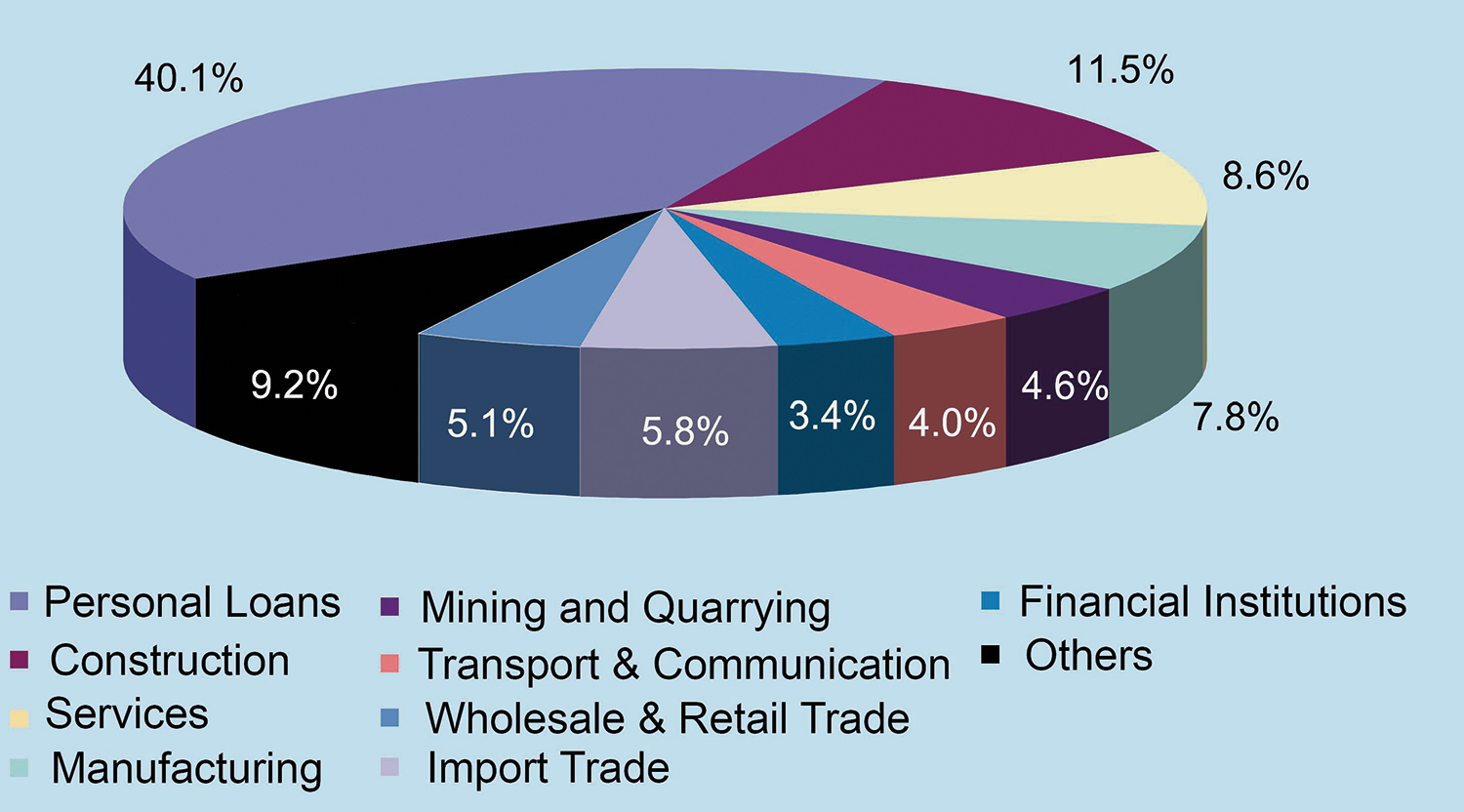

MUSCAT, July 16 - Personals loans grew a significant 7.7 per cent to top RO 7.9 billion in 2016, accounting for 40.1 per cent of total credit of RO 19.9 billion advanced by commercial banks in the Sultanate, the Central Bank of Oman (CBO) said.

“Personal loans turned out to be the strongest driver of bank credit,” the apex bank said.

“Personal loans including residential housing loans were largely backed by salary assignments and mortgages and this segment remained the mainstay and key profit driver for banks,” it further stated in its 2016 Annual Report.

Bank credit in the form of personal loans grew nearly 10 per cent to RO 7.3 billion in 2015 up from RO 6.6 billion a year earlier, tracking a year-on-year growth trend that continues to shore up revenues for lenders in the Sultanate.

The personal loan interest rate ceiling currently stands at 6 per cent per annum for all loans extended since October 2013.

Within the personal loan segment, residential housing loans accounted for 9.8 per cent of the banks’ total credit outstanding, the Central Bank said. “On an incremental basis, the flow of credit to towards personal loans led to an additional credit disbursement of RO 564.2 million during 2016 compared to a large outlay in the previous year amounting to RO 678.3 million,” it noted.

A distant second in the breakdown of sectors benefiting from bank credit was the construction industry with a 11.5 per cent share (RO 2.274 billion) of the total credit. In third place was the Services sector with an 8.6 per cent share (RO 1.689 billion), followed by the Manufacturing sector with a 7.8 per cent share (RO 1.523 billion).

Lending to other key sectors was as follows: Import Trade RO 1.146 billion (5.8 per cent), Wholesale and Retail RO 675 million (5.1 per cent), Mining and Quarrying RO 902 million, and Transport and Communications RO 782.4

million (4 per cent).

Conrad Prabhu

Oman Observer is now on the WhatsApp channel. Click here