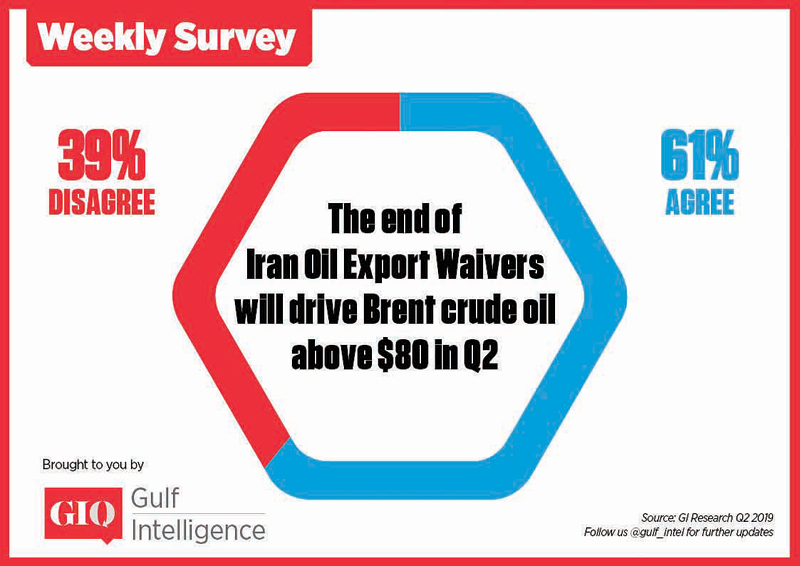

The removal of US waivers on Iranian crude oil export sanctions in April will not push Brent prices above $80/bbl in the second quarter, according to 61 per cent of those polled in GIQ’s monthly Energy Market Survey in May.

Although the re-imposition of US sanctions has provided some support to prices — Brent has averaged in the low $70s/bbl range in the past month compared to the $60s/bbl in the first quarter of the year — they have yet to break through $80/bbl.

On the direction of prices for the second half of the year, 59 per cent of survey participants felt it would rest on whether the Opec + group of producers extends output cuts when it meets in Vienna in June. The other 41 per cent said the main impetus would continue to be US sanctions on Iran. Meanwhile, 68 per cent were of the opinion that output should be increased at the end of June, given rising geopolitical tensions in the region, with the remaining 32 per cent voting for a retention of the current production agreement.

The Opec + group, which includes Russia, has pledged to reduce supply by 1.2 million b/d during the first six months of this year, with statistics so far indicating strong adherence to the pact. At the most recent meeting of the Opec Joint Ministerial Monitoring Committee in Jeddah, Saudi Arabia on May 19, Saudi Arabia’s Energy Minister, Khalid al Falih, indicated a consensus among producers to continue to drive down crude inventories, but in the same breath said that the kingdom would remain responsive to the needs of the market, effectively leaving all options on the table come June.

On US-China trade deal dynamics, 79 per cent of the GIQ polled audience felt that US President Donald Trump would blink ahead of Chinese Premier, Xi Jinping. The tit-for-tat rhetoric on tariffs between the world’s two largest economies has held the global economy on tenterhooks for the past year, with the most recent development diminishing any renewed hope of a prompt settlement.

Oman Observer is now on the WhatsApp channel. Click here