Liz Hampton and Nia Williams -

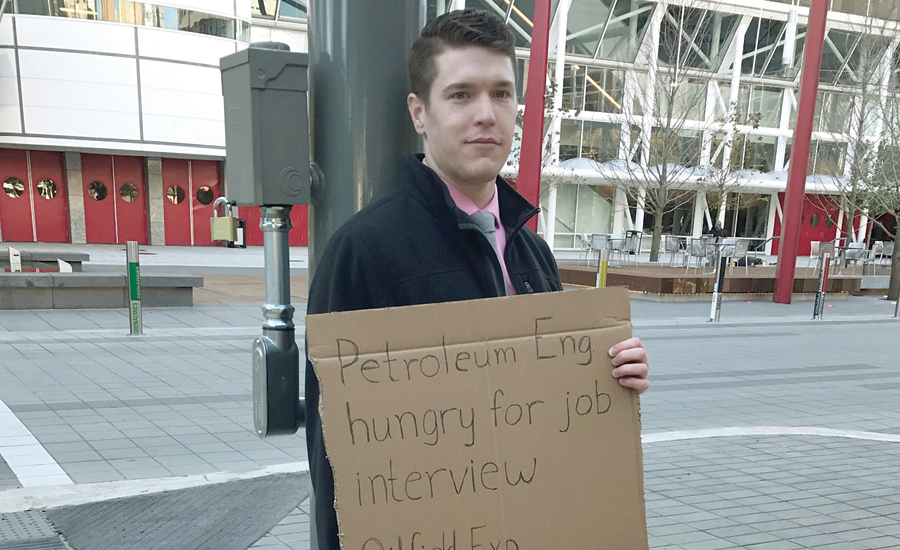

Doug Lucas stood outside a Houston energy conference early one morning last month handing out resumes and hoping to catch the eye of oil executives with a hand-written sign advertising “Petroleum Eng Hungry for job interview.”

Cut from oilfield services firm Halliburton Co in 2015, the 26-year-old temporarily turned to lawn care and cable-TV sales jobs while finishing a master’s degree in petroleum engineering at the University of Southern California.

Despite relying on a depression-era sign for introductions, he is hopeful demand for petroleum professionals will come back.

“It’s way better now than it was six or eight months ago,” he said optimistically, as he solicited business cards from convention goers.

After a rout that began in 2014 due to a worldwide glut of oil in part caused by a US shale boom, crude prices have rebounded from 13-year lows hit a year ago and have held above $50 a barrel since the start of the year when major oil producers curbed output as part of a global deal.

The higher prices have spurred an uptick in drilling activity as energy companies boost spending plans to take advantage of the crude price recovery.

However, massive cuts that cost some 440,000 jobs globally at energy companies in the last two years have left veteran workers and skilled job-candidates without a clear future in oil and gas.

Unable to find work in their chosen field, some have turned their sights to technology or other industries, adding a note of uncertainty to next week’s CERAWeek industry conference in Houston.

The outflow of experienced workers and a lack of hiring as oil companies drive to become more efficient could put future production growth in jeopardy, should a nascent upturn in the industry accelerate, say experts. In western Canada, companies resuming production of crude oil are struggling to rehire rig crews following job and pay cuts.

A University of Houston global survey of laid off oil workers found that 25 per cent had already moved to another industry and another 55 per cent were considering it. Only 13 per cent of those polled in late 2016 had found energy jobs.

“A good number of people are ‘lost’ to other industries,” said Christiane Spitzmueller, the study’s principal investigator. “This will translate into high recruitment and training costs for new hires.”

The combined US and Canadian rig counts, which can be an indicator of the health of the industry, jumped to 1,091 by Friday from 618 a year ago, a sign of the upturn in drilling in North America.

In western Canada, where many more rigs are working this year than last, drillers say a lack of experienced employees could slow their work later this year — or force them to pay higher salaries to lure workers back.

Dan Block, Chief Executive of Edmonton-based Jomax Drilling (1988) Ltd, said contractors he once employed took jobs in other industries, including construction. “We are scrambling to bring people back,” Block said.

Halliburton, an oil services firm that had about 50,000 employees at the end of 2016, down from more than 80,000 two years earlier, is now holding job fairs in regions where there is an uptick in drilling activity, such as Colorado, Texas, New Mexico, Oklahoma, and Ohio, the company said.

“We’re seeing a good balance of both experienced and entry level candidates,” said spokeswoman Emily Mir, noting that there is strong applicant interest in open positions in the Permian Basin — one of the hottest drilling areas in the United States due to its favourable economics.

The US oil and gas industry will need to fill 1.9 million new jobs through 2035, according to consultancy IHS Markit .

But filling those jobs could prove a challenge, management consultancy KCA said in study published in September.

“A rapid run-up is going to be a really difficult spot for the industry, versus a slow ramp up where you can start to lure people back over time,” said David Skinner, KCA’s Chief Executive. — Reuters

Oman Observer is now on the WhatsApp channel. Click here