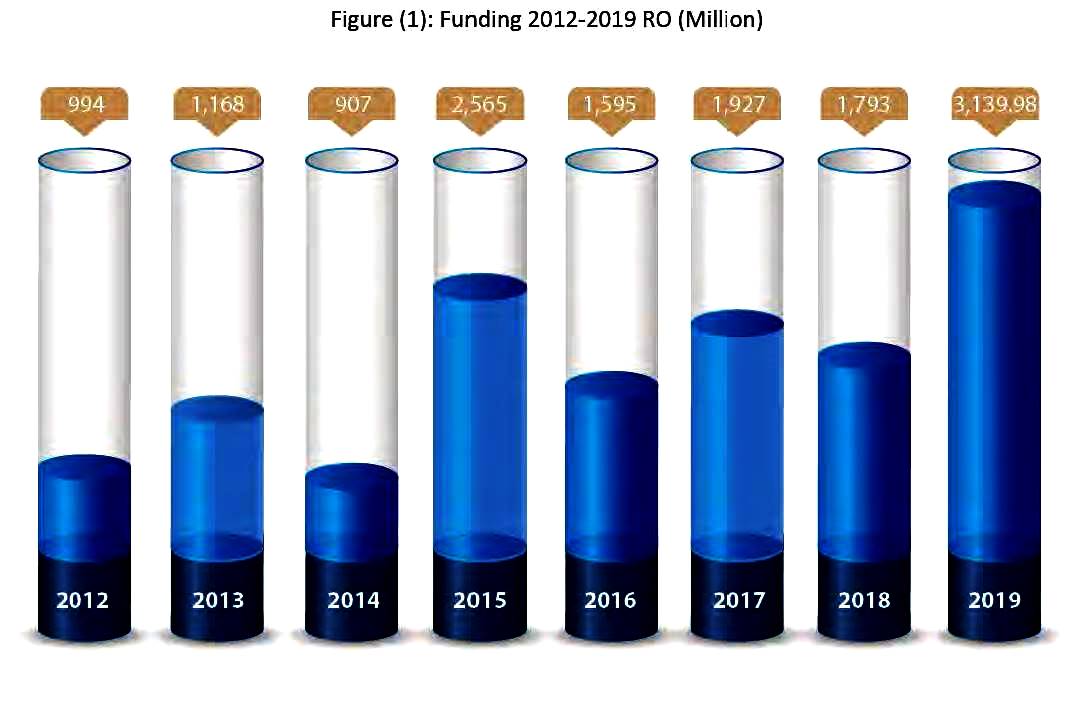

Muscat: Oman’s capital market raised funding to the tune of RO 3.14 billion ($8.2 billion) for various projects and economic initiatives in 2019, up from RO 1.8 billion ($4.67 billion) in 2018.

The roughly 75 per cent jump underscores the increasing important role of the sector as a source of finance for the Sultanate’s economic development, according to a top official of the Capital Market Authority (CMA).

“The CMA’s vision is to make the Omani capital market (capital and insurance market) a sustainable mover of comprehensive economic growth and wealth creation,” said Abdullah bin Salim al Salmi (pictured), Executive President.

“It stems from a belief of the importance of the Omani capital market to the national economy as a tool for facilitating the movement of capital between the various components of the economy to attain the largest possible contribution in economic development and employing savings and directing finance to various economic projects, in addition to providing appropriate insurance protection and coverage for various economic sectors and all segments of the community,” he stated in the newly published CMA’s 2019 Annual Report.

Of the RO 3.14 billion in total funding raised by the capital market in 2019, roughly half (RO 1.65 billion) came from Rights Issues (SAOC companies), while New Issue Bonds & Sukuk contributed RO 932 million. There were also modest contributions from Bonus Shares of SAOG companies (RO 52.90m), Rights Issues SAOG (RO 38.10m), SAOC Private Placements (RO 377.90m), and New SAOC listings (RO 79.78m).

Meanwhile, the size of the capital market -- encompassing listed companies, bonds and sukuk -- has been expanding as well. It reached a value of RO 18.77 billion ($48.75 billion) in 2019, up from RO 18.18 billion in 2018 and RO 17.95 billion a year earlier. Closed joint stock companies accounted for 44 per cent of this total capitalisation, followed by listed companies (35 per cent) and bonds and sukuk (21 per cent).

In terms of its share of the country’s Gross Domestic Product (GDP), the capital market stood at about 36 per cent last year – a level attributable “probably to the absence of vital economic sectors from the capital market, which the CMA endeavours to attract”, said Al Salmi.

Foreigners bought RO 235 million ($610.3 million) worth of securities in 2019. Foreign investment accounted a 25.37 per cent share of the capital of public joint stocks which had a total capital of RO 3.3 billion ($8.57 billion) as of 2019-end.

Listed firms generated RO 927m net profits in 2019

MUSCAT: Public joint stock companies listed on the Muscat Securities Market (MSM), and with the financial year ending December 31, recorded RO 927 million in total net profits in 2019, representing a 13 per cent increase over the previous year’s tally, according to the Capital Market Authority (CMA).

“The companies realised good rates of profit,” said the Authority, noting that 102 of the 111 companies listed on the MSM ended their fiscal year on December 31, 2029. The capital of the public joint stock companies listed on the MSM totalled RO 3.3 billion as of end-2019.

Cash and share dividends paid out in 2019 were in line with the broad expectations of investors, the Authority said. As many as 63 companies declared the distribution of dividends for 2019. Cash dividends totalled RO 401.1 million, representing 43 per cent of total net profits. Six companies declared share dividends totalling 320 million shares, while one firm declared 11.67 million bonus bonds.

Oman Observer is now on the WhatsApp channel. Click here