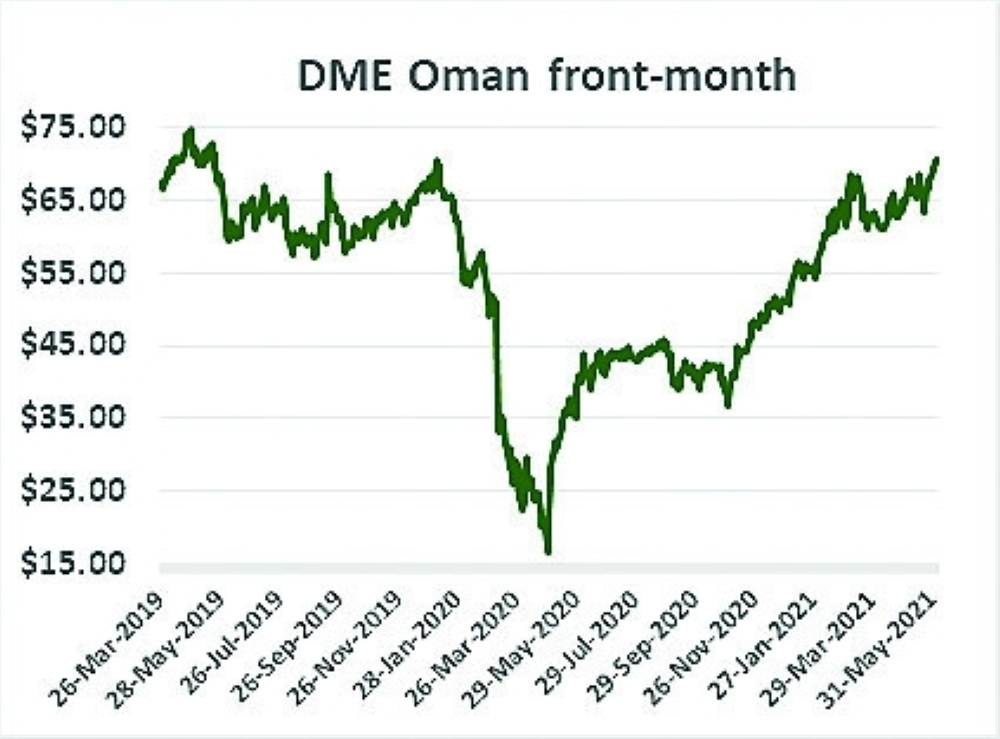

The Sultanate’s crude oil benchmark – Oman Crude Futures Contract – has registered a growth of over 300 per cent in trading on the Dubai Mercantile Exchange (DME) since the onset of the global pandemic that sent the benchmark plunging to around $17 per barrel in April 2020.

On Friday, the Oman Crude Futures Contract (DME Oman) climbed to $71.37 per barrel (for August 2021 delivery) in trading on the DME – the highest it has ever risen since the start of the pandemic.

“DME Oman is up by around 30 per cent since the end of January when prices were below $55/b,” said the Dubai-based commodities exchange in its latest analytical report issued on Sunday. “DME July futures contract expired at $68.03/b on May 31, nearly $3/b up from the June-contract expiry in April,” it further noted.

Buoyed by growing optimism over a global economic recovery and the aggressive vaccine roll-out, prices of crude benchmarks, including the Oman Crude Futures Contract, have been trading above $70 per barrel since the start of this month – for the first time in over two years, according to the report.

In 2007, the Sultanate became first producer in the Middle East to sell all of its crude output against a futures contract using the Dubai Mercantile Exchange as its principal platform. It led the way for other regional producers Saudi Arabia, Kuwait, Bahrain and Dubai, among others, to use DME Oman futures in their Official Selling Price (OSP) formulas.

Oman Observer is now on the WhatsApp channel. Click here