Despite stability in trading in first few days of the week, the general index reversed its path and posted declines as it was pressured by geopolitical and cautious sentiment in addition to results of Omantel. The weakness of trading has also made the index more sensitive to small moves on leading stocks, which does not reflect the actual status of many companies especially those, that recorded modest results, as we believe stock prices have already incorporated all the concerns and therefore are ready to rise again.

The MSM30 closed down by 1.36 per cent at 4,617.71. Sub-indices closed down led by the Industrial Index (-2.02 per cent) then the Financial Index (-1.16 per cent) and the Service Index (-0.37 per cent) while the MSM Shariah Index remained stable.

In the weekly technical analysis, as we mentioned in our previous report, the opportunity to MSM to reach the level of 4,644 points soon. Technical analysis indicators indicate that the MSM index will reach this level in the coming period.

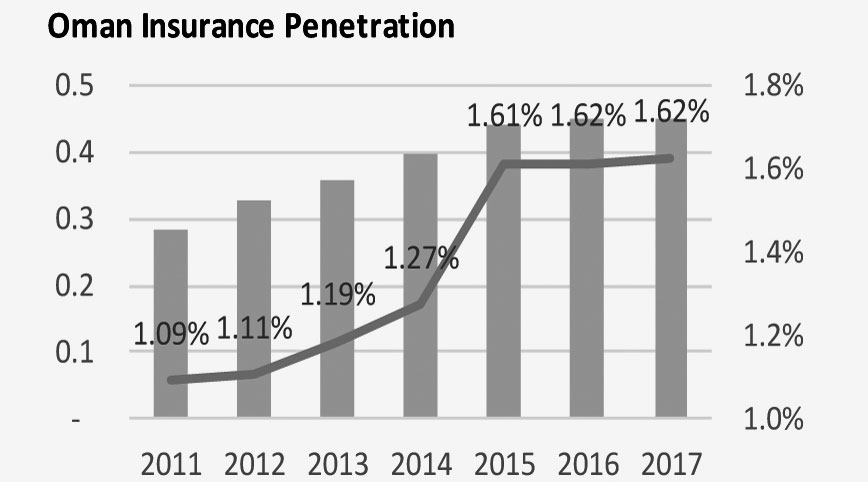

Last week, CMA issued detailed number of insurance sector performance of Oman for the year 2017. Gross written premiums have increased by 0.3 per cent to reach RO 451.57m at the end of 2017, compared to RO 450.24m at the end of 2016. The number of policies issued by insurers was 1.72m policies, a 4 per cent increase compared to 2016. Average growth of insurance premiums in the last five years was 5.8 per cent, with motor insurance comprising 34 per cent of gross premiums, while health insurance reached 30 per cent of gross written premiums. Insurance penetration during 2017 and 2016 was almost same at 1.62 per cent. While the insurance density dropped to RO 97.4 in 2017 compared to RO 99 in 2016. The total capital of insurance companies was RO 248.46m in 2017, a 16 per cent increase compared to 2016. The total assets of insurance companies increased in 2017 by 22 per cent to RO 1.048bn. In addition, the retention ratio of insurers increased to 57.46 per cent.

Supporting the local efforts and confirming the good position of Oman economy, S&P Global Ratings affirmed Oman’s BB/B foreign and local currency credit rating and said it is positive about the growth of the economy in the coming period. It predicts that performance of the Omani economy will improve due to the oil production stability and the growth of non-oil sector by 3 per cent in 2018. The agency forecasted that the Sultanate will be less exposed to fluctuation due to oil price hike and production stability. The issued report praised the efforts of economic diversification, including the establishment of Special Economic Zone in Duqm (SEZD in addition to other projects. The report also pointed that the foreign direct investment and private investment portfolios investments in stock markets also witnessed a rise in 2017.

Oman continues efforts in developing its promising gas sector. The Ministry of Oil and Gas signed MoU with some companies like Shell and Total. As per the agreement, Total and Shell as operator will develop several natural gas discoveries located in the Greater Barik area onshore Block 6 with respective shares of 25 per cent and 75 per cent. According to Total, the objective is to reach an initial gas production of around 500 million cubic feet of gas per day, with a potential to reach 1 bcf/d at a later stage. The company will use its share of the production as feedstock to develop a regional hub in Oman for LNG bunkering service, which will supply LNG as a fuel to marine vessels.

As per latest National Center for Statistics and Information monthly bulletin, the local production and imports of natural gas reached 10.9 bncm in 1Q’18, a yearly Increase of 6.8 per cent. The usage rate was 100 per cent with the industrial projects stood at 78 per cent of the total consumption versus 62 per cent a year earlier. Gas production CAGR over 2013-2017 was 1.13 per cent.

Also within the gas industry, Oman Trading International Limited, a subsidiary of Oman Oil Company, has signed a ten-year sales and purchase agreement (SPA) with Petrobangla, a government-owned national oil company of Bangladesh, to supply liquefied natural gas (LNG) to Bangladesh. The deal is to supply a base volume of 1m metric tonnes per year following the completion of the first two LNG import terminals, currently being constructed in Bangladesh. [Courtesy: U-Capital]

Oman Observer is now on the WhatsApp channel. Click here