After witnessing acceleration in last couple of weeks, the market underwent a correction which we believe was largely due to profit taking as some stocks witnessed sizable rally in last couple of weeks. MSM 30 went down by 1.39 per cent on weekly basis. Except Services, all sub-indices went down. Financial Index closed down by (-1.30 per cent) and Industrial Index went down by (-0.24 per cent), while Services Index went up by 0.07 per cent. The MSM Shariah Index closed down by -0.63 per cent.

The MSM published its quarterly list of Shariah Compliant Companies based on 2Q’18 results. The list showed the exit of Oman Oil Marketing and Voltamp Energy and the entry of Oman Education. The list saw lower number of companies at 32, compared with 31 companies in 1Q’18 list. The new list includes : Al Izz Islamic Bank, Al Jazeera Services, Al Kamil Power Co, Al Madina Takaful Co Saoc, Al Maha Ceramics Co Saoc, Al Anwar Ceramic Tiles Co, A’saffa Foods Saog, Bank Nizwa, Computer Stationery Inds, Dhofar Beverages Co, Gulf, International Chemicals, Gulf Mushroom Company, Gulf Stone, Muscat Gases Company , Muscat Thread Mills Co, National Biscuit Industries, National Real Estate Dev, Oman Cables Industry, Oman Cement, Oman Chromite, Oman Education , Oman Fisheries, Oman Flour Mills , Oman Int. Marketing, Omani Packaging, Ooredoo, Raysut Cement, Sahara Hospitality, Salalah Port Services, Shell Oman Marketing and Takaful Oman Insurance.

National Bank of Oman, rated Baa3 by Moody’s and BB+ by Fitch, is selling $500 million of five-year bonds. The senior, unsecured notes offer investors a spread of 270 basis points over mid-swaps, which comes out to be -5.6 per cent, compared to Oman Government 5yr Dollar Bond which offers yield of -4.9 per cent as of September 19, 2018.

The Ministry of Housing announced last week that the real estate transactions will be registered through the brokerage offices licensed by the ministry from October 1, 2018. These transactions will include residential, commercial, industrial, tourist, residential plots, mortgaging, apartments, villas and shops (subject to their classifications), both buying and selling transactions for GCC nationals and all sales and purchase transactions for expatriates and foreign nationals in integrated tourist complexes.

Oman educational sector is very minutely represented on the stock market. Only two companies are listed which are Majan College (MAJAN) and Oman Education and Training Investments (OETI). Recently both the companies announced their initial results for the year ending on August 2018. Overall, the sector witnessed a net income hike of 9 per cent to RO 3.4 million in 2017-18 (September-August), compared to RO 3.1 million in 2016-17. Majan profits went down by 6 per cent while that of OETI went up by 29 per cent. On the revenue side, sector revenue went up to RO 22.0 million in 2017-18, compared to RO 21.88 million in 2016-17. Net margins of the sector improved from 14.3 per cent in 2016-17 to 15.5 per cent in 2017-18.

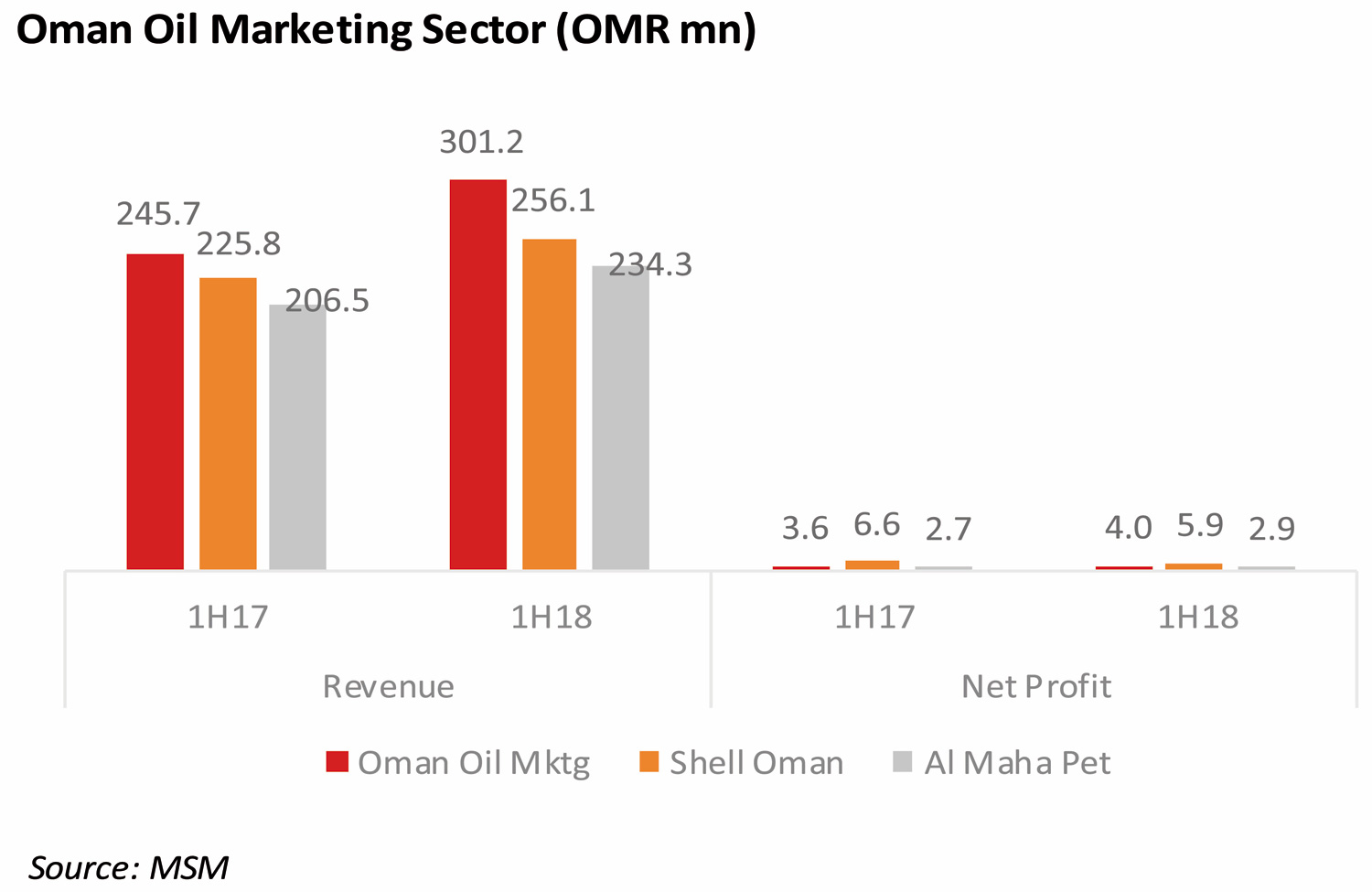

Last week, almost all oil-marketing companies announced their views on the challenges being faced by the oil marketing companies. Many of them were of the view that due to reduced margins offered on motor fuels supplied from the new fuel logistics terminal at Al Jifnain there is a significant dent in the profitability of all three marketing companies. In their quarterly reports presented to the Capital Market Authority (CMA), all three fuel-marketing companies i.e. Oman Oil Marketing, Shell Oman and Al Maha have warned that the new price structure has begun to eat into their profitability.

However, the under-secretary of the Ministry of Oil and Gas said that the decline in the revenues of these companies is not due to changes in pricing structure, but rather because of decrease in fuel sales in general and that the government will not lease the facilities owned by these companies at Mina Al Fahal Refinery as it used to.

As of H1”18, the sector revenue went up by 17 per cent YoY to RO 791.5mn, compared to RO 678 million in H1”17, majority because of higher oil prices. However, their net income dropped by a per cent to 12.8 million in H1”18, compared to RO 12.9 million in H1”17. Net margins reduced to 1.6 per cent, compared to 1.9 per cent during H1”17.

In the weekly technical analysis, The Muscat Market Index reversed its trend during the previous week affected by selling pressure for blue ships company. Currently, the MSM index crossed down the 10-day moving average. The nearest level is to support the index at 4,450 points. While the weekly RSI and RSI reverse their positive levels.

The last week witnessed the start of operation of the third integrated airport in the Sultanate with all its operational facilities, namely Duqm Airport, after the completion of all the construction packages of the airport, which cost around RO 90 million. The importance of this logistical addition lies in several elements, including supporting tourism, attracting direct investments, new airlines, providing jobs and increasing the contribution to support the “Tanfeedh” programme by supporting non-oil projects and putting Duqm on the regional and international map. The new airport will also increase the contribution of the logistics and tourism sector in the GDP and by facilitating the expected increase in the investments to $20 billion in the free zone. The successful launch of the new Muscat airport and the strong growth in passenger numbers during the period following (13.4 per cent for the period April-July of this year, compared to the same period of the previous year) indicate the high probability of recording high growth rates in the Duqm area. It is worth stating that Duqm Airport is among many projects in the Duqm economic zone including 1) Port of Duqm, 2) Ship Repair Yard and Dry Dock, 3) Fishery Harbour, 4) Hotels and Resorts, 5) Natural Gas Supply, 6) New Duqm Town, 7) Duqm Transport System, 8) Refinery and Petrochemical Complex Power and Water Generation and Distribution and 9) Renaissance Village Duqm.

Other macroeconomic events, news and meetings, happened in the last week include:

n A specialised committee to accelerate projects within the outputs of the mining laboratories in the Sultanate.

n The number of aquaculture projects by the end of 2023 is expected to reach RO 1.3 billion.

n National Cargo Strategy aims at 730,000 tonnes of cargo handling per year by 2030, compared with 210,000 tonnes currently.

Tadawul topped the gainers of the week amongst regional indices with weekly gain of 2.28 per cent while Qatar Exchange was the worst at -2.55 per cent.

(Courtesy: U Capital)

Oman Observer is now on the WhatsApp channel. Click here