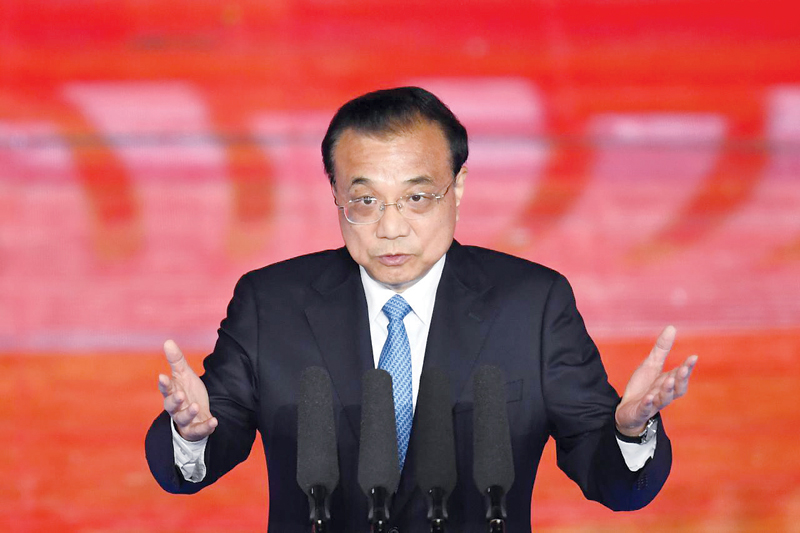

BEIJING: China will remove business restrictions on foreign banks, brokerages and fund management firms, a cabinet meeting chaired by Premier Li Keqiang said, state television reported.

But the move, which comes nearly 18 years after China joined the World Trade Organization (WTO), could have limited impact on the competitive landscape of an industry dominated by China’s state firms.

China has stepped up efforts to open its financial sector amid a festering trade war with the United States, with increased access to its financial sector among a host of demands from Washington.

Last week, China announced a firm timetable for opening its futures, brokerage and mutual fund sectors fully to foreign investors next year, as Beijing and Washington reached a tentative deal to resolve their trade dispute.

The cabinet did not elaborate on what effect the removal of the curbs would have. On Tuesday, the cabinet relaxed management rules for foreign insurers and banks, giving them easier access to China, and wider business scope.

China will also support local governments’ efforts to attract more foreign investment and allow foreign companies to be more flexible in choosing how they borrow funds from abroad, the cabinet said.

China will not allow forced technology transfers by foreign firms, it said.

Stabilising foreign investment is part of Beijing’s policies to support the slowing economy that has been hit by the country’s trade war with the United States.

SMALL MARKET SHARE

In 2007, HSBC Holdings, Standard Chartered Bank , Bank of East Asia and Citigroup became the first foreign banks allowed to set up locally-incorporated subsidiaries in China as Beijing gradually opened up the sector.

But hampered by numerous restrictions on business scopes and operations such as outlet openings, the roughly 40 foreign banks with local units operating in China account for a tiny fraction of a market dominated by state-owned rivals such as Industrial and Commercial Bank of China and Bank of China .

“Many people say ‘the wolves are coming’, but my observation is that...through opening, Chinese regulators intend to introduce technology and talents, but it doesn’t mean foreign players can grab a big market share in China,” Xin He, Societe Generale’s China head of global markets told a financial conference over the weekend.

He added that the French bank has retreated from its retail business in China after realising that “foreign banks cannot compete with Chinese players in this business segment.”

In the securities sector, China last year relaxed rules to allow foreign brokerages to own a majority stake in Chinese ventures. China said last week foreign ownership limits in the sector will be scrapped completely on Dec. 1, 2020. UBS Group , JPMorgan Chase and Japan’s Nomura Holdings have obtained regulatory approval to set up majority-owned China ventures. — Reuters

Oman Observer is now on the WhatsApp channel. Click here