Dubai Mercantile Exchange (DME), the premier international energy futures and commodities exchange in the Middle East, concluded its latest auction on Wednesday on behalf of Iraq’s National Oil Company, SOMO.

The 2-million barrel cargo of Basrah Light was awarded at a premium of $0.13 per barrel over the November Basrah Light Official Selling Price (OSP). 20 companies participated in the auction with 14 bids received during the two-minute auction.

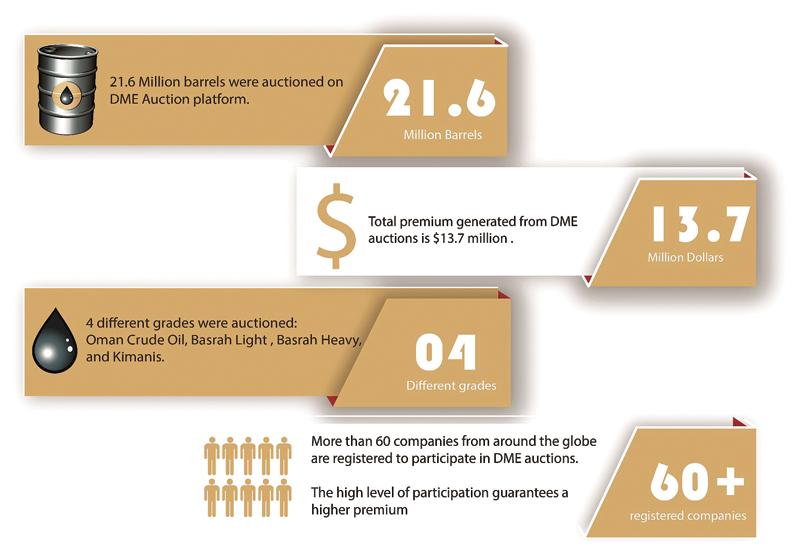

DME has now hosted 13 auctions on its platform since January 2016, with a total of 21.6 million barrels sold, generating premiums totalling $13.7 million. Four different crude grades have been sold via the the platform including Oman crude oil blend, Basrah Light, Basrah Heavy and Malaysian Kimanis.

Ahmad Sharaf, Chairman, DME said: “DME auctions allows sellers to access a large pool of potential buyers and what would take many hours of phone conversations can now be accomplished during a two-minute auction period.”

More than 60 companies from around the globe are registered to participate in DME auctions.

“The success of DME auctions underlines the need for price discovery mechanisms in the region and greater transparency. It has enabled national oil companies to assess their monthly official selling price and adjust it to find fair value for national resources,” added Sharaf.

Additionally, DME is working on a reverse auction, where buyers can procure commodities to meet domestic demand.

Launched in 2007, DME has rapidly grown into a globally relevant exchange. Its flagship Oman Crude Oil Futures Contract (DME Oman) contract is now firmly established as the most credible crude oil benchmark relevant to the rapidly growing East of Suez market.

Reflecting the economics of the Asian region like no other contract, and the largest physically delivered crude oil futures contract in the world, DME Oman is the world’s third crude oil benchmark and the sole benchmark for Oman and Dubai exported crude oil.

DME is a joint venture between Dubai Holding, Oman Investment Fund and CME Group. Global financial institutions and energy trading firms including Goldman Sachs, JPMorgan, Morgan Stanley, Shell, Vitol and Concord Energy also hold equity stakes in the DME.

Oman Observer is now on the WhatsApp channel. Click here