The MSM30 closed the week down by 1.62 per cent. Volatility in oil prices along with unsatisfactory results of some blue-chip stocks took the market down during the week. Foreigners were net sellers at $1.86mn.

Financial and Services Index closed down by 0.33 per cent and 1.87 per cent w-o-w while the Industrial index closed up by 1.24 per cent. Shariah Index was up by 1.74 per cent during the week.

Oman Arab Bank (OAB) has announced that it has been given the green light by the Central Bank of Oman (CBO) to acquire Alizz Islamic Bank SAOG (AIB) and to eventually become a publicly listed entity. The revelation came in a filing by OAB’s majority shareholder, Oman International Development & Investment Co SAOG (OMINVEST), to the Capital Market Authority (CMA). In the filing, OMINVEST referred to its disclosure dated January 16, 2020 pertaining to OAB’s “proposed transaction” with Alizz Islamic Bank. It proposed: Alizz Islamic’s acquisition as a fully owned Islamic banking subsidiary of OAB and its conversion into an SAOC entity; The transfer of the assets and liabilities of Al Yusr Islamic Window to Alizz Islamic Bank SAOC; and the conversion of OAB SAOC into an SAOG entity.

Two Islamic banks in Oman will allow customers to defer the instalment of their home loans by three months – May, June and July due to the current Covid-19 situation prevailing in the country. Bank Nizwa and Alizz Islamic Bank allowed all their customers who earn a net salary of RO1,500 and below and that have home finance Ijarah/diminishing Musharakah or commercial finance Ijarah diminishing Musharakah facilities to defer their finance installments up to three months (May, June, July) from May 1′ 2020.

NCSI released the latest data of public finance for the month of January 2020. Revenue was down 43.6 per cent largely because of drop in other revenue segment. Oil revenue in the first month of 2020 was up by 53 per cent while the gas revenue was down 18 per cent. Government was able to lower the expenditure in the first month by 12.6 per cent to RO 0.92bn compared to RO 1.05bn in same month last year. Deficit was RO 344mn in Jan 2020 compared to a deficit of RO 32mn in Jan 2019.

Oman has reduced its state budget by RO 500mn ($1.3 bn) as a result of recent cuts and will take new measures to stabilize the economy. Oman’s finance ministry directed all ministries to reduce development budgets by 10 per cent and operating budgets by 10 per cent. Last month, the government cut the budget allocated to government agencies for 2020 by 5 per cent.

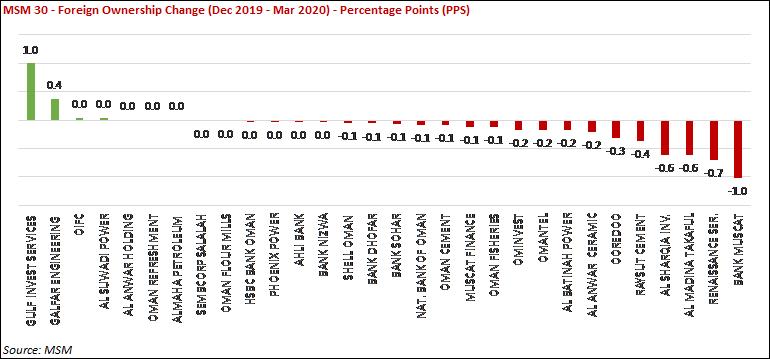

As per the latest data available with Muscat Clearing & Depository Company, only 4 companies in MSM30 witnessed increase in their foreign ownership during 1Q20 i.e. Gulf Investment Services, Galfar Engineering, Oman Investment & Finance and Al Suwaidi Power while ownership in three companies remained unchanged and declined in 23 companies.

Till the market close on April 23, 51 companies whose year ends in December announced 1Q20 results. Overall, the profitability of the 51 companies declined by 20.3 per cent to RO 78.4mn compared to RO 98.2mn in 1Q19. Earnings of the financial sector stood at RO 52.9mn (-29.9 per cent), Industrial sector at RO 7.2mn (+15.6 per cent) and Services sector at RO 18.2mn (+9.2 per cent).

Regionally, Abu Dhabi was the best market with gain of 2.35 per cent while Kuwait lost the most and was down by 4.47 per cent.

The awarding body for World Expos has postponed the Expo 2020 Dubai for a year because of the new coronavirus. The new timeline for holding the event is from Oct 1, 2021 until March 31, 2022.

Profitability of the finance companies in Saudi Arabia stood at SAR 1.41bn in 2019 compared to SAR 1.267bn in 2018, growth of 11.4 per cent. Within the sector, real estate finance company’s profitability was SAR 331mn (23.4 per cent of the total) while that of non-real estate finance companies was SAR 1.08bn (76.6 per cent of the total). In terms of ratios, return on equity and return on asset during 2019 stood at 7.96 per cent and 3.71 per cent compared to 6.94 per cent and 3.36 per cent in 2018, respectively.

According to secondary sources, total OPEC-13 preliminary crude oil production averaged 28.61 mb/d in March, higher by 821 tb/d m-o-m. Crude oil output increased mainly in Saudi Arabia, UAE and Kuwait, while production decreased primarily in Venezuela, Libya and IR Iran. Non-OPEC liquids production (including OPEC NGLs) decreased in March by 0.20 mb/d compared with the previous month to average 71.25 mb/d, higher by 1.84 mb/d y-o-y. Preliminary declines in production during March 2020 were mainly driven by OECD Americas, Norway, Brazil and Kazakhstan.

China is back in business with its manufacturing PMI jumping above 50. China General Manufacturing PMI jumped to 50.1 in March 2020 from a February's record low of 40.3, easily beating market consensus of 45.5 and signaling a broad stabilization of business conditions. Output rose slightly as more firms reopened following widespread company shutdowns and travel restrictions in February amid the COVID-19 outbreak. Meanwhile, demand remained fragile, with new orders falling for the second straight month and export sales declining sharply. Market sentiments held close to February's five-year high, with many firms optimistic that demand will pick up once the pandemic situation improves. [Courtesy: U-Capital]

Oman Observer is now on the WhatsApp channel. Click here