Mumbai: In the final monetary policy review of the current fiscal, the Reserve Bank of India (RBI) on Thursday lowered its key lending rate for commercial banks to 6.25 per cent.

The decision was guided on the basis of an assessment of the evolving macroeconomic situation wherein headline inflation is projected to soften further and the economy’s growth impulses had moderated, the RBI said.

The central bank was more accomodating, changing its monetary policy stance from “calibrated tightening” to “neutral”

Along with the lower repo rate, or the RBI’s short term lending rate for commercial banks, the central bank’s reverse repo rate has been adjusted to 6 per cent, and the marginal standing facility (MSF) rate and the Bank Rate to 6.5 per cent.

“Headline inflation is projected to remain soft in the near term reflecting the current low level of inflation and the benign food inflation outlook.

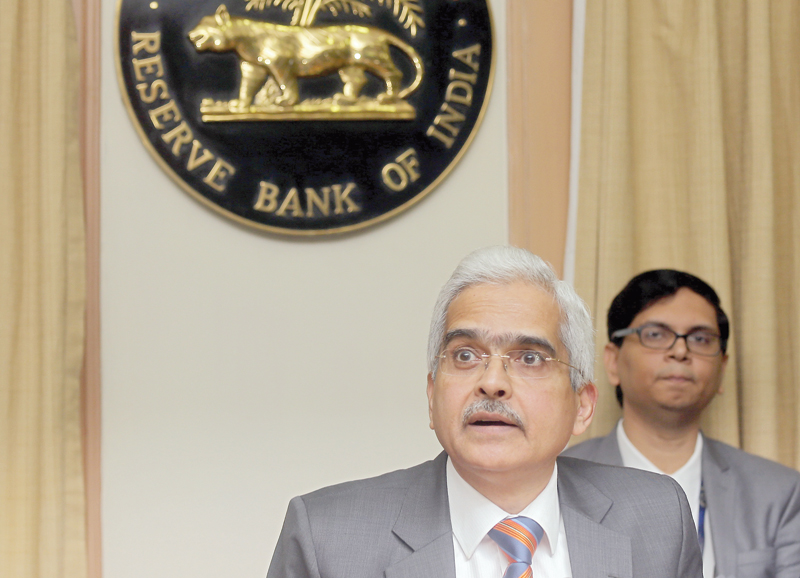

“Beyond the near term, some uncertainties warrant careful monitoring,” RBI Governor Shaktikanta Das, who presided over his first monetary policy committee (MPC) meeting said while making the policy review announcement.

“The MPC noted that the output gap has opened up modestly as actual output has inched lower than potential. Investment activity is recovering...but the need is to strengthen private investment activity and buttress private consumption,” he said following the meeting that started on Tuesday.

It is vital for the RBI to “act in a timely manner” to support growth, given that inflation continues to remain benign, and in view of the fact that investment demand has decelerated, Das added. — IANS

Oman Observer is now on the WhatsApp channel. Click here