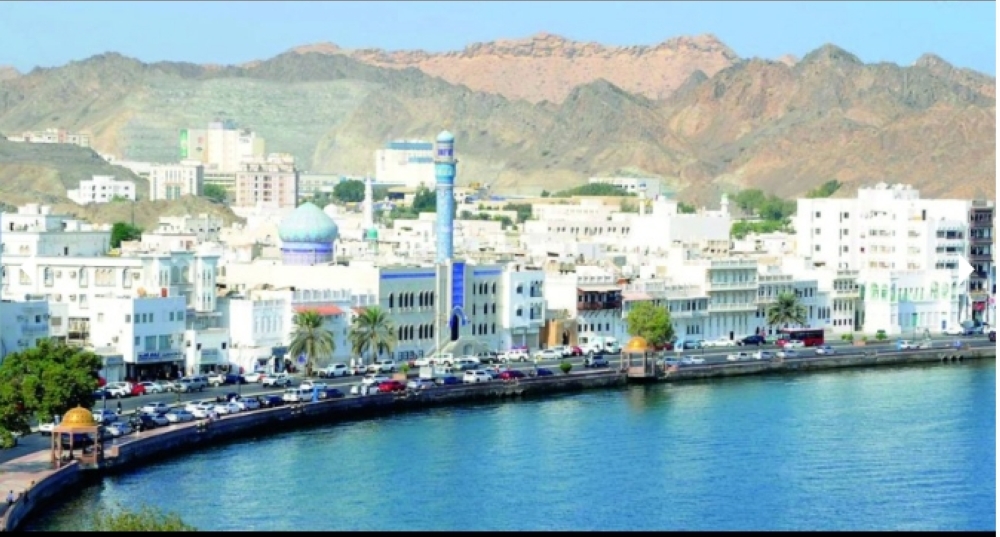

After a difficult 2020, the Sultanate of Oman’s economy is on a solid path to recovery amid the easing of pandemic pressures, higher hydrocarbon outputs, and wide-ranging government reforms.

According to the World Bank's GCC Economic Update for April 2022, "Frontloaded fiscal reforms, including VAT, and cuts in spending are expected to turn the country's fiscal and current account deficits into surpluses, starting from 2022. Downside risks include any resurgent pandemic pressures, volatility in oil prices, and slower implementation of the government’s reform program. On the upside, rising hydrocarbon production, improved non-oil revenues, and the rationalization of expenditure could strengthen fiscal and external positions."

The Sultanate of Oman’s economy is recovering gradually from the dual impact of the pandemic and the temporary collapse in oil prices it caused. Estimates suggest that the country's overall growth reached 2.1 percent in 2021.

Hydrocarbon GDP grew by an estimated 2.2 percent, driven by higher oil production due to the easing of OPEC+ cuts and the coming on stream of a new liquified gas plant in mid-2021.

Non-oil GDP is estimated to have rebounded by almost 2 percent in 2021, signaling the recovery of domestic and external demand, aided by increased vaccine penetration that boosted the sectors most impacted by the pandemic (tourism, hospitality, and retail).

Annual inflation switched from negative territory in 2020 and picked up to an average of 1.5 percent in 2021, due to the introduction of VAT last April and improved domestic demand.

The economy is expected to improve gradually and strengthen in the medium-term, supported by higher oil and gas production and ongoing structural reform.

Growth is projected to pass 5 percent in 2022, underpinned by more than 8 percent growth in the hydrocarbon sector, boosted by the increased production of liquified natural gas in the key Ghazeer and Khazzan fields.

The country's non-oil economy will continue to grow, exceeding 2 percent in 2022, as a fast vaccine rollout strengthens domestic activity. Over the medium term, growth will decelerate to an average of 2.7 percent per year in 2023-2024, while the hydrocarbon sector will remain the main driver of growth.

Outlook for Other GCC Countries

Bahrain’s economic outlook hangs on oil market prospects, pandemic conditions, and reform implementation. Growth is projected to accelerate to 3.5% in 2022, boosted by the surge in energy prices caused by the economic consequences of the war in Ukraine and associated sanctions. Recovery of the non-oil economy is likely to continue thanks to successful vaccination rollout and further relaxation of restrictions on movement.

Kuwait's economic growth in 2022 is expected to accelerate to 5.7% due to higher oil output, as OPEC+ cuts are phased out, and as domestic demand strengthens. Oil production is expected to increase by 8.6% in 2022 as OPEC+ lifts quotas and new capacity at the Al Zour refinery comes online.

Qatar's real GDP is estimated to rise in 2022 to 4.9% on the heels of boosted hydrocarbon exports of 10%. Growth in private consumption may be slightly lower, at 4.8%, driven by potentially fewer World Cup proceeds and higher prices. Consumer prices are projected to jump by an additional percentage point in the current year.

The economic consequences of the war between Russia and Ukraine and its associated sanctions have triggered an oil price surge, which will have positive implications for the UAE economy and its fiscal and external balances. However, tourism and the non-oil economy might face headwinds.

Saudi Arabia's growth is expected to accelerate to 7% in 2022 before leveling out at 3.8% and 3.0% in 2023 and 2024, respectively. Stronger oil output is the main driver behind the recovery, which is expected to grow by 13% in 2022 following the end of the OPEC+ production cuts in December 2022. The non-oil sector is expected to continue its trajectory for growth, estimated at 4% in 2022 and 3.2% in the medium-term.

The World Bank MENA Economic Update estimates that the Middle East and North Africa (MENA) region’s economies will grow by 5.2% in 2022, the fastest rate since 2016. However, uncertainty reigns with the unpredictable course of the war in Ukraine and the scientific uncertainty about the evolutionary path of the virus that causes COVID-19. The economic recovery may be uneven as regional averages mask broad differences between countries. Oil producers may benefit from elevated energy prices along with higher vaccination rates for COVID-19, while fragile countries lag. Per capita GDP, which is a more accurate measure of people’s standard of living, barely exceeds pre-pandemic levels due to a lackluster performance for most countries in 2020-2021. If these forecasts materialize, 11 out of 17 MENA economies may not recover to pre-pandemic levels by the end of 2022.

Oman Observer is now on the WhatsApp channel. Click here