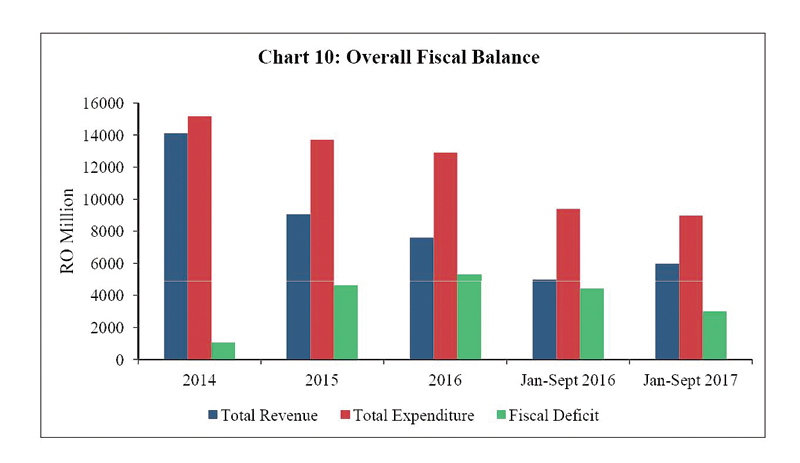

Oman’s fiscal deficit for the first nine months of 2017 (January-September) declined 47.5 per cent to around RO 3 billion, down from RO 4.427 billion during the corresponding period of 2016, the Central Bank of Oman (CBO) stated in its newly released Mid-Year 2017 report.

Aggregate government debt, however, climbed 73.7 per cent to RO 11.605 billion as of end-September 2017, up from RO 6.681 billion at the end of September 2016, it noted.

The decline in fiscal deficit has been attributed to the substantial recovery in the price of Omani crude, which averaged $56 per barrel during the January-September period of 2017, versus an average of $38.3 per barrel for the same period of 2016. This differential translated into a 73.7 per cent increase in the aggregate revenue to the government in 2017 in comparison with figures for 2016.

“The hydrocarbon revenues have remained the main source of government revenue in Oman, although concerted policy efforts have been made in the last few years to augment non-hydrocarbon revenue,” the CBO report said. “Such policy efforts included increasing the corporate tax rate, raising the user fees, and diversification of the economy through enhanced participation of the private sector. The policy measures aimed at rationalising expenditure are also implemented, which mainly comprises of reduction in subsidies on energy, cutting back other expenditure wherever possible, etc,” it noted.

These fiscal measures, coupled with the recovery in oil prices, contributed to a 20 per cent increase in government revenues during the period under review, according to the apex bank.

Significantly, the vast chunk of Oman’s deficit is financed via external borrowings, aided in part by relatively low interest rates prevailing in international markets. As a result, total external debt surged 118 per cent to RO 8.893 billion at the end of September 2017, up from RO 4.079 billion at the end of December 2016. Plugging the shortfall were domestic borrowings, which climbed 4.3 per cent mainly due to issuances of Government Development Bonds.

The external debt is expected to rise further in line with a government preference for external borrowings to finance the fiscal deficit in order “to avoid crowding out of private credit”, the Central bank pointed out.

“The burgeoning debt to GDP ratio indicates a reduction in fiscal space to support the growth momentum. Hence, there is need to further accelerate the pace of fiscal consolidation through both rationalising expenditure and augmenting capacity for non-hydrocarbon related revenues. Going forward, the lower capacity for non-hydrocarbon related revenues could have implications for debt sustainability,” it noted.

Oman Observer is now on the WhatsApp channel. Click here