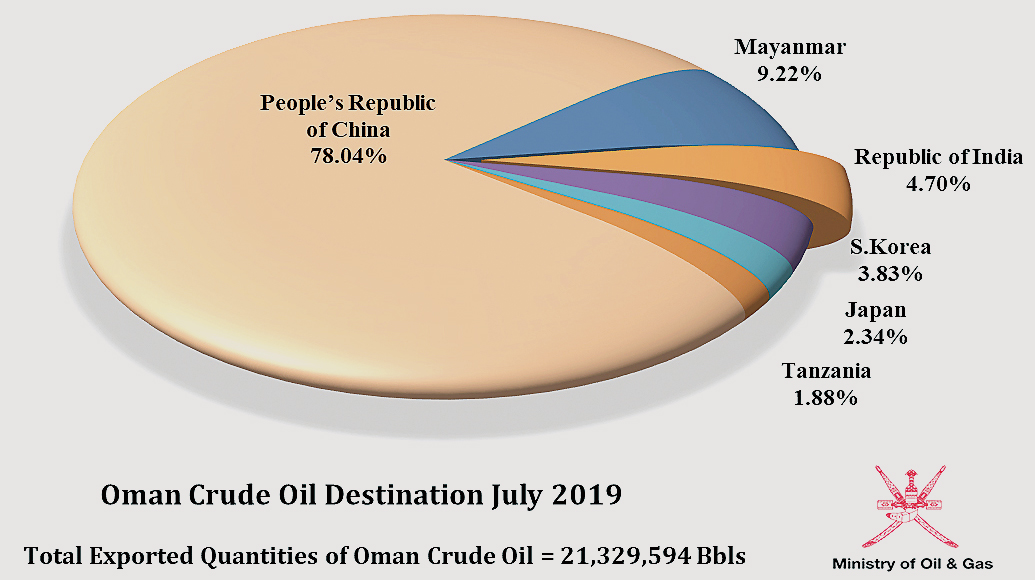

MUSCAT, AUG 18 - Myanmar emerged as the largest importer of Omani crude, after long-standing and dominant importer China, during the month of July 2019, according to the Ministry of Oil and Gas. Myanmar accounted for a 9.22 per cent share of total exports of 21.329 million barrels in July, underscoring a return of demand from buyers in this southeast Asian nation. China however remained the biggest market for Omani crude, seeing its share rise 7.98 percentage points to 78.04 per cent of total exports in July. Other markets included India (4.70 per cent), South Korea (3.83 per cent), Japan (2.34 pc), and Tanzania (1.88 pc).

Total production of crude oil and condensate during July reached 30.091 million barrels, representing a daily average output of 970,682 barrels. Exports averaged 688,051 barrels per day. Crude oil prices rebounded during July 2019 compared with June 2019 for the major crude oil benchmarks around the world. The West Texas Intermediate crude oil at the New York Mercantile Exchange (NYMEX) averaged $57.67 per barrel, up by $2.76, compared to June 2019 trading. Within the same trend, North Sea Brent Blend on the ICE in London averaged $64.21 a barrel, elevated by $1.18 compared to June 2019.

Likewise, the average monthly price for Oman Crude Oil Future’s Contract at the Dubai Mercantile Exchange (DME) rose by 3.5 per cent compared with previous month’s figures. The official selling price for Oman Crude Oil during trading of July 2019, for the delivery month of August 2019, settled at $63.87 per barrel, up by $2.15 compared to August 2019 delivery. The daily trading marker price ranged between $61.01 per barrel and $66.77 per barrel.

“The crude oil prices during July 2019 were influenced by several factors that directly and positively affected the price jump, and the most prominent factor was the consensus of OPEC and its allies to extend the production cut agreement until March 2020,” said MOG in a statement.

Other factors included the decline in US commercial crude inventories, and interest rates cut by the US Fed for the first time in more than a decade. Geopolitical tensions in the Gulf region and the Middle East and positive signs of US-China trade talks have also contributed to rising prices. Finally, oil market gains were also boosted by the upsurge in US stock markets and the reduction in the number of oil rigs operating in the US, it added.

Oman Observer is now on the WhatsApp channel. Click here