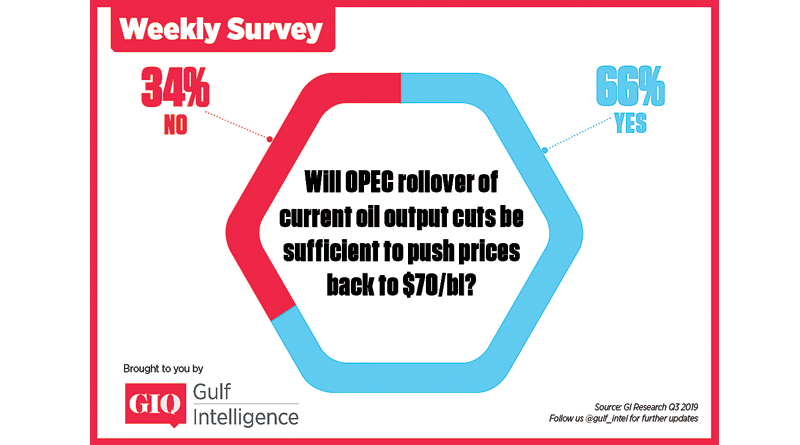

The extension to March 2020 of an oil production cut deal by Opec to remove of 1.2 million b/d from the market will push Brent crude prices to $70/bl, according to 66 per cent of those polled in GIQ’s monthly Energy Market Survey in July.

At its meeting in Vienna in late June, Opec, with Russia’s backing, announced it would be extending its existing output cut deal for a further nine months. On the policy front, 63 per cent of GIQ respondents said Saudi Arabia had greater influence than Russia on Opec and non-Opec’s (also known as Opec+) supply policy.

Prices have averaged $63.92/bl during July, similar to the range witnessed during the first quarter of this year. Brent crude prices hit the low $70s/bl for a brief period during April but then fell below $70/bl for the remainder of the second quarter. This was despite the re-imposition of US sanctions on Iranian oil exports and heightened geopolitical tensions in the Gulf. Weaker global economic growth forecasts and the ongoing trade spat between China and the US are seen to be dampening demand sentiment.

More than a third of GIQ respondents (77 per cent) said that increases in shale oil production — notably from the US — would continue to undermine the Opec+ group’s efforts to reduce global inventories.

In its July Oil Market Report, the International Energy Agency (IEA) highlighted that OECD commercial stocks increased in May stood at 6.7m barrels above the five-year average and that a global surplus of 0.5m b/d was registered in the second quarter, versus expectations of a deficit of the same volume for the period.

The IEA report published an expectation of a 2.1m b/d expansion in non-Opec supply in 2020, led by US shale, versus a 2m b/d expansion this year. Huge stock builds in the second half of 2018 caught the market off guard as global oil demand faltered last year. The picture does not seem to be shifting.

Oman Observer is now on the WhatsApp channel. Click here