Road traffic crashes are one of the leading causes of death globally — 1.25 million people are estimated to be killed on the roads each year, representing more than 3,400 deaths per day — equivalent to more than 141 deaths per hour — while another 30 to 50 million people are injured every year.

Road crashes are responsible for more deaths than malaria, suicides and homicides and are the only non-disease-related cause among the ten leading causes of death ranked by the World Health Organization (WHO).

Road crash deaths are estimated to rise to 1.9 million by 2020 due to increased motorisation across the world, especially in low and middle income countries (LMICs), which are highly likely to experience the greatest increases in future fatality rates.

Today, 91 per cent of the world’s collisions happen in LMICs, showing significant gaps of impact between high income countries vs LMICs.

Road collisions have a total global cost of $518 billion, which corresponds to 1 to 3 per cent of the countries’ GDP.

Costs can rise up to 5 per cent in LMICs and even to 8 to 10 per cent in some cases such as South-Africa and Uganda where road crashes are a crucial challenge.

While road traffic crashes are far too numerous and cause dramatic losses for society, it is important to mention that they are not inevitable because the vast majority is preventable if subject to targeted actions.

AXA Insurance, the Global Road Safety Partnership (GRSP) and the United Nations Environment Programme Finance Initiative’s Principles for Sustainable Insurance (UNEP FI PSI) have joined forces to publish a report on how insurers may further impact road safety.

The report showcases a strong business case for insurers to contribute to a reduction in the incidence of road crashes by reducing risks on the road, particularly given that they actually have many levers for action at their disposal to encourage safer driving.

The insurance industry has a key role to play to impact road safety and contribute to the global target set by the United Nations within the Sustainable Development Goals (SDGs) to halve by 2020 the number of global deaths and injuries from road crashes.

Covering almost 1 billion vehicles globally, with $626 billion premiums in 2016, Motor Insurance is a major business for insurers. It accounts for 12.8 per cent of the total insurance premiums.

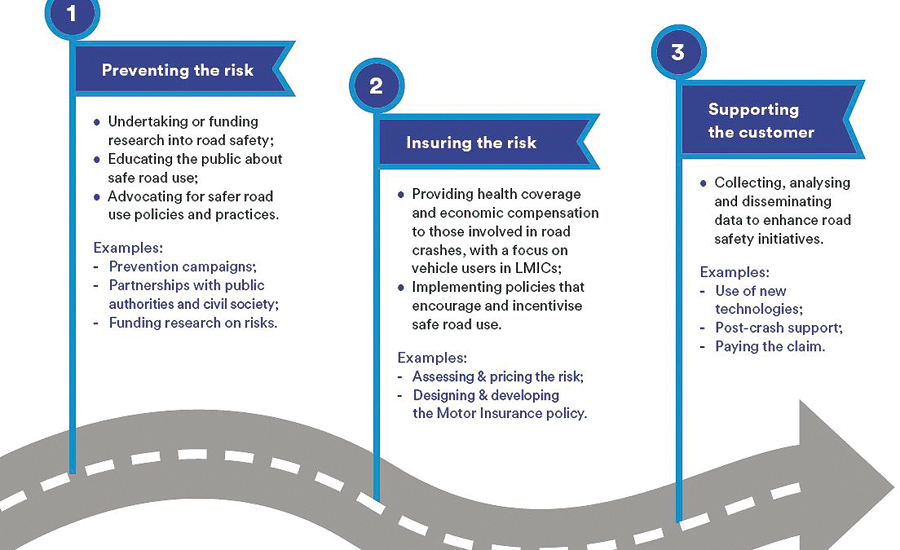

The motor vehicle insurance value chain highlights how the insurance industry can respond to road risks, by embedding road safety incentives in their business model, in order to provide benefits to their customers and the wider community:

Road safety leaders in international organisations also recognise the power of the insurance industry to drive change in road safety by fostering risk prevention with road users every day and working with governments for enforced regulation and infrastructure.

Insurers have a key role to help improve road safety worldwide.

The potential benefits of these initiatives for society as a whole are even larger, as road safety improvements are also linked to environmental and health issues.

“This global guide to strengthen the insurance industry’s contribution to road safety supports the vision of UN Environment’s Principles for Sustainable Insurance (PSI) Initiative — a risk-aware world, where the insurance industry is trusted and plays it full role in enabling a healthy, safe, resilient and sustainable society,” says Butch Bacani, Programme Leader, UN Environment’s Principles for Sustainable Insurance Initiative UNPSI.

“At AXA Gulf, we believe that we have a role to play in supporting the communities in which we operate and, in turn, to help create stronger and more sustainable societies.

With the mission to empower people to live a better life, we have identified road safety as one of the many initiatives we feel requires our immediate attention. We aim to share our extensive knowledge on protection and risk management to support the authorities in their efforts to increase awareness of safe driving,” stated Cedric Charpentier, CEO of AXA Gulf.

New technologies will heavily disrupt the traditional motor vehicle insurance business.

Oman Observer is now on the WhatsApp channel. Click here