The financial market remains cautious and watchful, which affected trading volumes and values. A number of result announcements, coupled with regional pressure, contributed to increased losses in the regional financial markets, including local.

MSM30 went down by 0.8 per cent on a weekly basis. The Financial Index closed down by 1.38 per cent followed by the Industrial Index (-1.1 per cent) and the Services Index (-0.89 per cent). The MSM Shariah Index closed down by 1.02 per cent w-o-w.

Aiming to support the trading activities, the MSM Board approved to extend the daily trading session to four hours, starting from 10 am to 2 pm. This comes at the request of brokerage firms. The extension will be for a trial period of six months starting next month. The daily average turnover in the 9M’18 stood at RO 3.4 million which is 7.5 per cent lower on yearly basis.

SMN Power Holding stated in a statement to the MSM that a small fire broke out in the Load Voltage (LV) switchgear room at the Barka II plant. The estimated financial impact to date amounts to RO 200,000 because of shutting down of the desalination plant. Referring to a previous disclosure regarding the operations of the Barka II desalination plant after fire broke out in the Load Voltage (LV) switchgear room, SMN Power Holding reported that the plant was operational on October 8, 2018 and that the expected financial loss due to this event is about RO 385,000.

In the weekly technical analysis, as we mentioned last week that MSM index currently near the level of (4,500 points) will push the index to the level of 4,460 points. In the coming trading, we expect the pressure on the leading stocks to continue under pressure from negative indicators.

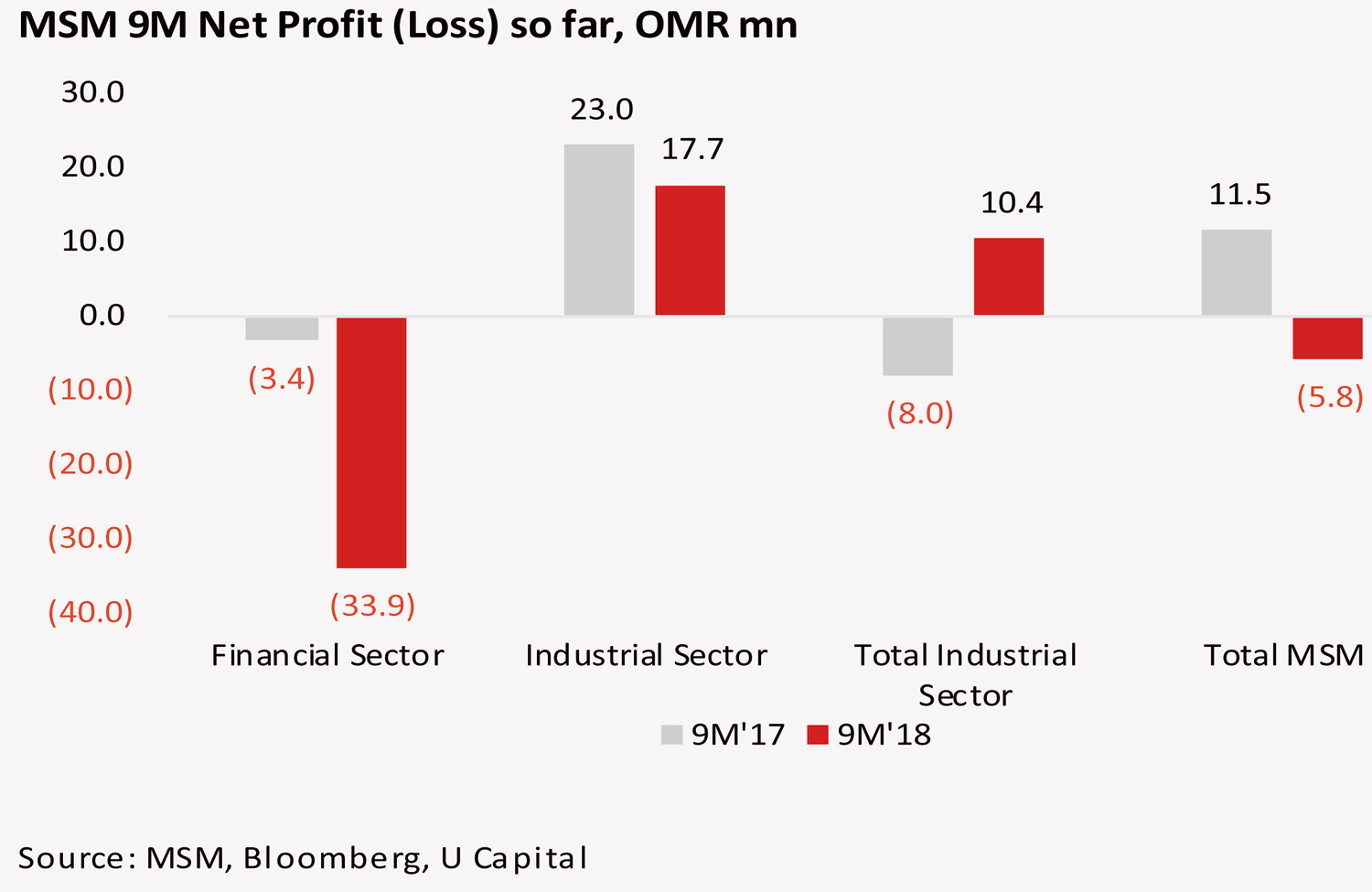

Total announced 9M’18 initial net earnings so far, as per MSM, for the companies whose year ends in December showed a net loss of RO 5.8 million mainly on Dhofar Int. Dev. & Inv. Holding Co. (DIDI) which posted unrealised loss on financial assets at fair value and Salalah Port Services which was hit by the Cyclone Mekunu. Excluding those two companies, net earnings would be up by 175 per cent to RO 30.7 million thanks to good results posted by Renaissance Services.

Sector wise, the Service Sector posted best results as its net profit stood at RO 10.4 million for 9M’18 versus a net loss of RO 8 million in 9M’17 on better performance by Renaissance Services as the company moved to profits from losses. The Industrial Sector total net earnings declined by 23.2 per cent on annual basis to RO 17.6 million mainly pressurised by Al Anwar Ceramic and Voltamp Energy. On quarterly basis, the total market announced results indicates a net loss of RO 0.868 million in 3Q’18 compared to a net loss of RO 3.1 million for 3Q’17. We would like to highlight here that so far not many large cap companies have announced the results.

In a step to attract more foreign direct investments, Nama Holding, a government-owned holding company, announced the launch of a privatisation programme for Nama Group’s electricity transmission and distribution companies. During press conference in London, the company stated that the partial privatisation of the transmission company and one of the distribution companies through an international strategic partner. The vice-president — distribution and supply at Nama Group announced sale of upto 49 per cent of Nama Holding shares in Oman Electricity Transmission Co (OETC), and the sale of up to 70 per cent of Nama Holding shares in its distribution and supply companies respectively: Muscat Electricity Distribution Co (MEDC), Majan Electricity Distribution Co (MJEC), Mazoon Electricity Distribution Co (MZEC), and Dhofar Power Co (DPC).

The Under-Secretary of the Ministry of Oil and Gas said that Oman has the capacity to raise the ceiling of its oil production by about 40K barrels per day, a share that was previously reduced in accordance with the agreement with the oil producing countries from Opec and other producers.

As per CBO’s latest statistical bulletin, the total credit of the Omani Banking sector (conventional loans and Islamic financing) stood at RO 24.27 billion as at the end of July’18, up by 6.3 per cent YoY and flat on MoM basis. Total deposits stood at RO 22.28 billion, up by 3.4 per cent YoY but down by 0.3 per cent MoM or RO 64 million from June to July’18. Credit growth (on YoY basis) slowdown reversed at the end of 2017 until April’18 and was slowing down until July’18 when it has once again begun to show signs of recovery. Deposit growth, on one hand, had picked up markedly from a low of 2.3 per cent in April’18, to 4.5 per cent YoY in June’18 but has once again fallen to 3.4 per cent YoY in July’18. Total Loan-to-Deposit Ratio remains stretched at 108.9 per cent.

Conventional banks account for 86.0 per cent of total system credit at RO 20.88bn as at the end of July’18, rising by 4.1 per cent YoY and declining by 0.3 per cent MoM. Credit extended to the private sector remained stable on MoM basis at RO 18.59 billion. Conventional deposits at RO 19.19 billion (+1.8 per cent YoY, flat on MoM basis) form 86.12 per cent of the total banking deposits of Oman. Conventional Loan-to-Deposit ratio stood at 108.8 per cent. Islamic credit stood at RO 3.39 billion (+21.7 per centYoY, +1.9 per cent MoM) and Islamic deposits stood at RO 3.09 billion (+14.5 per cent YoY, -1.8 per cent MoM), with Loan-to-Deposit ratio stretching to 109.5 per cent in July’18 from 105.4 per cent in June’18, due to RO 58 million worth Islamic deposit withdrawal during the month of July’18.

Oman Observer is now on the WhatsApp channel. Click here