With the exception of trading in Government Development Bonds (Issue 60), the financial market continued to suffer from weak trading despite the traditional activities linked to the month-end and the support received by some shares, which led to an improvement in the performance of the general index. The MSM30 ended the week up by 0.62 per cent at 3,964.83. The Financial Index closed up by 0.35 per cent followed by the Services Index (+0.15 per cent) while the Industrial Index closed down by 0.58 per cent. The MSM Shariah Index closed down by 0.68 per cent w-o-w.

In the weekly technical analysis, the MSM 30 index hovered around the 3,940 points level, which is the resistance level referred to in our last report. Currently the MSM index is still in the downtrend channel and to exit from this channel it needs to close above 4,040 points.

As reported by Reuters, Oman is preparing a sale of US dollar-denominated bonds. It would be its first international issuance of 2019. The government said at the beginning of the year it planned to cover 86 per cent of this year’s expected budget deficit through local and foreign borrowing. That would correspond to around $6.2bn in debt.

The Central Bank of Oman (CBO) is drafting a new Banking Law with inbuilt flexibility to take into account current and emerging trends and developments in the banking and financial services industry. CBO Executive President said the “agile” banking law, which will be underpinned by “dynamic” bylaws, is likely to be issued before the end of this year.

Some of the statistics presented by the Executive President are:

• Credit growth year-on-year was up 6.42 per cent in 2018

• Deposits grew 7.8 per cent year-on-year

• Gross NPLs pegged at 2.73 per cent last year, while Net NPLs were at 0.92 per cent

• The Capital Adequacy Ratio of banks stood at 18.4 per cent while the Tier-1 Capital Ratio posted 17.1 per cent.

MSM30 performance in April’19 saw a drop of 0.95 per cent mainly on cautious sentiment, selling pressures on selected shares and some speculative activities. Since the start of the year, the market continued to see pressures despite good macro performance and better oil prices. The index ended the month at 3,945.64, one of its lowest level in more than 14 years. In terms of trading activities, the average daily values and volume stood at RO 2.2m and 16m shares respectively, which are moderate and reflect cautious sentiment.

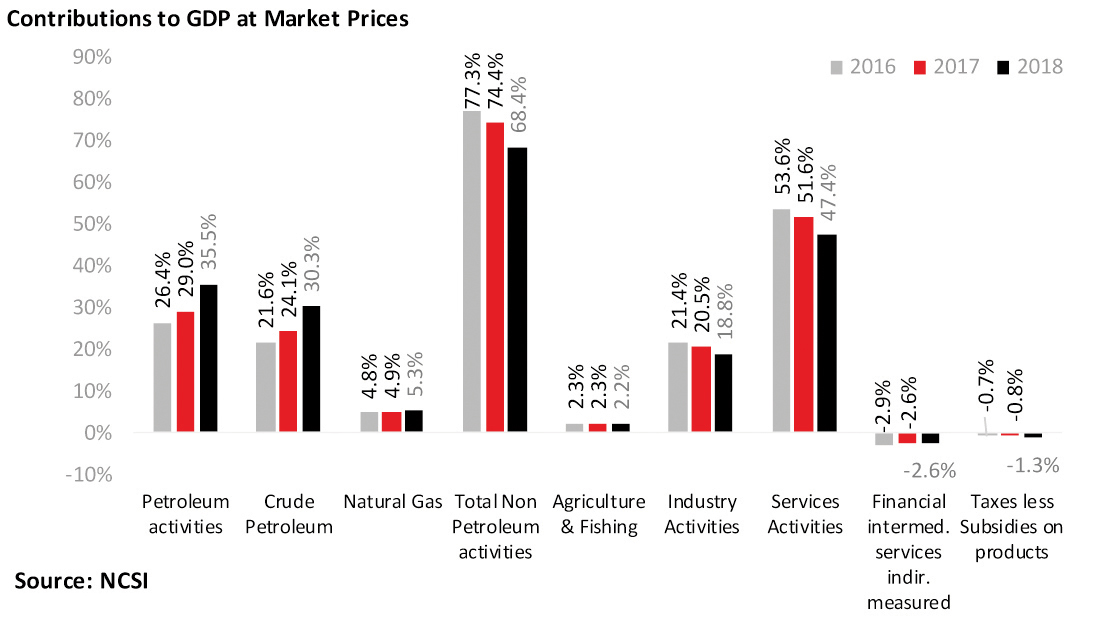

Recent data published by the National Centre for Statistics and Information about Oman GDP at market prices showed that it continued going up as it went up by 12 per cent in 2018 on yearly basis on the back of strong improvement of petroleum activities (+37.1 per cent) and non-petroleum activities (+2.9 per cent). The key factor was better average Oman oil prices (+35.9 per cent YoY at $69.7/BBL) compared with $51.3 for 2017). Petroleum activities contribution to GDP at market prices went up to 35.5 per cent in 2018 compared with 26.4 per cent and 29 per cent for 2016 and 217 respectively.

Uptil April 25 since the start of the year, Oman market has witnessed net foreign inflow of $6.83m. Top three companies which witnessed increase in foreign ownership are: Shell Oman, Oman Cement and Al Anwar Ceramics. While three companies which lost the most foreign ownership are: Al Madina Takaful, Galfar Engineering and Al Sharqiya Investment.

Saudi Stock Exchange topped the GCC financial markets up by 0.66 per cent while Abu Dhabi Securities Exchange declined the most during the week down by 2.77 per cent. [Courtesy: U-Capital]

Oman Observer is now on the WhatsApp channel. Click here