@conradprabhu -

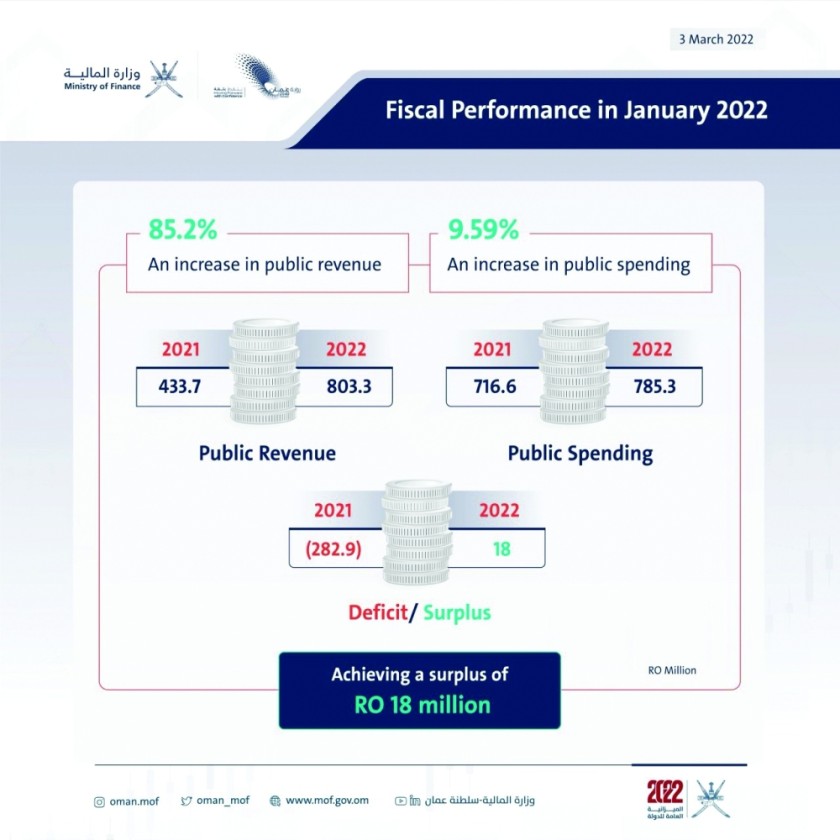

Bolstered by revenues from skyrocketing oil prices, the Sultanate of Oman posted a modest, but fiscally significant, budget surplus of RO 18 million at the end of January 2022 – an uptick that augurs well for a sizable reduction in the country’s public debt pile by the end of the year.

According to the Finance Ministry’s monthly newsletter on the country’s fiscal performance, public revenues ballooned an unprecedented 85.2 per cent to RO 803.3 million at the end of January 2022, versus earnings of RO 433.7 million for the corresponding period of 2021.

In comparison, public expenditure climbed 9.59 per cent to RO 785.3 million this year, versus spending of RO 716.6 million in 2021. The marginal surplus of RO 18 million accruing over January 2022 compares with a deficit of RO 282.9 million for the January 2021 period.

Aiding the upsurge in public revenues were robust increases in oil and gas export earnings, the Ministry noted. Oil export revenues soared 94.42 per cent to RO 553.9 million during January 2022, up from RO 284.9 million in January 2021.

International oil prices have scaled multi-year highs in recent months, effectively doubling the price of Oman crude to an average of $81.58 per barrel at the end of January 2022, up from an average of $41.11 per barrel in January 2021. Daily crude production too has been boosted to 1.010 million barrels per day (bpd), versus 946K bpd at the end of January 2021. Gas export revenues too surged 103.7 per cent to RO 218.6 million as of January-end 2022, up from RO 107.3 million last year.

The fiscal situation has improved even further since end-January 2022. A series of crises impacting global energy markets, most recently by Russia’s invasion of Ukraine, has lifted the price of Oman crude by a further $30 per barrel. On Thursday, Oman crude traded at $116.73 per barrel on the Dubai Mercantile Exchange (DME) after gaining $5.92 a barrel over the previous day’s marker price. If oil prices remain at these buoyant levels for much of this year, it will result in a windfall for the Omani economy, given that the 2022 State Budget has been based on a conservative oil price assumption of $50 a barrel.

In its latest newsletter the Ministry of Finance also underlined the importance of its latest initiative under the Public-Private-Partnership (PPP) programme centring on the procurement of 42 government schools on behalf of the Ministry of Education.

In return for designing, constructing, financing and managing these new facilities, the private developer will be allocated land in the vicinity of these schools for investment in income-generating commercial facilities and services – an arrangement based on the PPP model.

Oman Observer is now on the WhatsApp channel. Click here