Uptick: The official selling price for Oman Crude Oil during October 2018, for the delivery month of December 2018, settled at $80.20, up by $1.48 compared with September trading prices

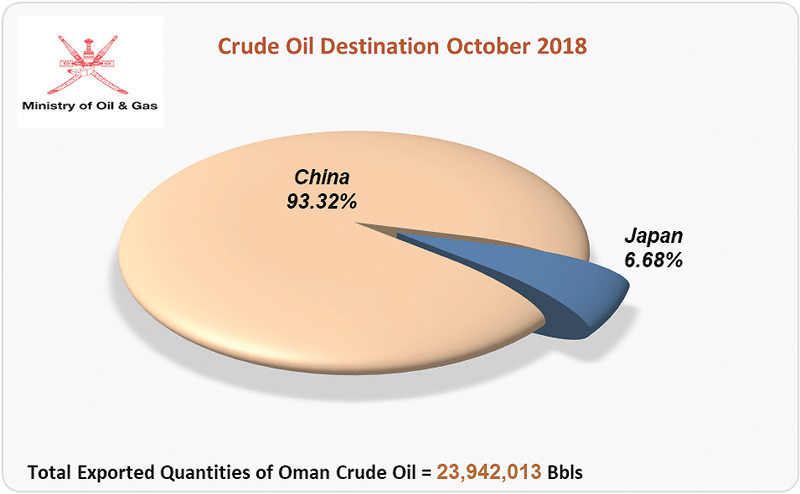

Asian markets have dominated Omani crude oil exports in October 2018 with China accounting for 93.32 per cent of total imports, increasing its share by 2.58 per cent over the previous month’s tally. Japan saw its share decline by 6.68 per cent, the Ministry of Oil and Gas stated in its report for October.

According to the report, Oman’s production of crude oil and condensate in October 2018 amounted to 30,854,300 barrels, representing a daily average of 995,300 barrels. Exports of Oman crude oil during October 2018 totalled 23,942,013 barrels, representing a daily average of 772,323 barrels.

Crude oil prices witnessed an increase during October’s 2018 futures trading, compared with September 2018 for the major crude oil benchmarks around the world. The average price for West Texas Intermediate crude oil at the New York Mercantile Exchange (NYMEX) reached $70.70 per barrel, rising by $0.79 compared to the previous month’s trading. The average price for North Sea Brent mix at the Intercontinental Exchange (ICE) in London climbed to $80.63 per barrel, up by $1.52 compared with September 2018 figures.

Likewise, the average price for Oman Crude Oil Future Contracts on the Dubai Mercantile Exchange (DME) witnessed a price hike by 1.9 per cent compared with the previous month. The official selling price for Oman Crude Oil during October 2018, for the delivery month of December 2018, settled at $80.20, up by $1.48 compared with September trading prices. The trading price ranged between $75.42 per barrel, and $85.35 per barrel.

“The crude oil prices’ uptrend through October 2018 futures trading was attributed to several factors that positively affected the trading settlements, such as the drop of Iranian crude oil exports, Opec’s third-largest producer, because of the new US sanctions, as well as the partial closing in the Gulf of Mexico due to Hurricane Michael,” the Ministry said.

“In addition, the decline in the number of US oil drilling platforms, and the decrease in US crude oil inventories, contributed to the rise in prices. Finally, the oil prices were supported by the rise in US stocks, which had a positive impact on the improvement in oil prices.”

Oman Observer is now on the WhatsApp channel. Click here