The local market witnessed an improvement in trading values and volumes last week which can be largely attributed to some special deals, especially involving Ominvest. Excluding this, cautious continues to dominate the market, especially before the second quarter results season and also due to the geopolitical tensions. The MSM30 ended the week down by 0.95 per cent at 3891.06. All sub-indices closed down led by Industrial which was down by 2.10 per cent. Financial & Services Index closed down by 0.93 per cent and 1.57 per cent, respectively. MSM Shariah Index closed down by 0.34 per cent w-o-w.

Ominvest’s fully-owned subsidiary Jabreen Capital has entered into an agreement with EastBridge Partners Singapore to expand its private equity footprint in the South East Asia market. The acquisition of a significant stake in EastBridge Partners Singapore will further enable Jabreen Capital to tap into new investment opportunities, particularly in South East Asia. EastBridge Partners Singapore focuses on mid-market investments and targets proprietary transactions, an area where the team has a substantial competitive advantage due to their longstanding experience, network and reputation in the market.

Omantel signed a definitive share purchase agreement with Integrated Telecommunications Oman (TeO) whereby Omantel acquired 40 per cent stake in Majan Telecommunication (Renna) for a sum of RO 5m. Renna launched its operations in 2009, as one of the first mobile virtual network operators (MVNOs) in Oman. As of April 2019, resellers including Renna/Friendi have total subscriber base of 745.4k. Subscribers of resellers have declined from 756.8k at the end of December 2018 to 745.4k in April 2019.

Muscat Finance, which earlier appointed an independent consultant to investigate suspicious transactions, announced last week that the monetary impact resulting from that incident amount to RO 0.9m. However, the company expects to recover the money and the monetary impact will be lower on successful recovery.

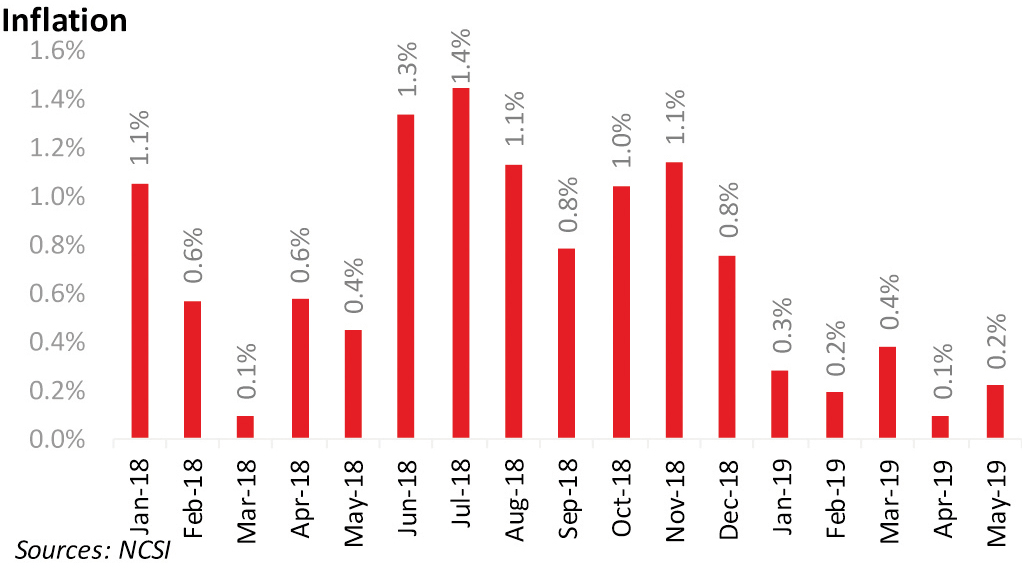

The inflation rate in the Sultanate, increased by 0.22 per cent in May 2019 compared to the same month of 2018, according to the latest data released by the National Centre for Statistics and information (NCSI). The increase in inflation was driven by a rise in cost of major segments such as food and non-alcoholic beverages by 0.31 per cent; restaurants and hotels by 0.01 per cent; education by 1.99 per cent; recreation and culture by 0.90 per cent; and furnishings, household equipment and routine household maintenance by 4.88 per cent. However, the prices of health; communication; and miscellaneous goods and services fell by 0.49 per cent; 0.48 per cent; and 2.29 per cent, respectively.

SMEs continue to surge in Oman, highlighting their increasingly important role in diversifying Oman’s economy. SMEs in Oman have grown from 23,221 in December 2016 to 39,473 at the end of May 2019. Majority of those are located in Muscat Governorate at 38 per cent followed by 19 per cent in Al Batinah North and 11 per cent in Al Dakhiliyah, while the rest distributed across eight other governorates in the country.

Among GCC markets, Bahrain was the only market which closed up by 0.92 per cent while all other markets ended in red.

Saudi Arabia relaxed a 49 per cent limit for foreign strategic investors in shares of listed companies. Saudi CMA announced that there will be no minimum or maximum ownership limit, although the owners must hold the shares for two years before they can sell. Strategic foreign investors can take stakes in listed companies by buying shares directly on the market, or through private transactions and via initial public offerings. While the CMA has removed the cap, limits by other regulators or a company’s own rules still apply. Some sectors in which authorities still have to approve deals that surpass a pre-established threshold are banking, insurance and telecommunications.

MSCI Inc announced that it will reclassify the MSCI Kuwait Index to Emerging Markets status, subject to omnibus account structures and same National Investor Number (NIN) cross trades being made available for international institutional investors before the end of November 2019. MSCI will communicate its final decision by December 31, 2019. Kuwait’s index weightage will be 0.5 per cent and nine companies will be part of the Main Index while nine will be in MSCI Emerging Small Cap Index. Kuwait upgrade should result in $2.5-3.0 bn in passive inflows. Oman and Bahrain, the only remaining markets from GCC in MSCI Frontier Index would not witness any change in weightage.

The government of Abu Dhabi has launched a financing scheme for Small & Medium Enterprises (SMEs) that provides guarantees to Abu Dhabi banks in case of default. The government will guarantee up to 75 per cent of the value of a loan extended to an SME run by UAE nationals, and up to 60 per cent for SMEs run by expatriates. Conditions for eligibility to the scheme is that the Company has to be an Abu Dhabi-based, to have a minimum turnover of AED 15m ($4.08m, and to have a solid business case. [Credit: U-Capital]

Oman Observer is now on the WhatsApp channel. Click here