Muscat: The Sultanate’s average daily production of crude oil during April 2020 stood at (946,968) barrels, said the monthly report by Ministry of Oil and Gas.

Furthermore, the average daily exported quantities of Oman Blend crude oil was (894,139) barrels, constituting a decline by 2.41 per cent compared with last month.

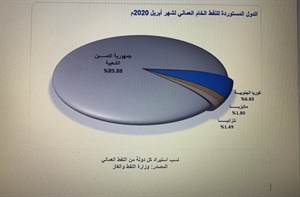

China’s imports from Oman crude exports hit 89.88 per cent, comprising a fall by 2.32 per cent m-o-m, compared with March 2020 share.

Oil prices for all reference crude oil grades around the world have shown a slump during the trading of April 2020 for June delivery 2020 compared with trading of March 2020. The average price of West Texas Intermediate Crude Oil at the New York Mercantile Exchange (NYMEX) settled at ($22.47) per barrel, a drop by ($8.20) whereas the average price of North Sea Oil (Brent) at the Intercontinental Exchange (ICE) in London reached ($26.65) per barrel, a decline by ($7.07) compared with trading of March 2020.

The average price of Oman’s Crude Oil futures contract at Dubai Mercantile Exchange (DME) similarly slumped by 32.1 per cent compared with previous month. The monthly official selling price for Oman Crude oil for June 2020 delivery – traded during April 2020 - stood at ($23.65) a barrel, lower by ($11.19) compared with May 2020 selling price whereas the daily trading price ranged between ($16.82) per barrel and ($29.54) per barrel.

Crude oil prices have experienced a collective decline during the trading of March 2020 due to several factors, which had direct and negative impact on prices. The continued negative impact of the lockdown caused by the spread of the Coronavirus – Covid-19 - on the global economy, and on the global demand for crude oil and petroleum products. In addition, the decline in global stock markets, as well as the subsequently rise in US crude oil commercial inventories, which negatively affected oil prices further.

Oman Observer is now on the WhatsApp channel. Click here