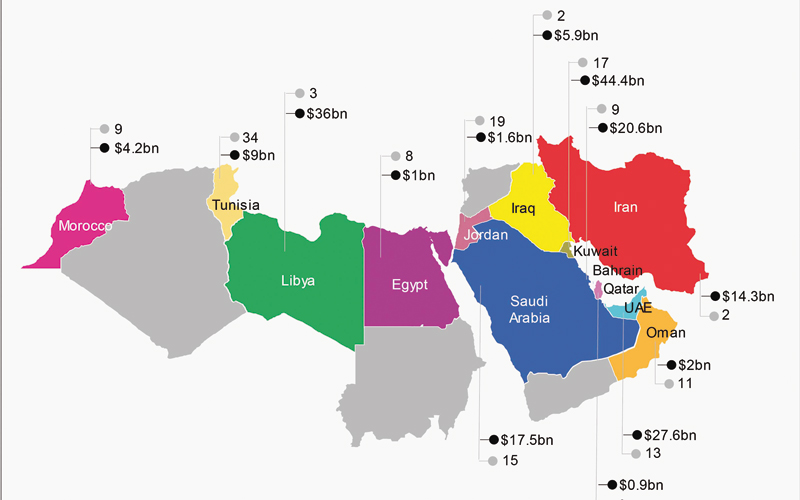

PARTNERSHIP PROSPECTS: $185 billion worth of schemes currently planned or under way in the region -

BUSINESS REPORTER -

MUSCAT, OCT 11 -

The Middle East and North Africa (MENA) region has witnessed a 116 per cent increase in the value of projects planned or under way using public private partnerships (PPP) over the past 12 months, according to new research from MEED.

MEED’s latest research PPP in the Middle East and North Africa 2017 says that about 151 PPP projects are currently planned or under way across the MENA region outside the energy sector with a combined value of about $185 billion.

The report looks at the region’s plans to use PPP to deliver government infrastructure and services such as railways, airports, housing and healthcare that traditionally have been delivered directly by government agencies.

Structural change

The fall in oil prices since 2014 is restricting the capacity of governments to fund new infrastructure projects and finance ministries are increasingly seeking to engage the private sector in designing, building, financing and operating public sector infrastructure and services.

But it warns that significant legislative, capacity and political barriers remain to be overcome if the region is to deliver its PPP plans.

“The rise of public-private partnerships (PPP) over the past few years is one of the most strategically significant shifts in the business landscape of the Middle East since the nationalisation of the oil industry in the early 1970s,” says MEED Editorial Director Richard Thompson.

“But it is not easy,” he says. “The transition from full government control to private-sector control requires a host of difficult changes to be implemented covering everything from the way entire industries are regulated, to how much things cost over, to who has decision making authority.

It requires new skills and technical capacity. And it requires not just a change in business models but also in political mindset.”

PPP in the Middle East and North Africa 2017, analyses more than 151 PPP projects across the region. About 60 per cent of the projects are in the planning stage and scheduled to be awarded in the next five to six years. MEED estimates that the total value of planned projects exceeds $100 billion.

The PPP pipeline will grow further in the next two to three years as governments seek to increase private sector participation to complete mega-projects, especially in the transportation sector.

Troubled past

Using private sector financing to fund public sector services is not a new concept in the MENA region. Countries here have been using private financing models since the mid-1990s. The majority of these projects however have been limited to the utilities sector for Independent Power Plants (IPPs) and Independent Water and Power Plants (IWPPs), which have benefited from special agreements to provide low cost energy.

Outside the energy sector, PPPs previously have struggled to take root.

MEED’s latest report provides a detailed breakdown and country-by-country analysis of PPP legal framework, contact details of the PPP authority and planned projects, along with clients and key players in each market.

Most of the PPP projects planned are in the GCC, with Saudi Arabia announcing extensive privatisation plans in its National Transformation Programme (NTP) in 2016 that are expected to see fruition by 2020.

With about $42.9 billion worth of PPP projects planned, Saudi Arabia has by far the biggest pipeline of PPP projects and has recently created a dedicated unit, the National Centre for Privatisation (NCP) to deliver the programme. Kuwait and the UAE are also moving forward with their PPP project pipeline, while Oman and Qatar are planning to launch PPP legislation in the second half of 2017.

Major sectors

With almost $93 billion worth of PPP projects planned or underway, the transport sector has the biggest value of PPP projects planned with the rail and aviation sectors accounting for the bulk of planned projects.

Saudi Arabia has the biggest number of transport PPP projects planned in the region with the kingdom’s aviation sector in particular witnessing a rapid increase in activity, as the kingdom’s General Authority of Civil Aviation (GACA) seeks to deliver on its promise to privatise all of Saudi Arabia’s 27 airports by 2020.

Affordable housing is another major segment that has attracted significant private sector’s interest. Countries such as Saudi Arabia, Kuwait, Bahrain and the UAE are the major markets for PPP driven housing projects.

Saudi Arabia, Egypt, Qatar and Kuwait are also utilising PPP contract models to deliver social infrastructure projects in the healthcare and education sectors.

Oman Observer is now on the WhatsApp channel. Click here