MUSCAT: Personal loans disbursed by licensed lenders in the Sultanate of Oman climbed 2.7 per cent to hit a new peak of RO 10.542 billion in 2021, the Central Bank of Oman (CBO) revealed in its newly published annual report for the year.

This compares with a tally of RO 10.269 billion for 2020, which was marginally up from RO 10.242 billion a year earlier.

Personal loans encompass credit extended by commercial banks to individuals seeking funding to finance everything from real estate investments and car purchases to educational, wedding, home improvement, travel, medical and other household-related costs. Together, they account for up to 40 per cent of the combined lending portfolio of banks in Oman.

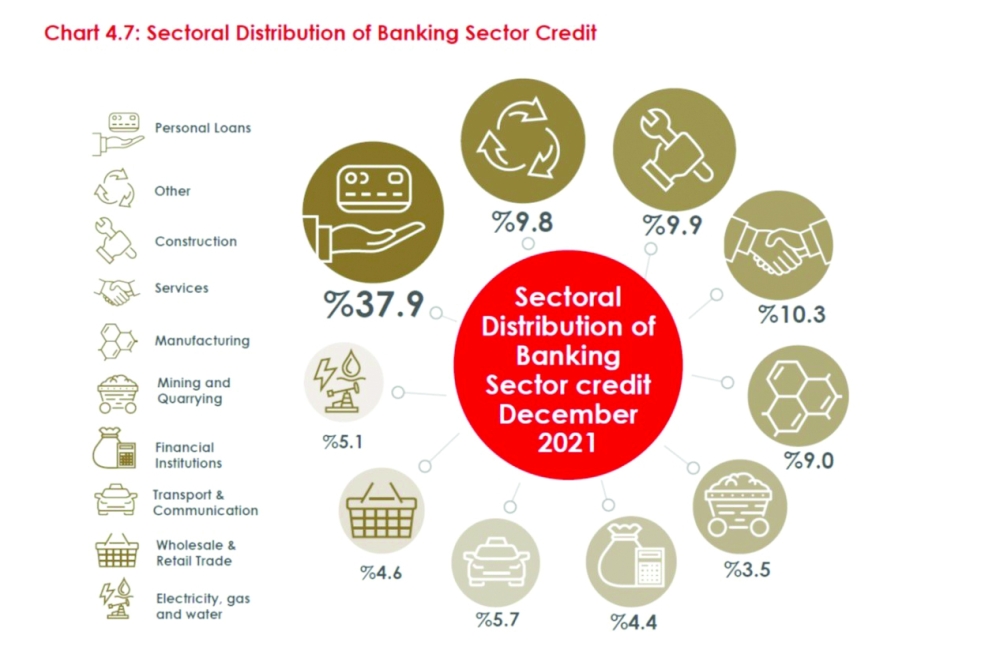

“Credit under personal loans, which continued to hold the major share in total credit at 37.9 per cent at the end of 2021, increased by a 2.7 per cent during the year as compared with a marginal growth of 0.3 per cent in the previous year,” the apex bank noted in its annual report.

According to the Central Bank, 2021 witnessed an expansion of banking sector operations in conjunction with a revival of economic activities, following the “disruptions” caused by the pandemic during the previous year.

“Recognising the need for bank credit in supporting the revival of economic activities, banks increased their lending in credit growth to 4.4 per cent in 2021 as compared with 3.3 per cent growth in the previous year."

"Furthermore, the CBO has been pursuing a policy framework to ensure that the banking sector could lend its support to the government’s economic diversification initiatives through meeting the credit needs of all segments of the economy in a seamless manner,” the report stated.

While the Personal Loans category accounted for a dominant share of total credit, the Services sector came next with a 10.3 per cent share (RO 2.871 billion), up from RO 2.512 billion a year earlier. Credit to the ‘Wholesale & Retail Trade’ sector climbed 22.8 per cent to 1.288 billion (up from 1.049 billion in 2020), while the Manufacturing sector’s share grew 15.4 per cent to RO 2.502 billion (up from RO 2.168 billion in 2020).

Transport & Communications saw its share rise 15.2 per cent to RO 1.575 billion (up from RO 1.367 billion in 2020). However, some sectors reported a contraction in credit: Mining & Quarrying (-32 per cent to RO 970 million), Electricity, Gas & Water (-1.9 per cent to RO 1.406 billion).

“Credit to Agriculture and allied activities, though relatively small in the overall credit portfolio of banks, recorded a jump of 132.3 per cent in 2021.

The credit to government maintained its upward trajectory (29.8 per cent growth) to reach RO 620.4 million as of end-2021,” the report added.

Oman Observer is now on the WhatsApp channel. Click here