Oman’s banking sector sustained its robust performance in terms of profitability on the back of expanded top-line and improved efficiency, the Central Bank of Oman (CBO) stated in its 2018 Annual Report

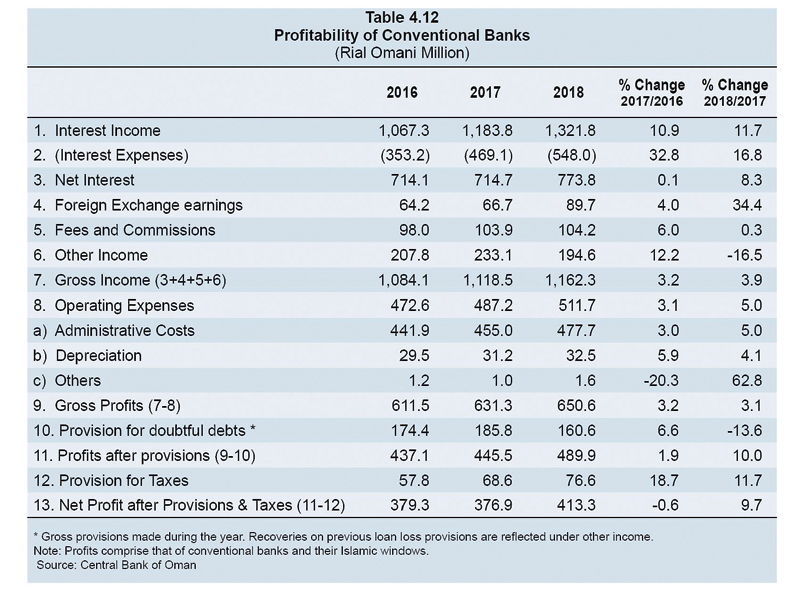

Gross income of conventional banks grew 3.9 per cent to RO 1.162 billion in 2018, up from RO 1.118 billion a year earlier, with net interest income and foreign exchange earnings as the main contributors, the apex bank said. Net interest income and foreign exchange earnings constituted about 66.6 per cent and 7.7 per cent of gross income respectively.

“Despite a marginal drop in RO interest rate spread, net interest income rose considerably reflecting the expanding business. Although operating costs and other expenses increased at a higher rate, the conventional banks were able to post reasonable growth in gross profit,” the Central Bank stated.

“Net profit (of RO 413.3 million) also jumped considerably by 9.7 per cent in 2018, as provisions for doubtful loans declined to reflect the improved quality of assets,” it noted.

Conventional banks’ total assets witnessed a robust YoY growth of 7.5 per cent to RO 29.995 billion in 2018, up from RO 27.913 billion a year earlier. The credit extended by conventional banks grew at a somewhat higher rate and accounted for 71.6 per cent of total assets during 2018.

In terms of contribution to growth in total assets, the share of credit fell down sharply to about 47 per cent in 2018 from about 94 per cent in 2017, while cash on hand and deposits with CBO recorded a turnaround with their share increasing to about 17 per cent from about -44 per cent during this period.

On the liabilities side, total deposits held with conventional banks registered a sharp increase of 7.5 per cent to RO 19.996 billion in 2018, up from RO 18.602 billion in the previous year. Intra-year trends, however, reveal a spike in growth of deposits in the later part of 2018, which may be attributed to one-off factor.

The deposits constituted about 67 per cent of total liabilities in 2018, almost similar to the previous two years. Although growth in deposits exceeded that in credit for the full year suggesting liquidity easing, the intra-year trends indicate otherwise, the report said.

An analysis of sources exhibits that deposits accounted for the largest share of 67 per cent in total incremental funds mobilised in 2018. Furthermore, a major portion at 63 per cent in growth of deposits was contributed by public enterprises in 2018, while it was the private sector in 2017 that contributed the highest increase of 92 per cent to total deposits. The government’s contribution to incremental deposits increased from about 11 per cent in 2017 to about 30 per cent during 2018.

Of the total incremental credit, the private sector availed the highest share of 52 per cent, followed by public enterprises with 42 per cent during 2018. Private sector’s contribution to additional deposits mobilisation was miniscule as compared to availing incremental credit during 2018, while public sector enterprises contributed higher to additional deposits than availing additional credit during the year.

Oman Observer is now on the WhatsApp channel. Click here