MUSCAT, SEPT 10 -

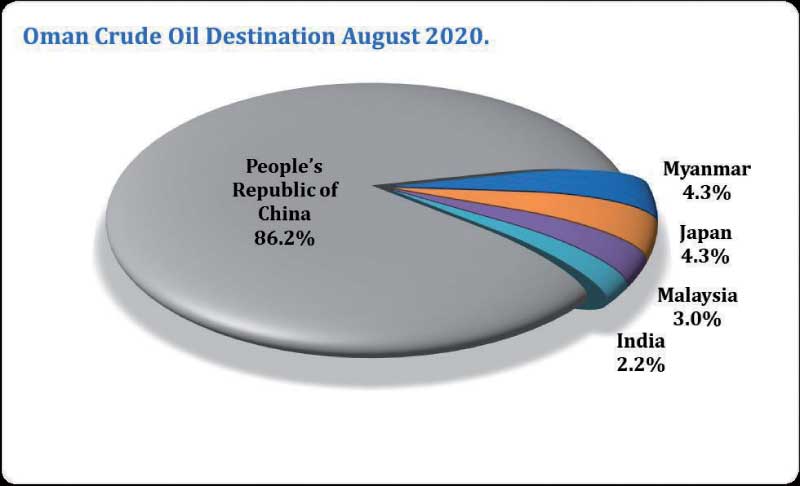

China, the dominant importer of Oman Export Blend, saw its share dip slightly by 2.58 per cent to 86.2 per cent of exports totalling 744,736 barrels per day during August 2020 versus figures for July 2020, according to the Ministry of Energy and Minerals.

India’s share too dropped 9.03 per cent m-o-m to 2.2 per cent of total exports for the month. However, three other markets saw their shares rise in August: Japan (4.3 per cent), Myanmar (4.3 per cent) and Malaysia (3.0 per cent)

According to the monthly report of the Ministry, the Sultanate’s average daily production of crude oil during August 2020 reached 720,300 bpd, which was up 7.26 per cent m-o-m compared with July 2020. Exports of Oman Blend crude averaged 744,736 bpd, representing a decline of 4.3 per cent over the previous month.

Oil prices for all reference crude oil grades around the world experienced a bullish trend during the trading days of August 2020 — for October 2020 delivery —compared with trading for July 2020.

The average price of West Texas Intermediate Crude Oil at the New York Mercantile Exchange (NYMEX) settled at $42.75 per barrel, an increase by $1.84 only. The average price of North Sea Oil (Brent) at the Intercontinental Exchange (ICE) in London averaged $45.02 per barrel, a rise by $1.80 compared with trading during July 2020.

The average price of Oman’s Crude Oil futures contract on the Dubai Mercantile Exchange similarly increased by 1.6 per cent compared with the previous month.

The monthly official selling price for Oman Crude oil for October 2020 delivery — traded during August 2020 — was announced to be $44.32 per barrel, rising by $0.70 compared with the July 2020 official selling price. The daily trading marker price ranged between $42.85 per barrel and $45.74 per barrel.

“Crude oil prices experienced an overall optimistic sentiment during the trading of August 2020 due to several factors, which had direct and positive impact on prices.

The main factors that supported positive trading sentiments were significantly the decrease in US inventories and the devaluation of the US dollar’s exchange rate, in addition to the full commitment of Opec+ producers with their global agreement on cuts in July.

What helped in the price increase was also a statement by US officials that China adhering to the first stage of the trade agreement between the two countries.

Also, the suspension of more than half of the production in the offshore platforms in the Gulf of Mexico prior to Hurricane Laura was a factor,” said the Ministry.

Oman Observer is now on the WhatsApp channel. Click here