The first half of the week was impacted by selling pressures. Then we noted partial recovery on in selected shares — especially the telecom sector. Trades remain calm, as we believe investors are waiting for additional factors such as dividends.

MSM30 closed the week down by 1.34 per cent at 4,180.14. All sub-indices ended down led by the Services Index (-2.77 per cent) then the Industrial Index (-1.55 per cent) and the Financial Index (-1.07 per cent). The MSM Shariah Index also closed down by 2.73 per cent w-o-w.

In the weekly technical analysis, according, to our last week recommendation that Muscat Securities Market index crossed the second support level at 4,211 points, which happened. Currently, the index is going to touch 4,100 points. If this level crossed down, it will move towards 4,060 points. Technically the index has positive indicators that may support the market or keep it at least within current levels in the short-term.

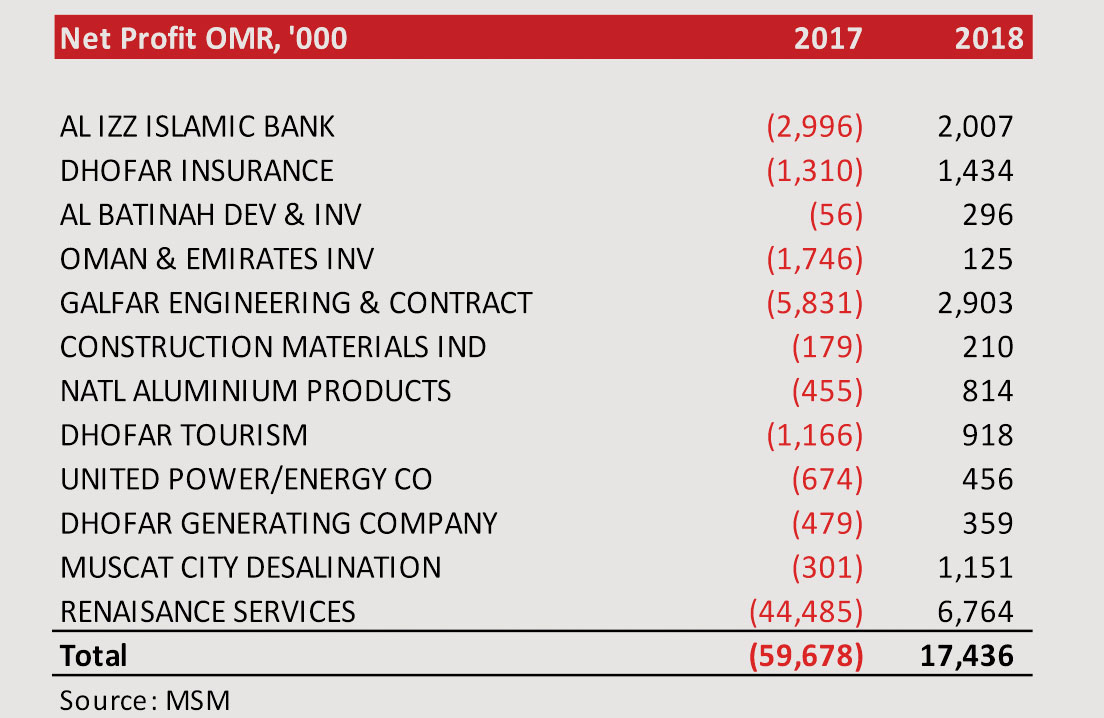

The initial annual results of 2018 indicate that 12 companies have been able to post net profit compared with their net loss for 2017, an incremental addition of RO 77.1m. Five companies were in the Services sector including Renaissance Services and Dhofar Tourism, four companies in the Financial sector including Al Izz Islamic Bank and Dhofar Insurance and, three in the Industrial Sector including Galfar Engineering and Contracting. Renaissance Services posted a net profit of RO 6.7m versus net loss of RO 44.48m for 2017 largely due to better operating profits and lower Impairment of vessels. In case of Dhofar Tourism Co, the other income played key role in supporting the net earnings. In the Financial Sector, Al Izz Islamic Bank saw strong performance in Operating profits. Dhofar Insurance posted strong net underwriting results. In the Industrial Sector, Galfar Engineering posted net profit of RO 2.9m for 2018 versus net loss of RO 5.8m in 2017 largely due to impairment of receivables/investments.

Recent data published by the National Centre for Statistics and Information (NCSI) showed that the daily average production of 2018 went slightly up by 0.8 per cent YoY to 978.4k while the average price per barrel jumped by 35.8 per cent to $69.7. The average export percentage of the total production stood at 81 per cent for 2018 compared to 83 per cent for 2017. China remains the top importer of the Omani Oil with a stake of 83.1 per cent followed by India (7.6 per cent) then Japan (5.8 per cent).

In an attempt to relax residency rules for foreign investors, Oman has confirmed that the adult children of overseas investors who live in the country can stay with them, according to media source. Thus, now, expat investors’ children can stay with their families for as long as they continue to invest or are in the country unlike previously of which expat children who were aged 21 years and above had to leave the country, or receive an employment visa to stay in Oman.

Oman public finance figures showed a deficit of RO 1.88 bn, down by 43 per cent YoY for 11M’18 on better net oil and gas revenue as per latest monthly bulletin published by National Centre for Statistics and Information. Total revenues went up by 34.2 per cent to RO 9.68 bn supported by higher earnings from most segments especially net oil and gas revenue which formed 79.1 per cent of total revenues and went up by 42.2 per cent YoY (i.e. RO 2.27 bn) on better oil price. Total public expenditures went up by 4.8 per cent on yearly basis to RO 10.9 bn and actual expenditures under settlement increased by 553 per cent.

To finance the deficit, the government used means of financing covering net loans (71.1 per cent of total financing), net local loans (14.4 per cent of total financing) and the balance went to financing from reserves. Till 11M’18, Interests paid on Loans were RO 423.3m, up by 88.4 per cent YoY (i.e. RO 198.6m). When compared 11M’18 actual performance with total 2018 budgeted figure, it showed that total actual revenue is higher by 2 per cent of the total budgeted revenue. On the other hand, total public expenditure is lower by 12.7 per cent in 11M’18 versus 2018 budgeted figures. Means of financing at RO 2.08 bn is 30.7 per cent lower than 2018 budgeted level of RO 3 bn.

Oman Observer is now on the WhatsApp channel. Click here