Although traditionally a cash-dominated country, thanks to the adoption of a broader range of digital payment methods all segments of the society in Oman have increasingly switched to cashless payment channels.

The achievement is mainly attributed to the combined efforts of the government and financial institutions in boosting financial awareness, improving the country’s payment infrastructure, and expanding the use of payment card acceptance systems among retailers.

Consequently, the volume of e-payment transactions increased by 40.6 per cent in 2021 as compared to 19.2 per cent witnessed in 2020, reveals a report by the Central Bank of Oman.

With regard to cheques for payments, the report points out a remarkable decline in their use in the last two years with 3.8 million cheques in 2021, 4 million in 2020 compared to more than 4.7 million in 2019.

“The main driver for this trend was the wider spread of e-commerce and further movement away from cash and rising use of mobile phones,” says the report.

This shift, according to the apex bank, was further fueled by the lockdowns necessitated due to the Covid-19 that came as a measure to inhibit the pandemic spread.

In this regard, transaction volume via e-commerce and point of sale grew at a historical rate of 78.7 per cent and 47.9 per cent during 2021 and 2020, respectively.

The growing adoption of digital payments has contributed to the moderation in the use of cash.

“This is clearly reflected in the share of e-payment transactions by volume, where the share of point of sale increased by 3 per cent at the expense of ATM transactions as people were encouraged to avoid unnecessary cash usage,” reveals the Financial Stability Report 2022.

Card payment continues to dominate the overall transactions supported by high consumer awareness and government initiatives to promote electronic payments, it adds.

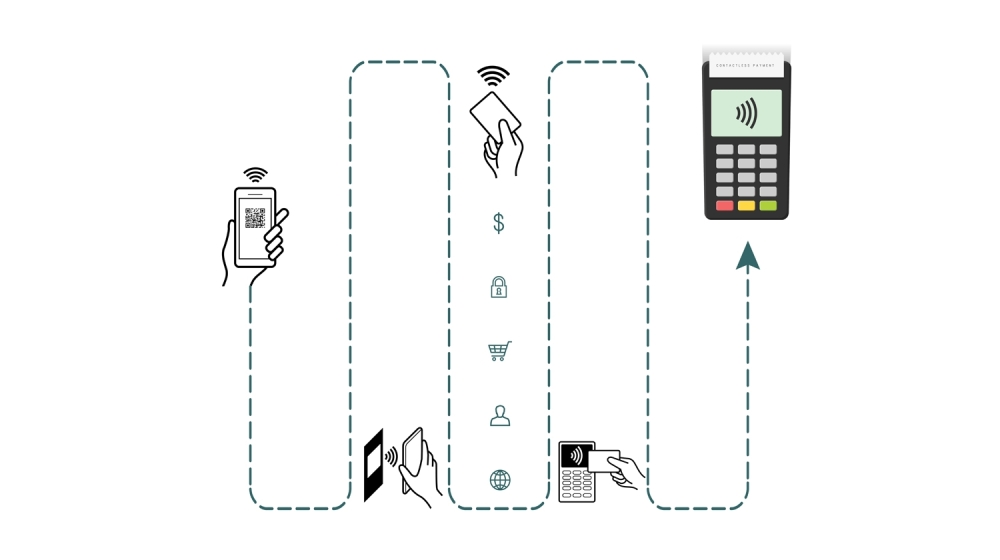

Developments such as the emergence of contactless payment cards, QR code payments and alternative payment methods are further anticipated to boost the Omani payment market going forward.

Although the pandemic has impacted consumer spending, it has also highlighted the importance of non-cash payment methods further driving the use of electronic payments in the country.

According to a report by GlobalData, Oman’s eCommerce market has observed strong growth in consumer demand, expanding at a review-period CAGR of 15.1 per cent from RO 285.0 million in 2017 to RO 500.9 million in 2021.

“Growth has been supported by rising Internet and smartphone penetration as well as rising consumer confidence in eCommerce,” the report by the UK-based agency said.

In addition, various government initiatives have helped stimulate growth in this space. The outbreak of Covid-19 also boosted online purchases of essential goods, as this helped consumers avoid close social contact and potential disease vectors.

In order to implement this without imposing any cost burdens on retailers, the ministry is working with the CBO to ensure that the required hardware facilities are provided to retailers by local banks.

Additionally, the Central Bank regulates the merchant fee for electronic transactions, which must not exceed 1.5 per cent of card transactions and 0.75 per cent of mobile wallet transactions. This scheme is part of the Oman Vision 2040 initiative.

To boost cashless payments, in July 2021 Oman’s Ministry of Commerce, Industry and Investment Promotion mandated that all commercial transactions at select stores and business establishments such as shopping malls, cafes and restaurants, grocery stores, commercial centres and gift markets must be conducted via cashless methods of payment with effect from January 2022.

Places that sell food items, restaurants and cafes are some of the facilities that are covered under this decision. The move seeks to achieve digital transformation through cooperation between all related counterparties.

@samkuttyvp

Oman Observer is now on the WhatsApp channel. Click here