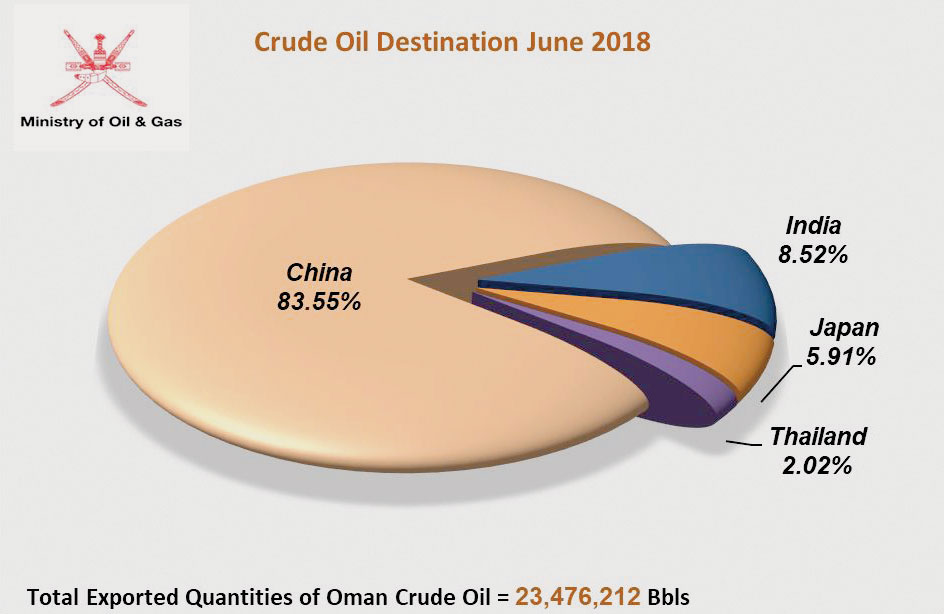

MUSCAT, JULY 10 - Shipments of Omani crude to China climbed 9.65 per cent to 83.55 per cent of total exports during June 2018, entrenching China’s position as the top destination for oil exports from the Sultanate. India was the next big importer with an 8.52 per cent share, which was higher by 4.73 per cent on a month-to-month basis. Supplies to Japan declined 0.4 per cent to 5.91 per cent, while demand from Thailand rose slightly to reach a 2.02 per cent share of total exports in June. Accordingly to the monthly report of the Ministry of Oil and Gas, output of crude oil and condensate in June 2018 totalled 29.205 million barrels, yielding a daily average of 973,500 barrels. Of this total, 23,476,212 barrels, averaging 782,540 barrels per day, were exported.

Prices witnessed a fallback during June 2018 futures trading compared with May 2018 for the major crude oil benchmarks around the world. The average price for West Texas Intermediate crude oil at the New York Mercantile Exchange (NYMEX) amounted to $67.23 per barrel, lower by $2.73 per barrel compared with May 2018. While the average North Sea Brent mix at the Intercontinental Exchange (ICE) in London dropped by $75.94 per barrel, down by $1.07, compared with previous month’s trading.

Within the same trend, the average price for Oman Crude Oil Future Contracts at the Dubai Mercantile Exchange (DME) witnessed a price drop by 1.1 per cent compared with the previous month. The official selling price for Oman Crude Oil during June 2018, for the delivery month of August 2018, settled at $73.61 per barrel, compared with May trading prices. The trading price ranged between $71.06 per barrel, and $75.32 per barrel.

The down trend in crude oil prices in June 2018 was attributed to several key factors that negatively affected the prices, including the rise in the exchange rate value of the US dollar, which placed pressure on primary commodities priced in US currency. Also, the increasing number of active drilling rigs in the United States led to continued speculation around higher US oil production.

Another main factor negatively impacted the oil prices was the market speculations ahead of the June meeting of the Organization of the Petroleum Exporting Countries (Opec) with its non-Opec partners, where the market was expecting a decision to boost production by two million barrels.

However, oil prices received some positive boost around some days of the month as the US-China commercial trade war dispute increases, the report added.

Oman Observer is now on the WhatsApp channel. Click here