The local market remains under pressure due to a number of factors: the desire of some investors looking to exit their investment positions, trading on ex- dividend prices, and cautious sentiments despite the strong general situation of the local economy. The MSM30 closed the week down by 0.92 per cent at 4,074.98. All sub-indices ended the week down led by the Services Index (-1.37 per cent), the Financial Index (-0.12 per cent) and the Industrial Index (-0.09 per cent). The MSM Shariah Index closed down by 0.61 per cent w-o-w. A’Saffa Foods SAOG announced that the expansion project —which includes the construction of 90 poultry houses, slaughter house, fully automatic and feed mill, hatchery expansion and rendering and wastewater treatment plant — is expected to be completed this year.

Shell announced that it has been awarded a three-year contract from Muttrah Tourism Development Company to manage the operation and maintenance of bunkering storage tanks and its associated facilities at Mina Al Sultan Qaboos and provide marine fuel and lubricants bunkering supply service. Accordingly, Shell Oman will become the primary fuel facility operator at the port and will be the key supplier of different grades of marine fuels and lubricants to vessels at MSQ port.

Salalah Mills Co is planning to set up a macaroni plant in Ethiopia to target the large Ethiopian market and neighbouring African markets. The company has signed a MoU with a giant Ethiopian industrial and trading group to set up the plant. The MoU was signed with a giant trading and industrial group in Ethiopia to set up a macaroni plant, which includes transferring one of the long cut production lines from Salalah Macaroni Factory to Ethiopia, in addition to installing a new short cut production line.

The prices of tobacco, alcohol, energy drinks and pork products will go up by 100 per cent from June, while carbonated drinks will go up by 50 per cent. Oman has followed in the footsteps of Saudi Arabia, UAE, Bahrain and Qatar in imposing a selective tax, dubbed as ‘sin tax’ on goods and beverages, seen to have a level of harm associated with their consumption. The news will affect the sales of companies engaged in these businesses in Oman.

The inflation rate in the Sultanate, increased by 0.18 per cent in February 2019 compared to the same month in 2018, according to official data. The increase in inflation was driven by a rise in cost of major segments, such as food and non‐alcoholic beverages by 1.07 per cent, housing, water, electricity, gas, and other fuels by 0.37 per cent, restaurants and hotels by 0.60 per cent, clothing and footwear by 0.25 per cent, education by 2.02 per cent, recreation and culture by 0.40 per cent, and furnishings, household equipment, and routine household maintenance by 4.46 per cent. However, the prices of health; transport; communication; and miscellaneous goods and services fell by 0.49 per cent; 1.41 per cent; 0.36 per cent; and 2.18 per cent, respectively, in February 2019 compared to the same month of the previous year.

The Tender Board approved its second tenders’ packages for the year allocating more than RO 118 million resulting in total awarded tenders on YTD at RO 210.8 million. The key contracts include establishing multi-purpose investment building worth about RO 54.7 million and establishing protection dam against flood risks in Wadi Adai worth about RO 36 million.

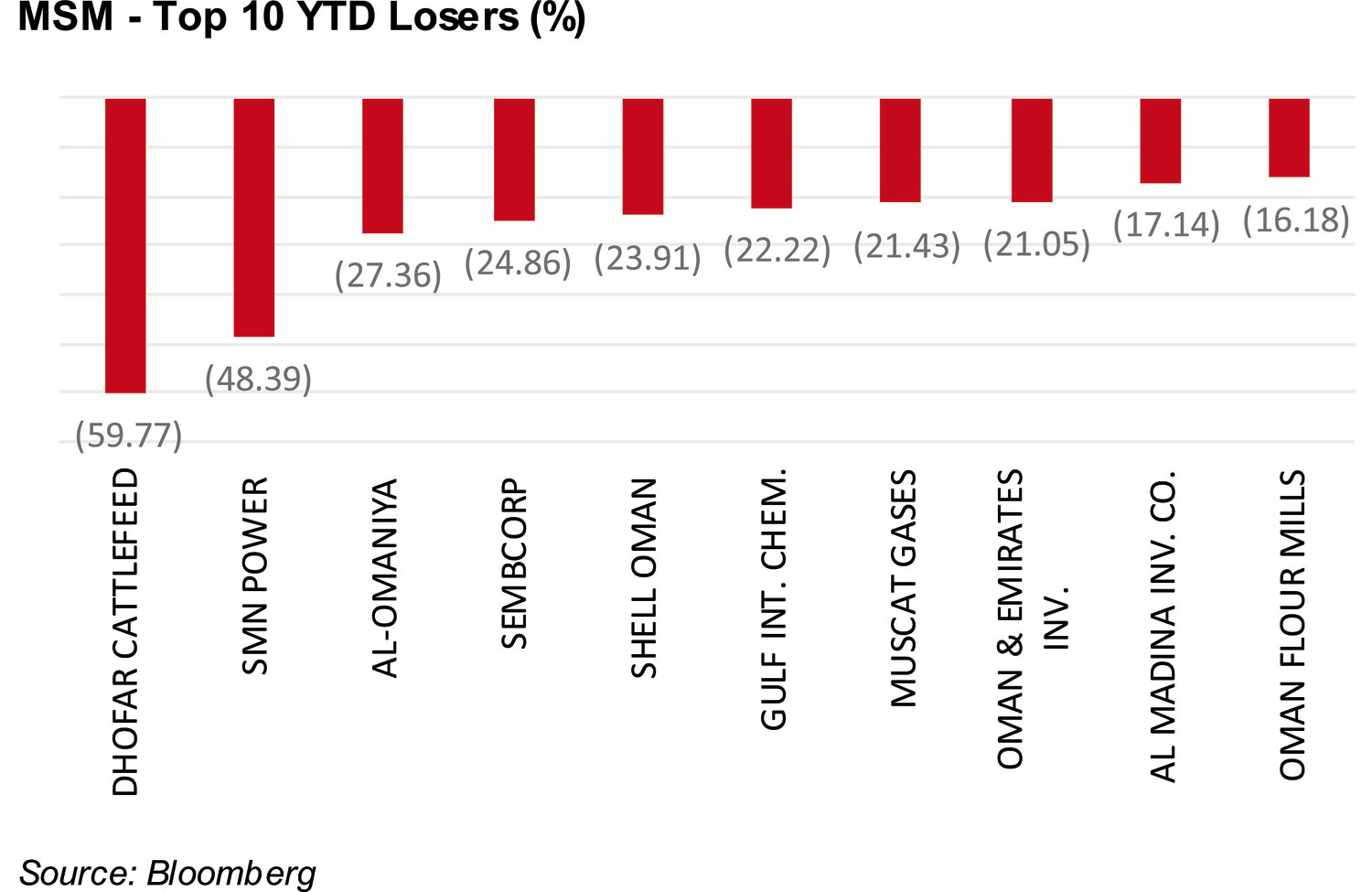

In the weekly technical analysis, according to our previous report, the MSM has reversed to the downside as we mentioned to the level of 4,040 points as the MSM was very close to this level at 4,080 points. Currently the MSM30 index will suffer from the dividend distribution season, which will pressure the index to goes down to 4,040 points again ( second support level will be at 3,800 points). Oman market has been the weak performing market YTD amongst the GCC. (Courtesy: U-Capital)

Oman Observer is now on the WhatsApp channel. Click here