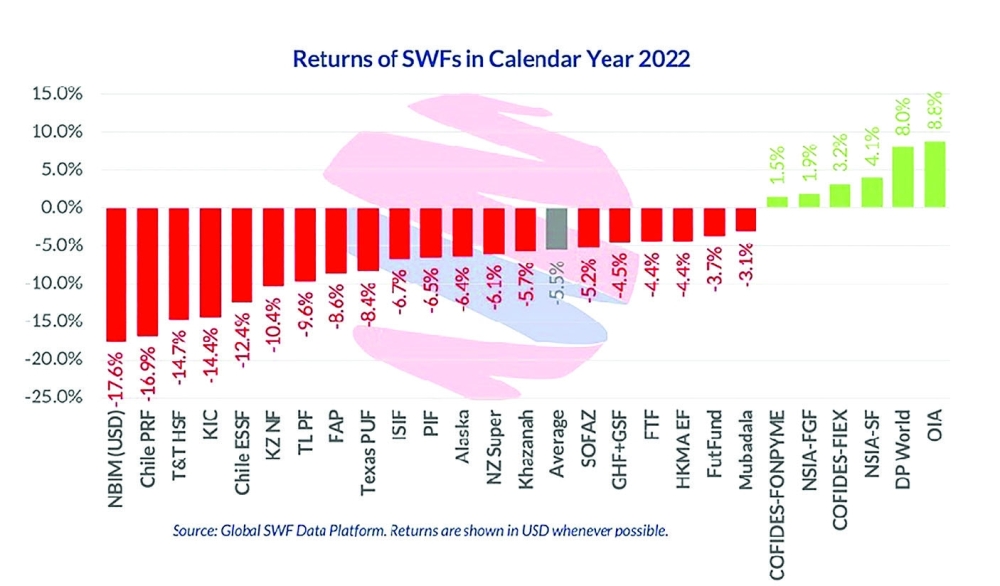

MUSCAT: In the highly competitive world of sovereign wealth funds (SWFs), the Oman Investment Authority (OIA) has emerged as the top performer in 2022, reporting a remarkable return of 8.8% on its investments. This outstanding achievement has been highlighted in the recently published Global SWF Report, which provides comprehensive insights into the performance of SWFs worldwide.

The Global SWF Report, a leading industry publication, has become an influential benchmark for evaluating the success and efficiency of SWFs. In its latest edition, the report analysed the performance of various SWFs, including DP World, Mubadala, and the Public Investment Fund (PIF) of the neighbouring countries. Notably, the report excluded the Abu Dhabi Investment Authority (ADIA), China Investment Corporation (CIC), National Social Security Fund (NSSF), and Samruk Kazyna from its analysis.

The Oman Investment Authority's exceptional 8.8% returns in 2022 surprised many industry experts and solidified its position as a leading player in the global investment landscape. This accomplishment is a testament to the OIA's investment strategy and prudent decision-making, which have allowed it to navigate through challenging market conditions successfully.

The OIA, the country's sovereign wealth fund responsible for managing and diversifying the Sultanate of Oman's vast wealth, achieved this outstanding performance against a backdrop of global economic challenges and market volatility. This accomplishment highlights the expertise and strategic decision-making abilities of the OIA's investment team.

The robust performance of the OIA can be attributed to its diversified investment portfolio, which spans various asset classes and sectors globally. The fund's prudent investment strategy, combined with its ability to identify and capitalize on emerging market trends, has played a pivotal role in delivering impressive returns.

Earlier this month, OIA announced a substantial increase in the size of its assets, reaching approximately RO 18 billion, following a remarkable 8.8% return on investments in 2022. This achievement underscores OIA's effective investment strategies and prudent decision-making, despite the challenging global economic landscape.

In addition to its financial accomplishments, OIA has remained committed to supporting the state's general budget. Since 2016 and up until the end of 2022, the Authority has contributed dividends amounting to RO 5.6 billion. This financial support has played a crucial role in meeting the government's fiscal requirements and promoting economic stability.

OIA's dedication to promoting job opportunities for Omani nationals has also been commendable. Over the past year, the authority and its affiliated companies created more than 800 job opportunities for Omanis. This initiative aligns with the government's vision of fostering sustainable economic growth and reducing unemployment rates by prioritizing the employment of its citizens.

Furthermore, OIA has actively supported small and medium-sized enterprises (SMEs) by awarding tenders and contracts worth approximately RO 190 million. These collaborations with SMEs not only stimulate entrepreneurship and innovation but also contribute to the diversification and development of the national economy. OIA's ongoing efforts to empower and uplift SMEs reflect its pivotal role in driving economic growth and fostering a vibrant business ecosystem.

Oman Observer is now on the WhatsApp channel. Click here