LONDON: Digital banking app Revolut has raised $500 million in a fresh funding round, confirming the British-based business as one of the world’s most valuable financial technology firms with a valuation of $5.5 billion.

The Series D funding round was led by US investment firm TCV — which has previously backed Netflix, Spotify and Airbnb — and takes the total amount raised by Revolut to $836 million.

Revolut has attracted more than 10 million customers since its launch in 2015 by offering slick money management tools and undercutting traditional banks on pricing for foreign exchange, stock trading and money transfers.

The firm is accelerating its expansion overseas and has expanded partnerships with payments firms Visa and Mastercard. It will open its virtual doors in America this year.

Revolut, which employs 2,000 people, said it would use the fresh funding to roll out new products including lending and to expand further in Europe.

The firm also said it would invest in improving its customer service and extending its savings service outside Britain.

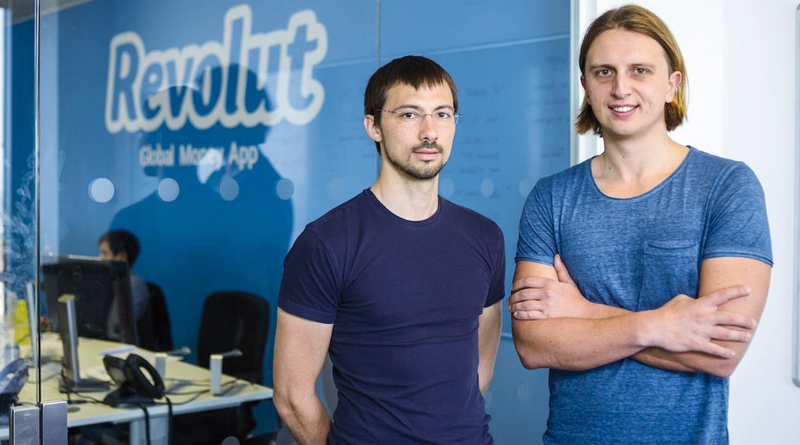

Founder and CEO Nik Storonsky said the firm was aiming to build “a global financial platform”.

Storonsky said last September that the company’s workforce could grow to as many as 5,000 people this year.

Leading ‘fintechs’ such as Revolut have rapidly grown customer numbers and valuations, but they have struggled to convert this into profits, with Revolut losing £33 million in 2018.

There are also some signs of a slowdown in the wider British fintech industry, with the customer growth rate across neo-banks dipping in the second half of last year from 170 per cent to 150 per cent, while the average deposit balance fell by a quarter to £260, according to a report by consultancy Accenture.

British fintechs are targeting international expansion to maintain their growth, with rival app Monzo launching in the United States last year. Revolut has experienced some growing pains, including media reports about a cutthroat working culture and poor treatment of some customers.

Customers who had been victims of fraud were frustrated by the digital bank’s customer service, which was slow to respond and offered only in-App chat rather than a telephone helpline.

Revolut has sought to bolster its top team with experienced financiers in recent months, including hiring Martin Gilbert, the former co-CEO of Standard Life Aberdeen, as chairman in November. — Reuters

Oman Observer is now on the WhatsApp channel. Click here